Stock market snapshot as of [14/07/2019 0420 GMT]

- Ahead of the European opening session, the release of China Q2 GDP figure has indicated that the China economy has continued to slow from Q1. Q2 GDP came in at 6.2% y/y as expected, the weakest in 27 years from Q1’s 6.4% y/y. China Jun Industrial production and retail sales had fared better than expected. Industrial production output recorded a growth if 6.3% y/y versus consensus of 5.2% y/y and retail sales came in at 9.8 y/y versus consensus of 8.3% y/y.

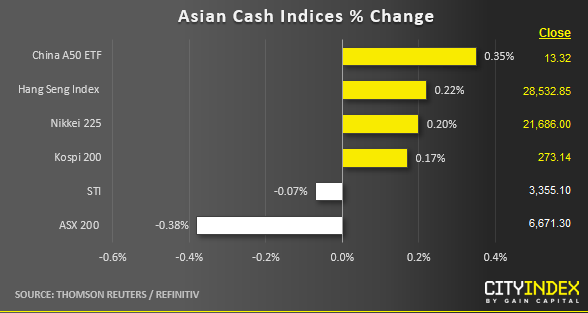

- Both the China A50 and Hong Kong’s Hang Seng Index has staged a recovery as today’s Asian mid-session after an intraday drop of close to -1.2% as market participants shrugged off the weak China Q2 GDP print in anticipation of more policy easing from the China central bank, PBOC in the next few months.

- Also, the highly anticipated mega Hong Kong IPO of brewer Anheuser-Busch InBev NV that aimed to raise between US$9.8 to 8.3 billion has been cancelled; making it the biggest IPO in the world so far after Uber’s US$8.1 billion deal. AB InBeV announced the decision on late last Fri, 15 Jul and cited lacklustre market conditions to pull the plug for the IPO of its Asia Pacific business.

- Overall, a mix picture for Asian stock markets where the modest losses have been recorded so far in Singapore’s STI and Australia’s ASX 200.

- In today Asian session, the S&P 500 E-mini futures is trading flat without any much significant movement after the bullish up move seen on last Fri, 12 Jun where the cash S&P 500 recorded a fresh all-time high close of 3013.

- Mix picture for the European stock indices CFD futures at this juncture where the German DAX is showing a modest gain of 0.23% while the FTSE 100 is almost unchanged.

- No major key European and U.K economic data releases for today.

Corporate Highlights

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 08:33 AM