Elon Musk becomes the world’s richest person: How far can TSLA soar?

We’ve repeatedly checked in on Tesla Motors (TSLA) in recent weeks (including already on Monday by my colleague Fiona Cincotta), but frankly, the price action in the stock demands it.

At this point, even superlatives aren’t enough. TSLA shares are trading higher for the eighth straight day and nearly hit $900 this morning after eclipsing $800 for the first time yesterday (…and $700 for the first time on Monday). They’ve doubled in less than two months. The company recently eclipsed Facebook (FB) to become the fifth largest company on the planet by market capitalization. Just yesterday, Tesla founder Elon Musk eclipsed Jeff Bezos as the world’s richest person, with a net worth approaching $200,000,000,000.

Technical view

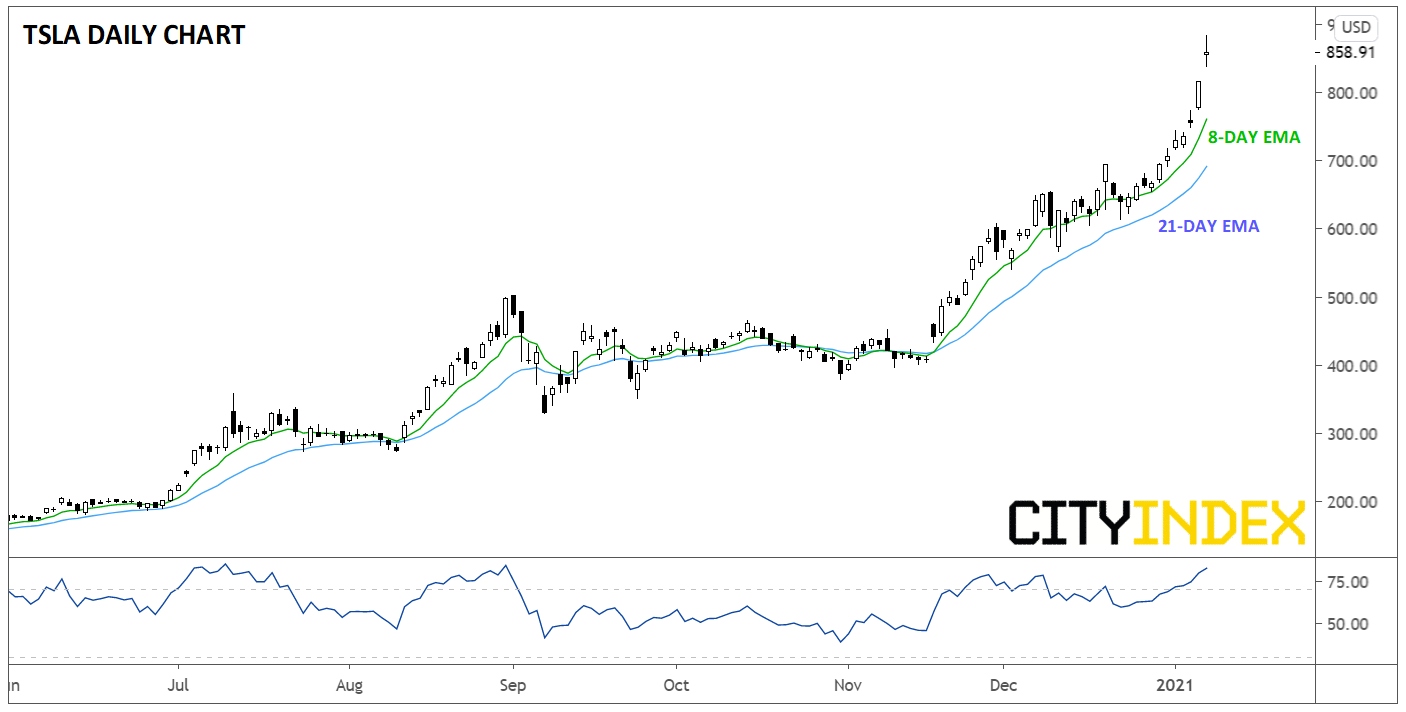

With euphoria over the shares reaching a fever pitch, the stock is certainly vulnerable to a quick reversal if momentum falters. After all, even a stock-specific -20% “bear market” would only take prices back to around $700, where they ended last week.

That said, in the infamous words of John Maynard Keynes, “the market can remain irrational longer than you can remain solvent.” Countless bears have been wrecked by shorting the stock over the last half decade, and there’s no reason it can’t continue to rise from here in the short term.

Any time a trading instrument is in the midst of a parabolic move, risk management is critical. In the case of TSLA, bullish traders could use a short-term moving average, like the 8-day EMA, as a possible stop loss area. If the stock breaks below that price, it could signal that a deeper pullback is in play. Likewise, rather than blindly shorting at these stratospheric levels, TSLA bears could wait for a breakdown below the 8-day EMA (or, more conservatively, a bearish crossover of the 8-day EMA back below the 21-day EMA) to consider short entries with a tight stop loss.

Source: GAIN Capital

To use an analogy, when you see a runaway freight train, don’t stand in front of it hoping it will turnaround; either hop aboard or wait or wait for to start slowing down before reversing!

Learn more about equity trading opportunities.