ECB stays the course, but Services PMIs should be watched

ECB left the Deposit Interest Rate unchanged at -0.5% today, as expected. In addition, the central bank will continue to buy bonds at a significantly faster pace this quarter under the Pandemic Emergency Purchase Program (PEPP). The ECB has the authority to purchase up to 1.85 trillion Euros through March 2022. However, “significantly faster pace” is an objective term. During the first quarter of 2021, the ECB bought roughly 10 billion Euros of bonds per month. “Significantly faster pace” thus far in Q2 meant buying 15-20 billion Euros per month.

Everything you need to know about the ECB

Christine Lagarde indicated that the ECB is still concerned about the coronavirus and its variants, as well as, the slow rollout of the vaccines. The ECB will continue to be accommodative, as any tapering of bond purchases will be “data dependent”. She also expressed a sense of urgency to pass the 750 billion Euro Recovery Fund. It was expected to be passed by the end of April, however with 9 holdouts, this may be wishful thinking.

However, though incoming data suggests there may have been a contraction in Q1, committee members expect a resumption of growth in Q2. Inflation may also increase in the coming months, though it be volatile. President Lagarde pointed to the services sector, noting that although the Services PMI is in contraction territory 49.6, there is evidence that it is “bottoming”. Manufacturing and services flash PMIs will be released later today. The expectation for the Eurozone Services flash PMI is only 49.1. A surprise to the upside may cause the Euro to bounce.

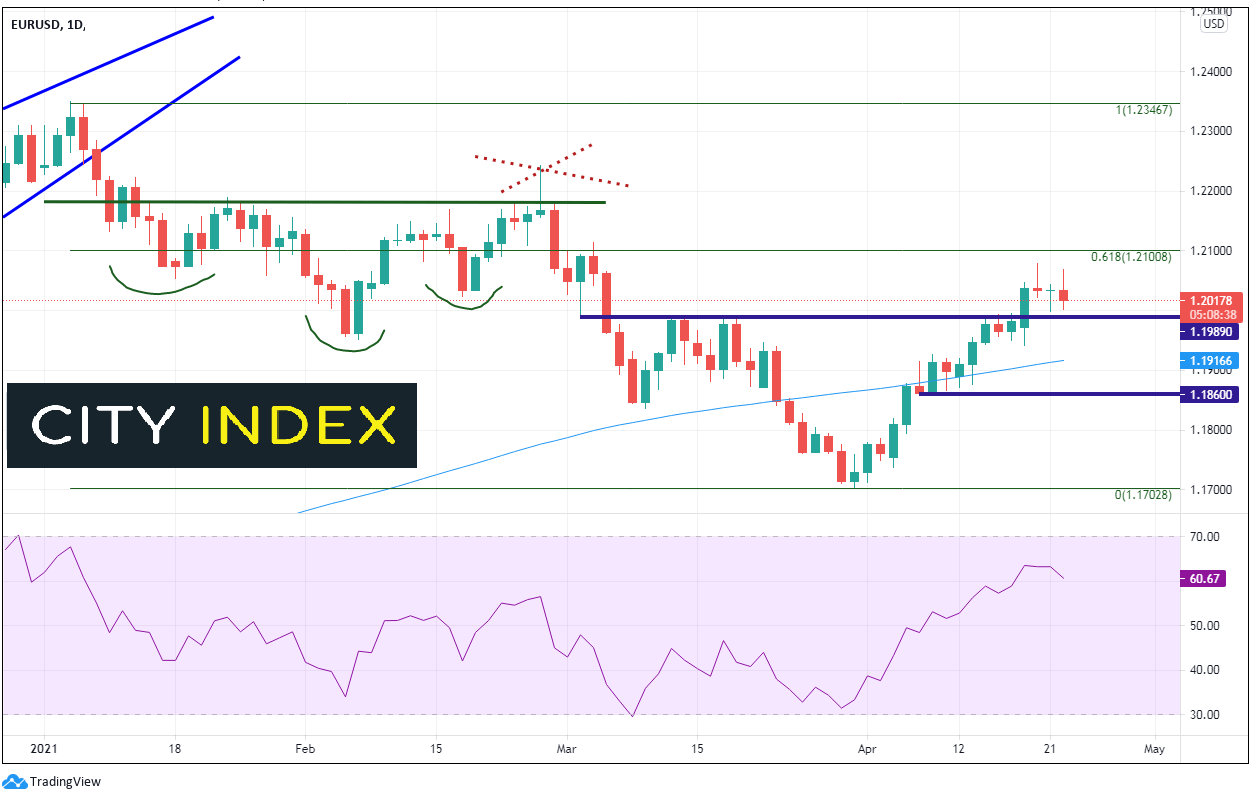

On Tuesday, EUR/USD had retraced to just beneath the 61.8% Fibonacci retracement level from the highs of January 6th highs to the March 31st lows, near 1.2080. Price drifted sideways into today’s ECB meeting. However, during the press conference, Christine Lagarde made a comment that “Europe and the Fed are not on the same page”. (But how could they be? The US Federal government has pushed out nearly $6 trillion in aid since the beginning of the pandemic. The EU can’t even get it together to pass a 750 billion Euro package.) EUR/USD began moving lower on this comment.

Source: Tradingview, City Index

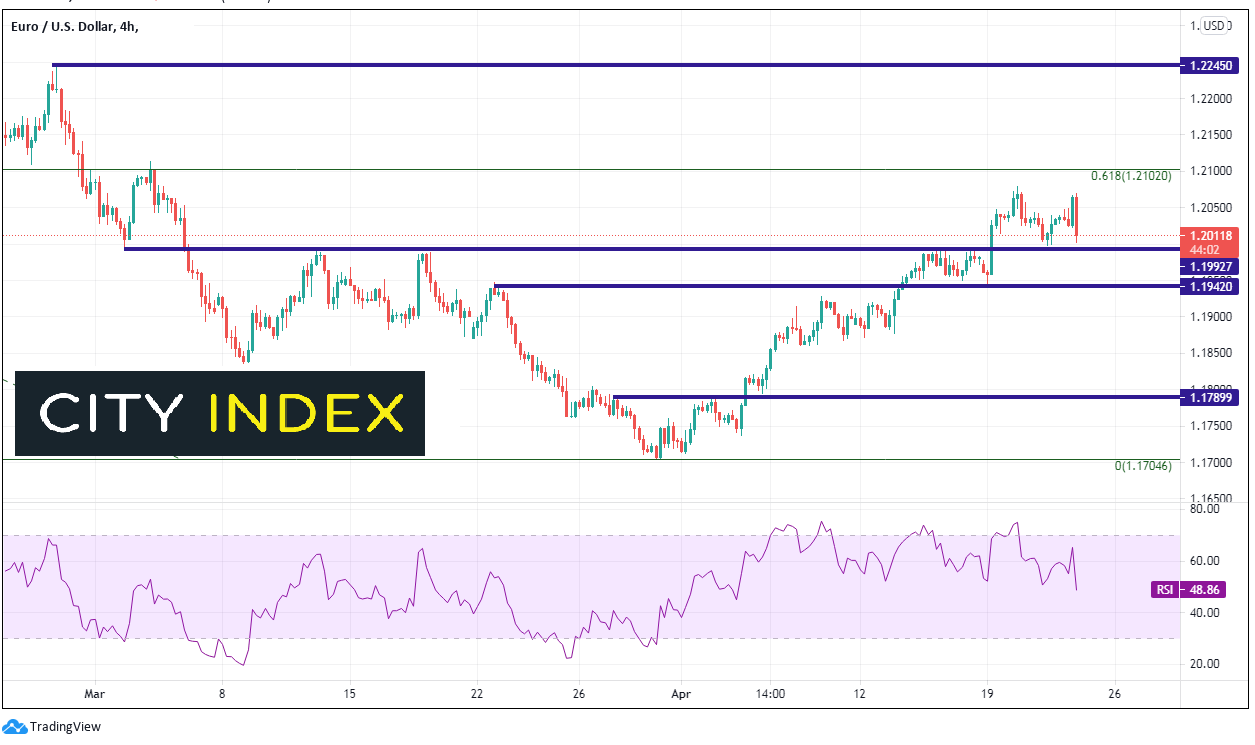

On a 240-minute timeframe, price moved from 1.2070 down to 1.2010. Key horizontal and psychological support arrive at 1.2000. Bulls will be looking to buy near here and bring EUR/USD higher. If price does break lower, it can fall to horizontal support near 1.1942. The 200 Day Moving Average is the next support level at 1.1917. Resistance above is at the confluence between the April 20th highs and the 61.8% Fibonacci retracement level previously mentioned in the 1.2080/1.2100 area. Bears will be looking to short here and target the 1.1705 lows on March 31st. The next resistance level isn’t until the February 25th highs of 1.2243.

Source: Tradingview, City Index

To sum up, April’s ECB meeting set the table for the June meeting. With the situation regarding the coronavirus and vaccines like that of March, Christine Lagarde kicked the can down the tightrope until June. Her comment comparing the ECB to the Fed caused the EUR/USD to sell-off, but that shouldn’t have been new information. Watch the data moving forward, especially services data. Stronger services data may indicate the possibility of a taper “discussion” among ECB members in June.

Learn more about forex trading opportunities.