Stock market snapshot as of [29/07/2019 0500 GMT]

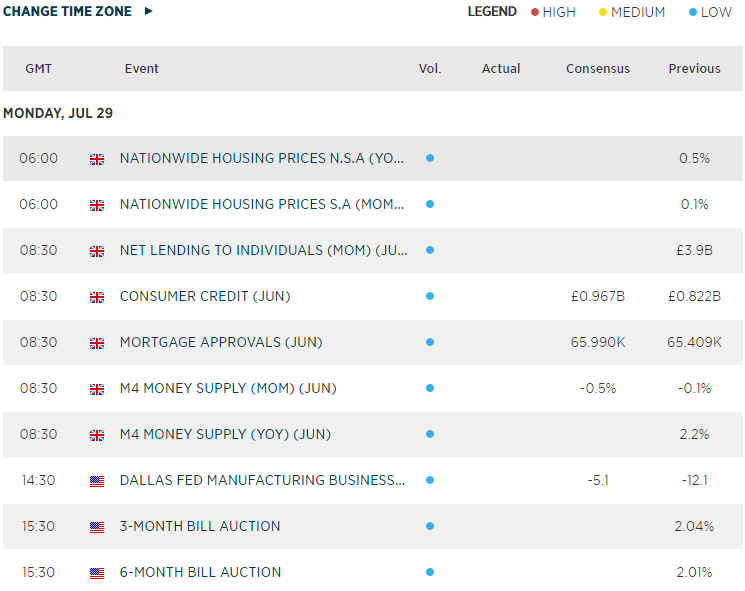

- Ahead of the European opening session, most Asian stock markets are in the red ahead of a busy event driven week where the start of fresh U.S/China trade deal negotiation talk kickstarted in Shanghai today, the U.S. Fed FOMC meeting outcome on Wed, 31 Jul and U.S. nonfarm payrolls job data out on Fri, 02 Aug.

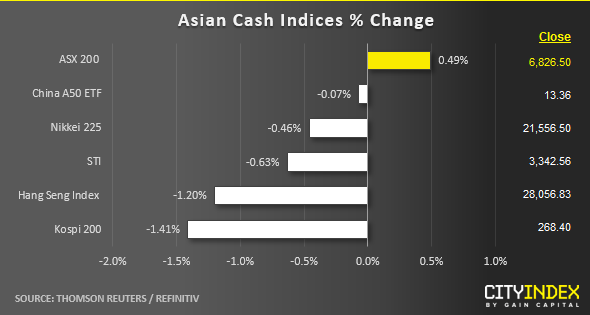

- The worst performers so far as at today’s Asian mid-session are the Korea’s Kospi 200 and Hong Kong’s Hang Seng Index. The Kospi 200 has declined by 1.41% dragged down by major semiconductors stocks; Samsung Electronics and SK Hynix that dived down by 1.9% and 2.6% respectively coupled with poor earnings results from Ssangyong Motor and Hanssem.

- The poor performance of Hang Seng Index can be attributed increasing domestic unrest in Hong Kong after the recent weekend demonstrations ended with a chaotic face off between the police and protestors. Hong Kong’s properties shares are the worst hit where the Hang Seng Property Index is down by 2.80%.

- After another fresh all-time high close of 3025 seen in the U.S. S&P 500 on last Fri, the S&P 500 E-mini futures has started to see some profit-taking in today’s Asian session where it has slipped down by 0.29% to print a current intraday low of 3020.

- No significant movement seen in the European stock indices CFD futures at this juncture where the FTSE 100 is almost unchanged and German DAX is down slightly by 0.24%.

Up Next

- China’s top office for Hong Kong affairs will hold an official news conference later today at 3 p.m local time on China’s stance towards the recent unrest seen in Hong Kong over the controversial China extradition bill.

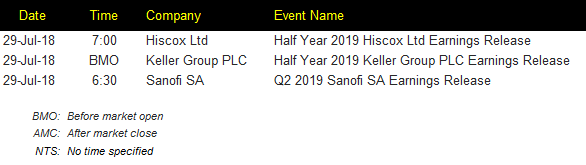

Corporate Highlights

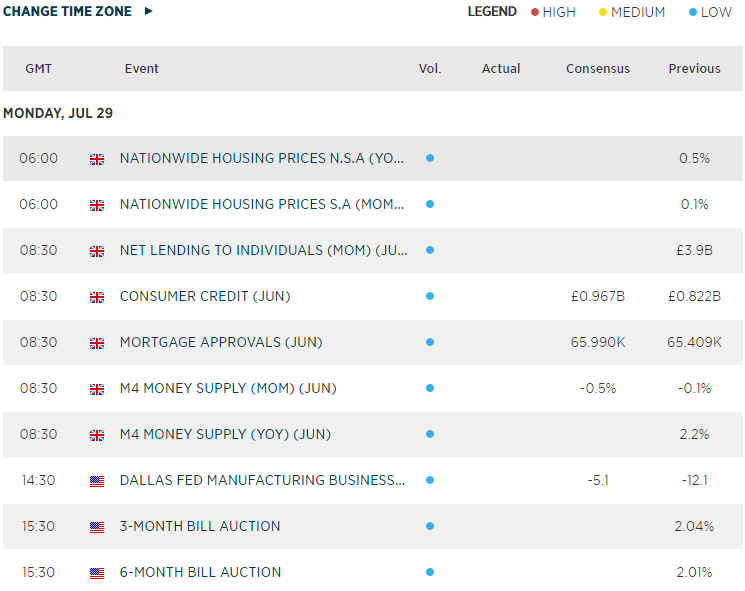

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM