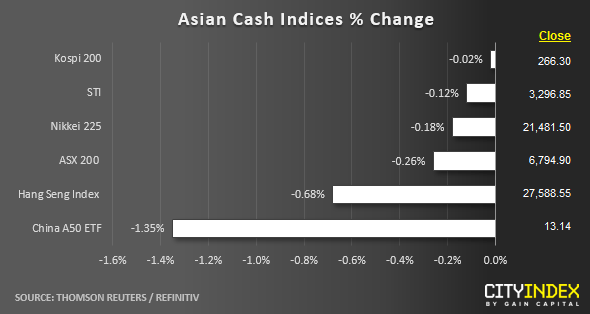

Stock market snapshot as of [01/08/2019 0430 GMT]

- Ahead of the European opening session, Asian stock markets have continued trade lower from yesterday’s losses after the eventful, Fed’s FOMC decision to cut the Fed funds rate by 25 bps for the first time since 2008 to 2.00%-2.25% as expected.

- The selling seen in Asian stocks as at today’s Asian mid-session has taken the cue from a weak performance seen in the key benchmark U.S. stock indices where the S&P 500 and tech heavy Nasdaq 100 have tumbled by -1.09% and -1.30% respectively.

- The on-going weakness seen in global stocks can be attributed to the unclear messages from Fed Chair Powell’s press conference on the future direction of U.S. interest rates. Powell had mentioned that yesterday’s 25 bps cut as an insurance against downside risks and can be considered as a “mid-cycle adjustment to policy” which did not signal the start of a length easing cycle. Also, he made a contradictive remark that his earlier description of “mid-cycle adjustment to policy” did not mean “just one rate cut”.

- Overall, the technical picture on the medium-term uptrend for global stock indices have started to deteriorate prior to yesterday’s Fed FOMC as per highlighted in our weekly outlook report published earlier where we highlighted the risk of a medium-term corrective decline of 10% to 15%. (click here for recap).

- China’s manufacturing activities have continued to decline in Jul where the Caixin manufacturing PMI came in at 49.9, slightly better than expectation of 49.6. A level below 50 represents contraction. The next round of U.S/China trade negotiation talks will resume in early Sep in Washington.

- The worst performers are China related plays with the Hang Seng Index and China A50 down by -0.68% and -1.35% respectively. Another negative catalyst for its losses can be attributed to a further strength seen in USD/CNH (offshore yuan) where it broke above a 4-week range resistance of 6.8970 to print a current intraday high of 6.9173.

- No significant movement see in European stock indices CFD futures at this juncture where the FTSE 100 and German DAX are almost unchanged.

Up Next

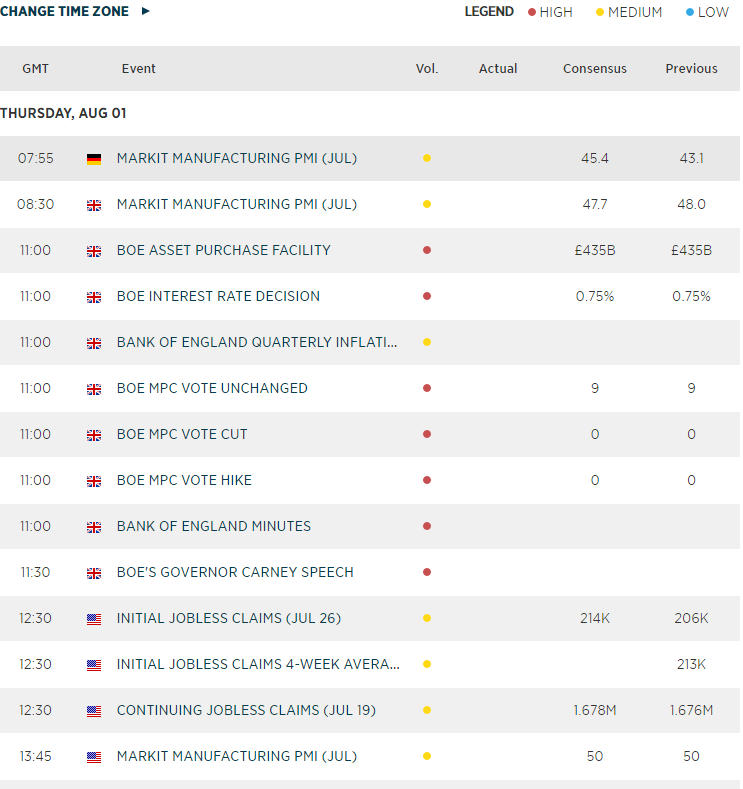

- Germany Markit manufacturing PMI for Jul out later at 0755 GMT where consensus is set at 45.4

- BOE monetary policy decision at 1100 GMT where key policy interest rate is expected to be unchanged at 0.75% follow by BOE governor speech at 1130 GMT

- U.S. Markit manufacturing PMI for Jul out later at 1345 GMT where consensus is set at 50.0

Corporate Highlights

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM