After an equity rally of such magnitude and as bonds are set to finish the month flat there has been an expectation that asset managers who run balanced funds that consist of a 60:40 split between stocks and bonds would rebalance/reduce equity exposure into month-end.

Some of the world’s largest pension funds including the Japanese GPIF and the Norwegian Oil fund are thought to use the 60:40 asset allocation split. In all, balanced funds are thought to manage over $7tr.

Of course, asset managers don’t leave all their rebalance until the last day of the month. Rather the flows are spread out over several days. Which means that more likely than not the lion’s share of this month’s rebalance has already gone through without leaving even the faintest footprint.

When looking for reasons as to how the market has been able to absorb such sizeable selling, the answer is thought to come from the staggering amount of equity inflows following the U.S. election and the announcement of successful COVID19 vaccine trials.

Over the past three weeks, it is estimated there has been over $100bn worth of equity inflows, the largest ever amount over a three week period that only partially reverses almost two years of outflows.

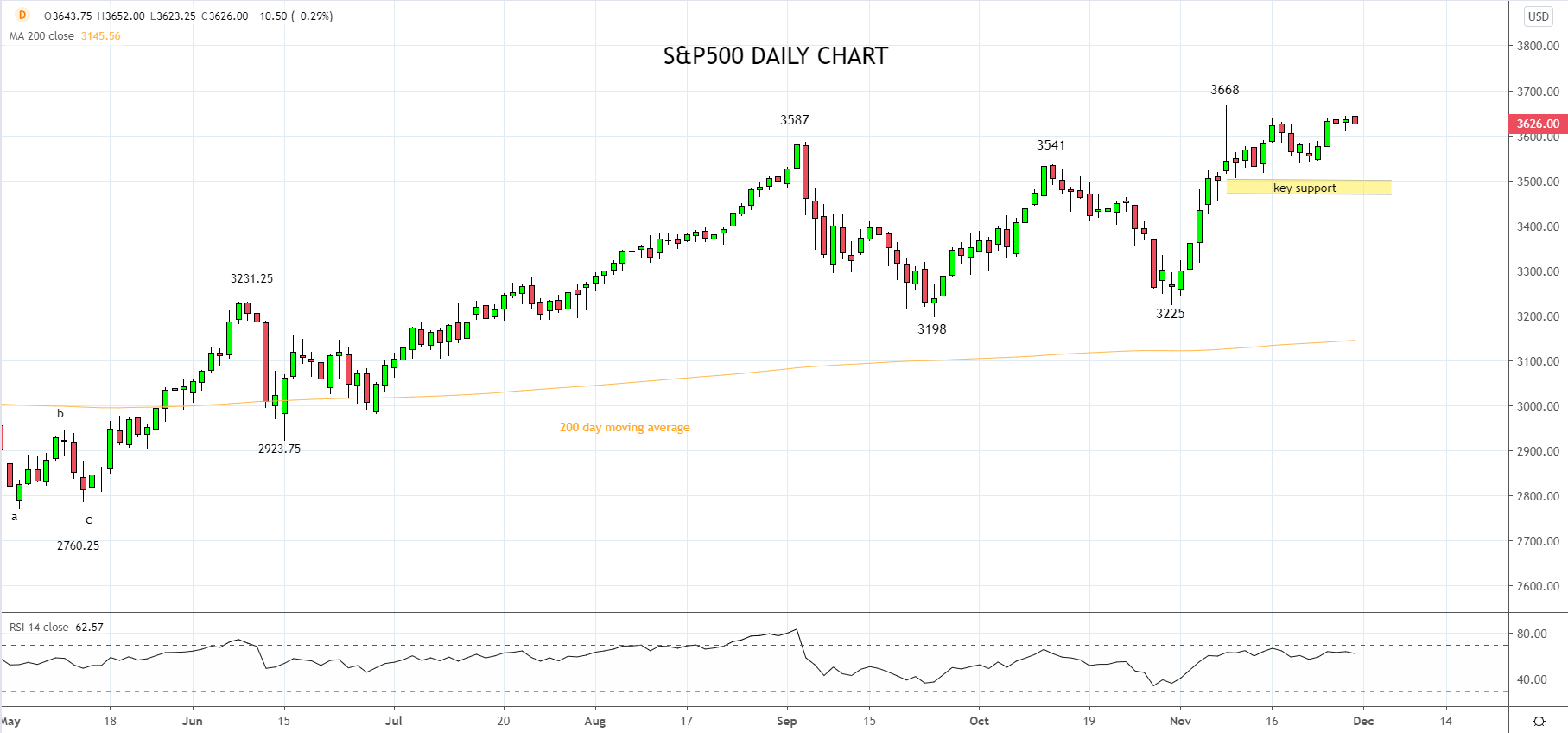

Returning to the S&P 500, following its new all-time high at 3668, the S&P500 has spent the past three weeks consolidating the gains of early November.

In the process it has worked off overbought readings and providing the current period of consolidation/corrective price action extends no lower than wave equality support 3480/70 area, the uptrend is expected to resume into year-end towards 3750/3800.

Aware that a move much below 3470ish would warn that a deeper correction is underway towards the bottom of the range, 3200ish.

Source Tradingview. The figures stated areas of the 30th of November 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation