Following on from a fresh all time high for the Nasdaq, Asian markets pushed northwards, and Europe is set to open on the front foot.

Optimism surrounding the economic recovery and more stimulus is overshadowing a record daily increase in US covid-19 numbers, the return to lockdown for 5 million Australians and elevated US – Chinese tensions.

Data from China is keeping sentiment buoyed on Thursday. China’s factory gate inflation fell for a fifth straight month in June, as the coronavirus pandemic weighed on the industrial sector. However, signs of recovery are starting to emerge and with the market’s glass half full attitude today, that was enough to underpin sentiment. Chinese PPI -3% in June yoy, slower than the -3.2% decline forecast and an improvement from May’s -3.7%. In the manufacturing sector PPI rose 0.4%, up from -0.4% in May, fuelling hopes that the sector was turning a corner.

Eurogroup to agree on stimulus?

Investors are also hopeful of more government stimulus to support the recovery as the finance minister from the Eurogroup meet today ahead of the summit of leaders next week.

Optimism is growing that a deal will be agreed over the European recovery Fund. The northern countries are pushing for recovery funds to be loans, the southern European countries and more fiscally challenged nations are pushing for the fund to be in the form of a grant.

Either way, the need for stimulus is becoming apparent. Whilst the region appears to have done a good job containing the virus, the EC has slashed its growth forecasts to -8.7% this year and lower 5.6% growth in the coming year.

US Jobless claims

Looking ahead US jobless claims are under the spotlight for further clues as to how the US labour market is healing. Expectations are for 1.37 million initial jobless claims, down from 1.46 the previous week.

Continuing claims, which shed light on the rate of re-hiring are expected to be 18.95 million, down from 19.29 million. Whilst this appears to be a frustratingly slow process, taking a step back and looking at the bigger picture offers some perspective. Continuing claims are now down -24% from the peak.

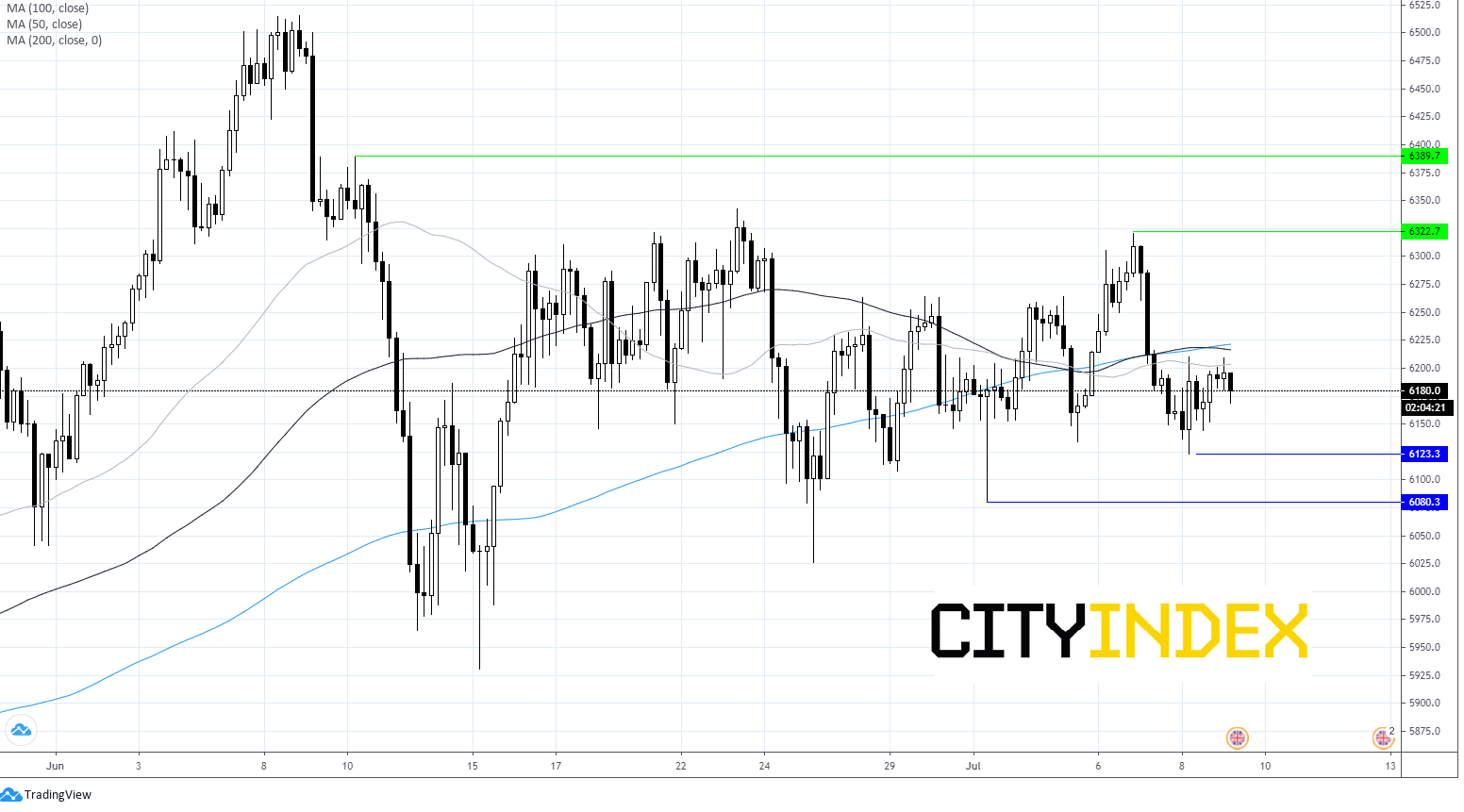

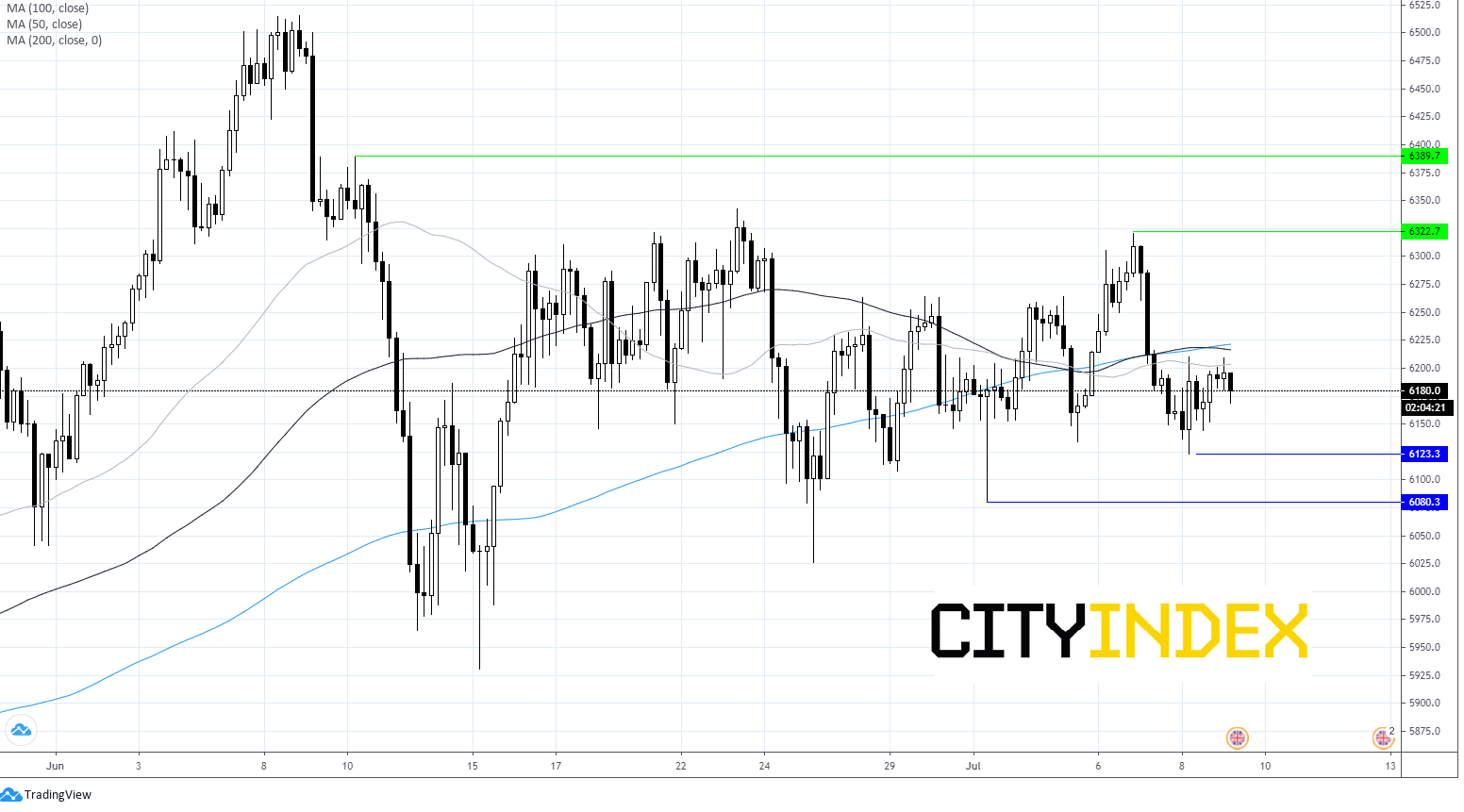

FTSE Chart