When is the ECB announcement?

The ECB is due to make its monetary policy decision on September 9th at 11:45 GMT. This will be followed by an ECB press conference at 12:30 GMT.

What to expect?

Surging inflation across the Eurozone as the economy reopens from lockdown has raised the possibility of the ECB starting to rein in its accommodative policy.

Inflation rises at fastest pace in a decade

CPI surged to 3% in August, up from 2.2% in July. Core CPI also jumped to 1.5%, up from 0.7%. This was the fastest rise in consumer prices in over a decade and well above the ECB’s target of 2%.

Meanwhile PPI which measure inflation at wholesale level also is elevated at 2.3% in July, well ahead of the 1.1% forecast. With PPI remaining high, this often creeps down into CPI suggesting that the surging levels of inflation may not be as transitory as initially thought.

What are the policy makers saying?

Whilst ECB President Christine Lagarde is a known Dove, might she finally be warming to the hawkish calls on the Governing Council?

Last week a series of public comments by ECB policymakers hinted towards a more hawkish bias on Thursday, these comments boosted the Euro. The hawks included Jens Weidmann, Klaas Knot and ECB vice president Luis de Guingos to name a few. The strengthening of the Euro suggests that the common currency is already starting to price in a move by the central bank.

However, it is worth keeping in mind that apart from inflation recent data from the Eurozone has been broadly down beat. Retail sales, German consumer and business sentiment and PMI figures all come in below forecasts.

The vote could be a close call.

Should the hawks win, the focus will be on the Pandemic Emergency Purchase Programme (PEPP). The ECB could trim the PEPP to €60bn - €70 billion a month, down from the current level of €80 billion.

Eurozone growth and inflation outlooks could well also be upwardly revised.

ECB relative to the Fed - EUR/USD

At the same time as watching whether the ECB are ready to start tapering monetary policy investors will also be keeping an eye on what other central banks are doing.

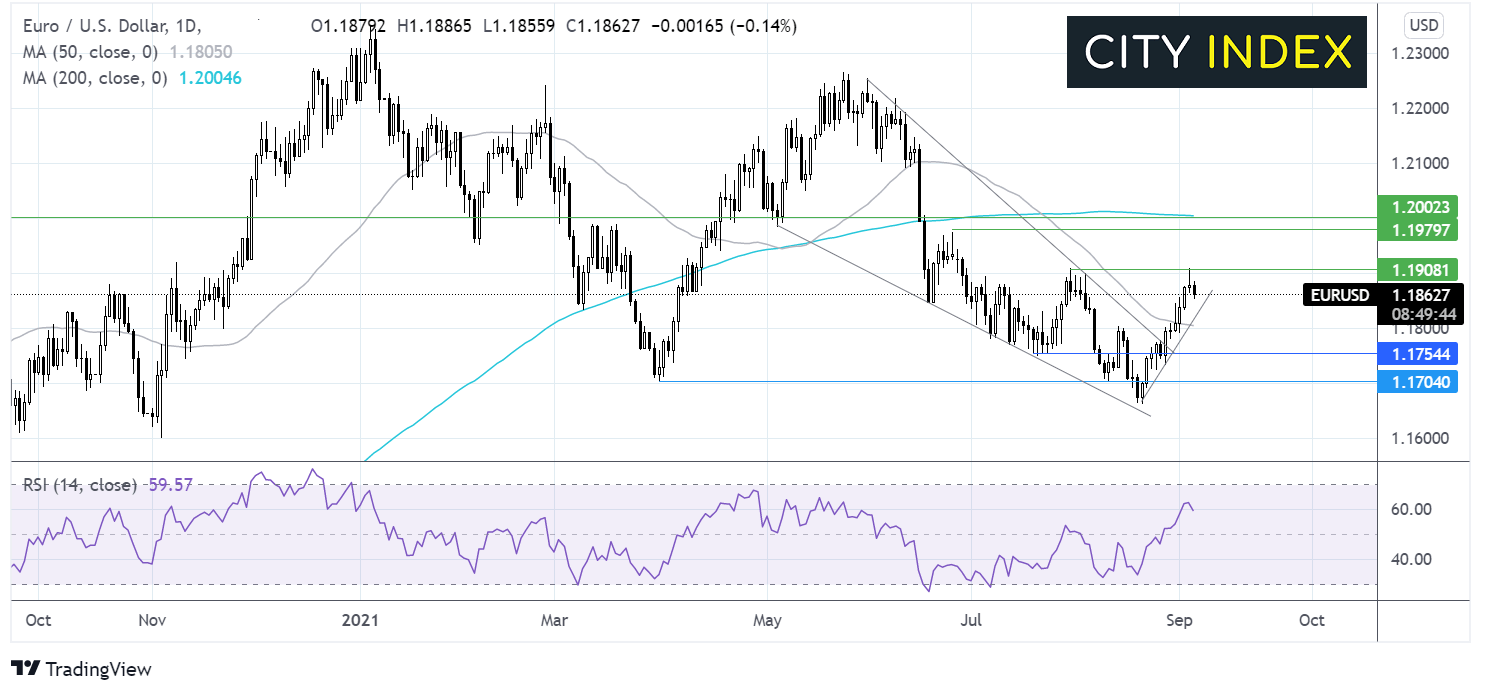

Should the ECB start to taper at a moment when the Federal Reserve has been forced to pause its path towards policy normalization, this could be beneficial to the Euro pushing it meaningfully above 1.19 potentially pushing it to resistance around 1.1975 -1.20 zone.

Should the ECB doves one again dominate then the Euro could fall towards 1.1750 unwinding some of the hawkish boost from last week.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.