Thursday 23rd January

Key points:

- No change to policy expected

- Learning to read Christine Lagarde

- Strategic review

The ECB ae not expected to alter monetary policy. Data since the December meeting is pointing to the slowdown in the eurozone economy bottoming out. However, there is still no sign of a rebound in the manufacturing sector. Concerns also exist that the slowdown in the manufacturing sector could still spill over into the labour market. Inflation is showing some signs of picking up, which will offer some reassurance to the ECB. However, at 1.3% it may be at the joint highest level since March last year, but it is still significantly short of the central bank’s 2% target.

Reading Christine Lagarde

This all means that we aren’t expecting any fireworks from the ECB regarding monetary policy. A continuation of wait and see and an opportunity to learn to how to read Christine Lagarde who has just three months in office.

Strategic review

Perhaps of more interest and the highlight of this month’s meeting will be the kicking off of the strategic review. The scope and parameters for the review need to be set and could garner attention. Going forwards (the review could take a year) the definition of price stability and how to reach it will almost certainly be the most important part of the review. We could eventually see a new definition for the “around 2% target” for inflation, possibly changing to a more flexible range.

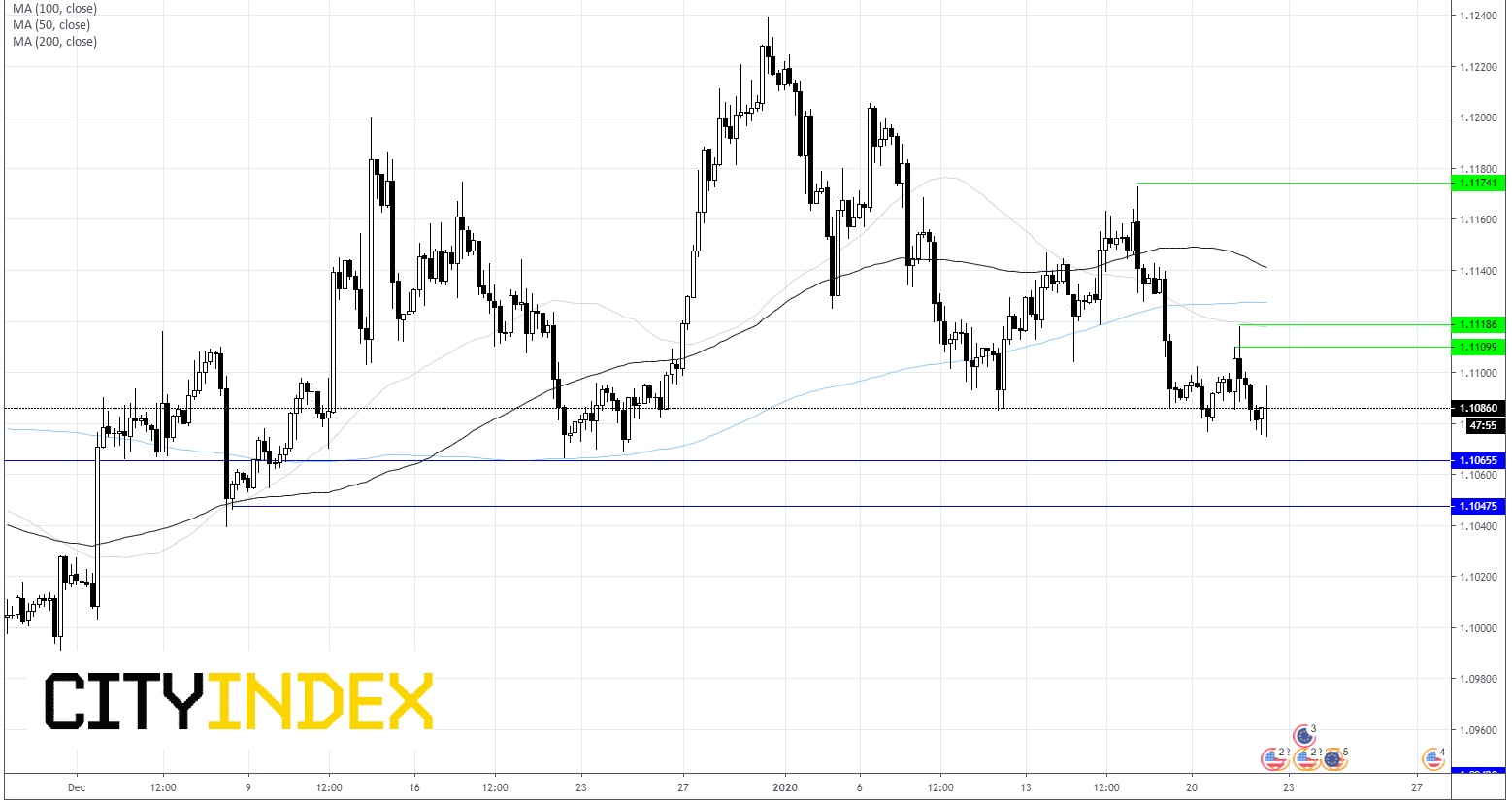

EUR/USD levels to watch

EUR/USD is holding steady at the time of writing and remains below $1.11. The pair is also below its 50,100 and 200 sma on 4 hour chart, a bearish sign.

Sustained weakness below $1.1065 could confirm EUR/USD’s bearish bias, setting the stage for further declines towards $1.1050 and towards the key psychological $1.10 level.

A move above $1.1095 should bring resistance at $1.1110 and $1.1120 into play. A move above $1.1175 could negate the current bearish bias.