End of Gold s Dead Cat Bounce

May 20, 2013 – Gold (daily chart) has approached an end to its “dead cat bounce” that brought the precious metal up to an early […]

May 20, 2013 – Gold (daily chart) has approached an end to its “dead cat bounce” that brought the precious metal up to an early […]

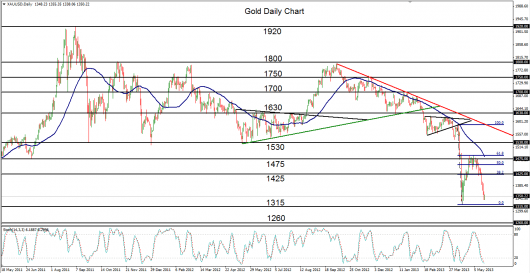

May 20, 2013 – Gold (daily chart) has approached an end to its “dead cat bounce” that brought the precious metal up to an early May high of 1488, which was also right at the 61.8% Fibonacci retracement of the prior plunge. A dead cat bounce is a financial market term which is simply a sharp decline followed by only a temporary rebound that is reminiscent of a bounce that a deceased feline might make after being dropped from a substantial height. The term is significant in the case of gold because it describes the fact that there has been a bearish trend bias since October of last year, which accelerated into a severe drop in mid-April, rebounding only temporarily in late April and early May.

Price has continued its dramatic decline within the past two weeks and is currently approaching the 2+ year low of 1321, which was established in mid-April. A retest of this low could likely soon be in the making. A breakdown below that level would confirm a bearish trend continuation with further downside support objectives around 1260 and then 1155.