ECB recap: EUR/USD rallies as Lagarde shrugs off euro strength

As my colleague Fiona Cincotta anticipated yesterday, the European Central Bank made no changes to monetary policy, determining that no additional stimulus was warranted (yet) despite another extension to pandemic-related lockdowns on the continent.

The headlines from the decision follow:

- ECB Leaves Deposit Rate Unchanged at -0.50%

- ECB Affirms Size of Pandemic Purchase Program at €1.85 trillion

- Rates at Present or Lower Levels Until Inflation Goal Near

- ECB Leaves Marginal Lending Facility Unchanged at 0.25%

- PEPP Will Run at Least Through End of March 2022

- ECB to Reinvest QE Debt for Extended Time After First Rate Hike

- ECB to Reinvest Maturing PEPP Bonds at Least Through End-2023

Notably, the central bank did not comment on the recent appreciation in the euro in its statement, giving speculators a proverbial “green light” to take EUR/USD to weekly highs in the mid-1.21s after the release.

As we go to press, ECB President Lagarde has taken the stage for her regular press conference and did note that the central bank will be monitoring developments in the exchange rate, though she doesn’t sound overly concerned yet. Other comments from the former head of the IMF struck a relatively dovish tone, with Lagarde emphasizing that “inflation remains low” and “short term risks are on the downside,” though she also noted that downside risks are “less pronounced” with an end in sight to the pandemic.

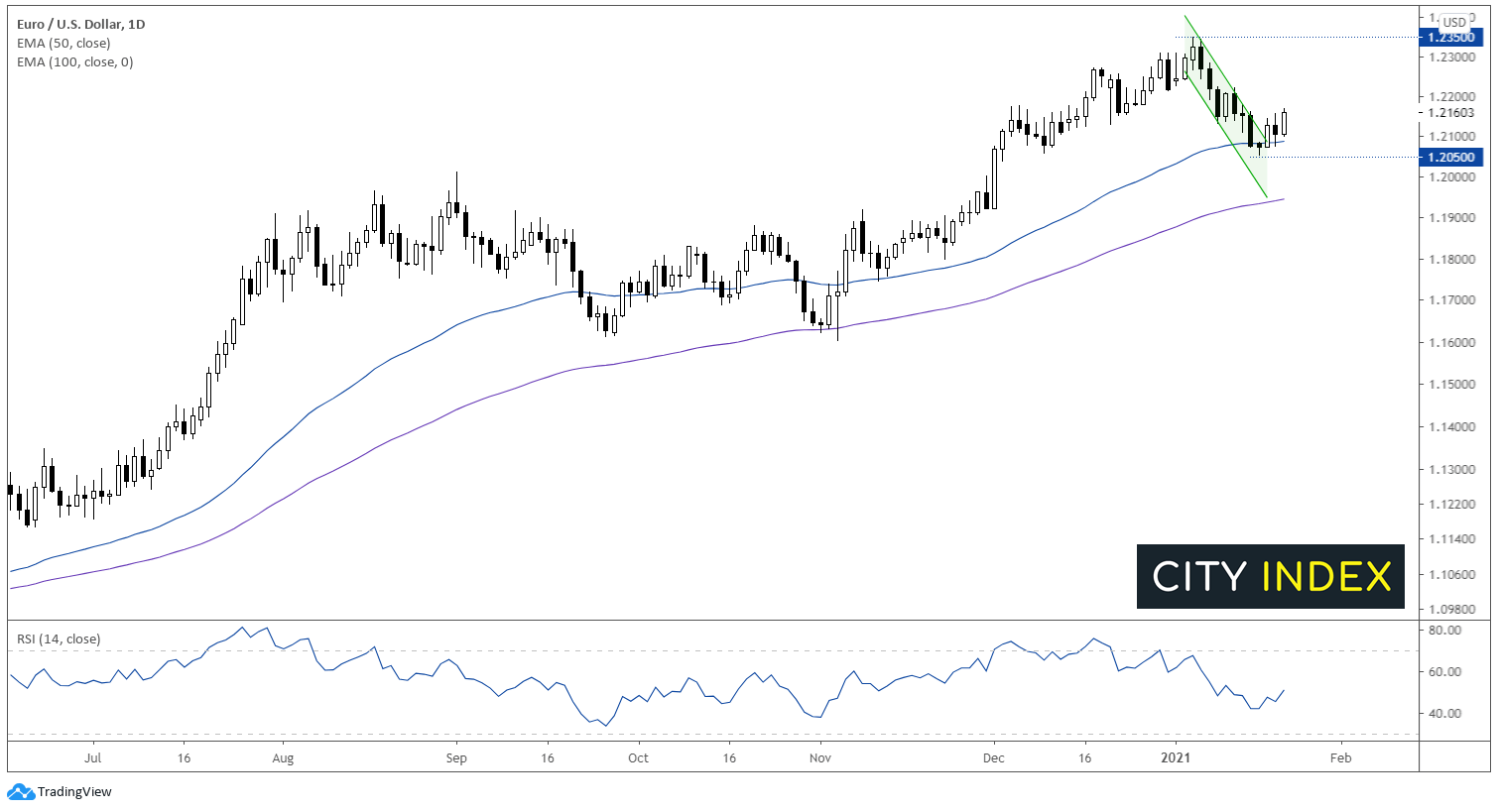

EUR/USD technical analysis

Turning our attention to the chart, EUR/USD remains in a longer-term uptrend, with rates finding support near its rising 50-day EMA this week. The pair has now broken out of a small descending channel pattern, suggesting that the established bullish trend may resume after the mid-month pullback.

If the uptrend has indeed resumed, bulls may look to quickly take EUR/USD back to this month’s nearly 3-year highs at 1.2350 pending next week’s US Federal Reserve meeting. Only a break below this week’s low in the 1.2050 area would turn the near-term bias bearish for a potential correction toward the 100-day EMA near 1.1950.

Source: TradingView, GAIN Capital

Learn more about forex trading opportunities.