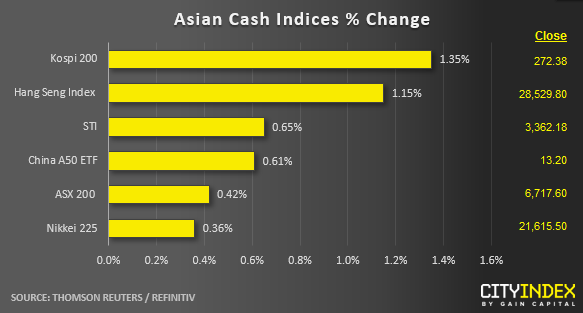

Stock market snapshot as of [11/07/2019 0415 GMT]

- Ahead of the European opening session, Asian stock across the board has shaped the expected recovery in a positive follow-through since its prior underperformance have started to stabilise yesterday’s 10 Jul.

- The best performers are South Korean’s Kospi 200 and Hong Kong’s Hang Seng Index that have rallied by 1.35% and 1.15% respectively as at today’s Asian mid-session. Another localised positive catalyst for the Kospi 200 is the proposed production cuts of NAND memory chips from key South Korean semiconductors firms due to the curbs on the export of key materials from Japan.

- Benchmark U.S. stock indices; the S&P 500 and Nasdaq 100 have rallied to print another fresh record high where the S&P 500 printed 3002 and the Nasdaq 100 hit 7923 before pulling back slightly towards the close of yesterday’s 10 Jul U.S. session. In today’s Asia session, the S&P 500 E-Mini futures has inched up by 0.20% to print a current intraday high of 3002. Overall, the medium-term uptrend remains intact for the S&P 500 with the next significant medium-term resistance/risk level at 3045 as per highlighted in our weekly outlook report (click here for a recap).

- European stock indices CFD futures are showing modest gains at this juncture as well with both the FTSE 100 and German DAX up by around 0.40%.

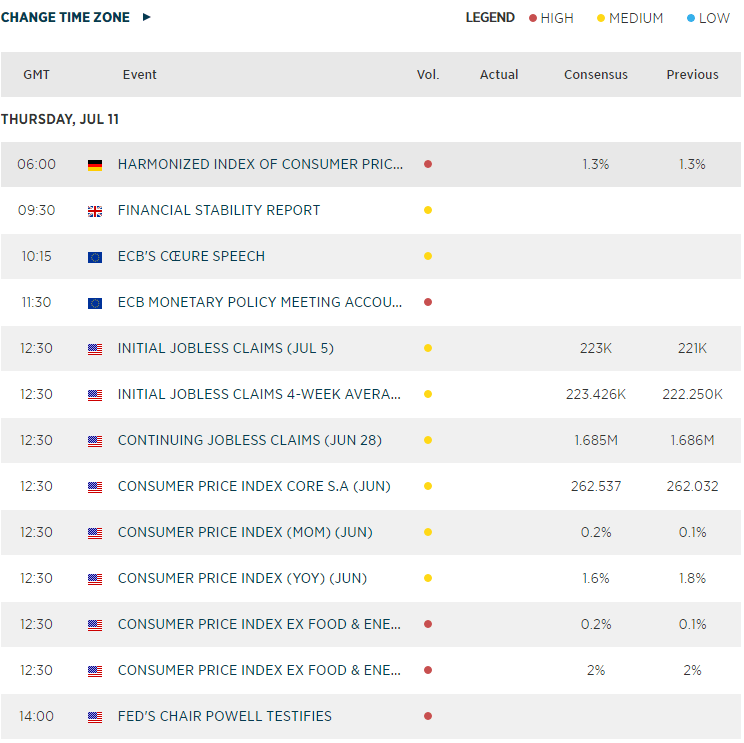

- Today, Fed Chair Powell will resume his 2nd of day of testimony to the U.S. Congress at 1400 GMT but it should be a non-event as his testimony is likely to be the same as yesterday.

- Key economic data releases to take note later will be Germany CPI for Jun out at 0600 GMT, a weak print below expectation of 1.3% y/y is likely to reinforce ECB’s dovish stance to reopen the QE floodgate later this year. Next up will be U.S. CPI for Jun out later at 1230 GMT.

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM