ECB reiterates changes made in Strategic Review

The ECB left rates unchanged at 0% and said its PEPP program will continue to be conducted at a significantly higher pace than during the first months of the year, at EU20 billion. However, the ECB changed the wording of their July statement to reflect changes made during the Strategic Review, released earlier in July. As such, the ECB now:

“…expects the key ECB interest rates to remain at their present or lower levels until it sees inflation reaching 2% well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realized progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilizing at 2% over the medium term. This may also imply a transitory period in which inflation is moderately above target”

Everything you need to know about the ECB

As discussed in our ECB Preview, this statement reiterates the Strategic Review which changed the ECB’s mandate on inflation from “Close to, but below 2%: to a “symmetrical 2%”. They also noted that they forecast inflation to pick up into the end of the year, while moderating to 2% during 2022. Christine Lagarde noted in her press conference that rates will not be raised if inflation is below 2%.

They also stand ready to adjust all instruments if necessary and that the course of monetary policy will depend on the direction of the pandemic and the vaccination progress.

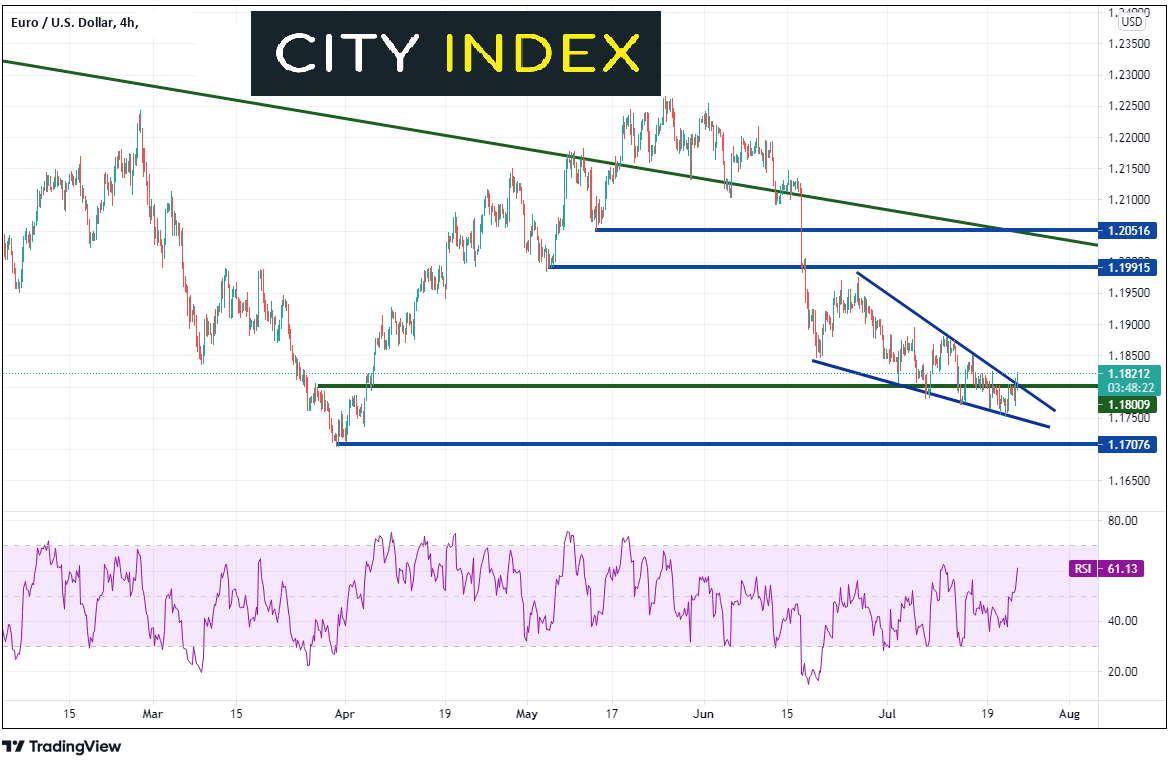

EUR/USD was choppy within 25 pips on either of the pre-statement release near 1.1795 following the release of the statement and during the press conference. On a 240-minute timeframe, EUR/USD has been moving lower in a descending wedge formation and price is nearing the apex. The expectations for a descending wedge will break to the upside and retrace 100% of the wedge. If price closes above 1.1800, it will have broken above the top, descending trendline of the wedge and prove to be a false breakdown below longer-term support. Resistance is at the top of the wedge near 1.1991 and then the confluence of horizontal resistance and a longer-term downward sloping trendline (green) near 1.2050, If price continues to move lower, support for EUR/USD is at the bottom trendline of the wedge near 1.1750, then the lows of March 31st near 1.1707.

Source: Tradingview, City Index

The results of the ECB meeting were as expected: a reiteration of the Strategic review. Although the governing council forecasts inflation to rise, they expect it to be transitory. Those expecting a more dovish statement may be disappointed. Watch for a possible bounce in EUR/USD if shorts decide to exit their positions.

Learn more about forex trading opportunities.