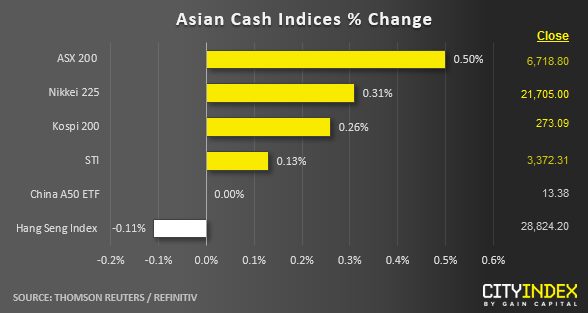

Stock market snapshot as of [04/07/2019 0500 GMT]

- Ahead of the European opening session, Asian stocks may have ended their 2-day minor consolidation phase and resumed their respective medium-term uptrend as most of them have started to show modest gains as at today’s Asian mid-session.

- The star performer for the 2nd consecutive day is Australia’s ASX 200 that has rallied by 0.50% led by the Big Four banks; CBA, ANZ, NAB and Westpac that have gained by more than 1% each. The next medium-term resistance to watch for the ASX 200 will be at the 6815/50 zone which also coincides with its all-time high level printed in Oct 2007 before the Great Financial Crisis.

- European stock indices CFD futures are showing a mix picture at this juncture with minor economic data releases later and a full day closure today in the U.S. for the Independence Day holiday before the release of the key U.S. nonfarm payrolls data on Fri, 05 Jul. The FTSE 100 is almost unchanged while the German DAX is up by 0.11%.

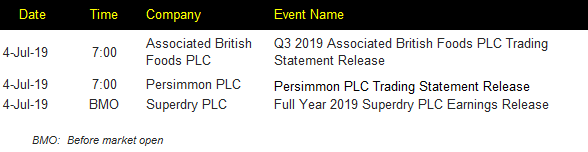

Corporate Highlights

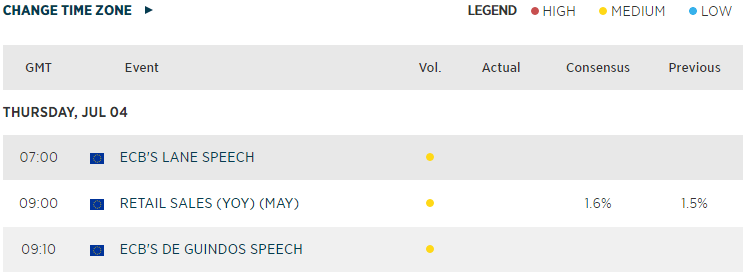

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM