Stock market snapshot as of [30/07/2019 0550 GMT]

- Ahead of the European opening session, Asian stock markets have staged modest gains to recover yesterday’ losses ahead of key Fed’s FOMC meeting decision out on Wed, 31 Jul. Based on CME Fed Watch Tool, markets have already priced in fully a 25bps cut on the Fed fund rate to 2.00%-2.25%. The probability of a deeper 50bps cut has increased slightly from a week ago; from 20.9% to 26.1% as at 30 Jul.

- No change in Bank of Japan’s monetary policy where short-term interest rate target is pegged at -0.1% and the yield curve control programme for the 10-year JGB yield remain changed at around 0%. BOJ has trimmed its inflation forecast for the current fiscal year ending Mar 2020 and added that it will take additional easing steps without hesitation if needed.

- Australia’s ASX 200 has breached above its Oct 2007 all-time high level of 6851 on an intraday basis; printed a high of 6875 but closed lower at 6848. The worst performer came from the technology sector that saw a sell-off of -1.39% after its strong gains seen yesterday, 29 Jul 2019.

- FTSE 100 CFD futures has continued to consolidate its stellar gains seen in yesterday’s European session (+1.82%) triggered by a sell-off in the GBP/USD. As at today’s Asian mid-session, FTSE 100 CFD futures is up by 0.39% while German DAX CFD futures remain almost unchanged.

Up Next

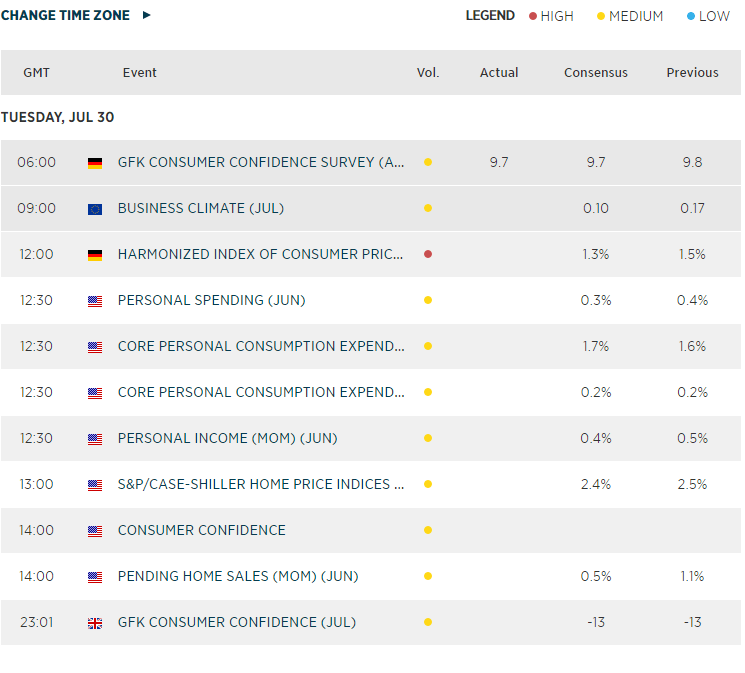

- Germany’s CPI data for Jul out @ 1200 GMT where consensus is set at 1.3% y/y

- U.S. Core PCE data for Jun (Fed preferred gauge for inflation) out at 1230 GMT where consensus is set at 1.7% y/y

- Apple, a bellwether component stock in the S&P 500 and Nasdaq 100 earnings release after the close of today’s U.S. session. Consensus EPS forecast is pegged at $2.10 versus $2.34 EPS as reported in the same period last year.

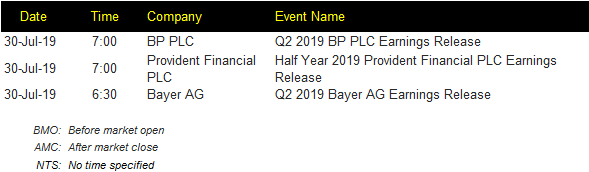

Corporate Highlights

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM