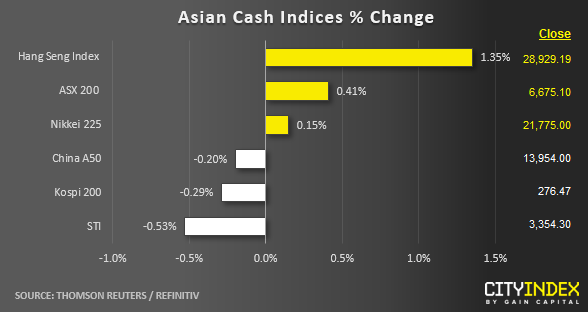

Stock market snapshot as of [02/07/2019 0420 GMT]

- Ahead of the European opening session, Asian stock markets are trading in a mix fashion as at today’s Asian mid-session. Hong Kong’s Hang Seng Index stellar performance with a current rally of 1.35% is an exception because it is just playing the “post G20 catch-up” due a public holiday closure yesterday, 01 Jul.

- Australia’s ASX 200 is the outperformer so far that is showing a gain of 0.41% with another interest rate cut just announced by RBA that brought the policy cash rate to a historical low of 1%, click here for out latest analysis on ASX 200. In contrast, Korea’s Kospi 200 has continued to see profit taking activities for the second consecutive day since 01 Jul due to concerns over Japan’s exports restrictions against South Korea.

- Japan’s Industry Minister said that the export curbs are the consequences of South Korea’s failure to present satisfactory measures to resolve forced labour issues and the curbs are not in violation of WTO rules.

- The S&P E-mini futures has continued to inch higher in today’s Asian mid-session from yesterday, 01 Jul U.S. session low of 2955. Its current price level at 2970 has surpassed yesterday’s cash index closing level of 2964. Overall, the medium-term uptrend for stock indices remains intact despite mix performances seen in the Asian stock indices, click here for a recap.

- European stock indices CFD futures are showing modest gains at this juncture. Both the FTSE 100 and German DAX are up by 0.39% and 0.25% respectively.

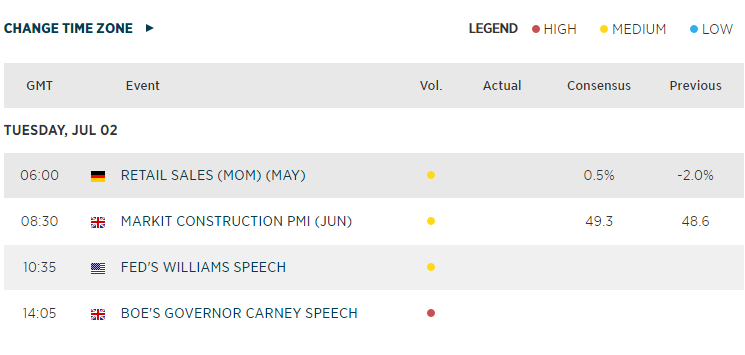

Macroeconomic Calendar

*Data from Refinitiv. Index names may not reflect tradable instruments and not all markets are available in all regions.

Latest market news

Yesterday 08:33 AM