ECB officials hinting rate cuts- What it means for EUR/USD

The headline read “ECB officials said to see markets underestimating rate-cut odds”. This headline coincided with the opening of the US stock market. Stocks already moving lower into the open and continued moving lower after the open. This was a double whammy for the EUR/USD as the ECB comments pushed the Euro lower and the move lower in stocks helped push the US Dollar higher (EUR/USD lower).

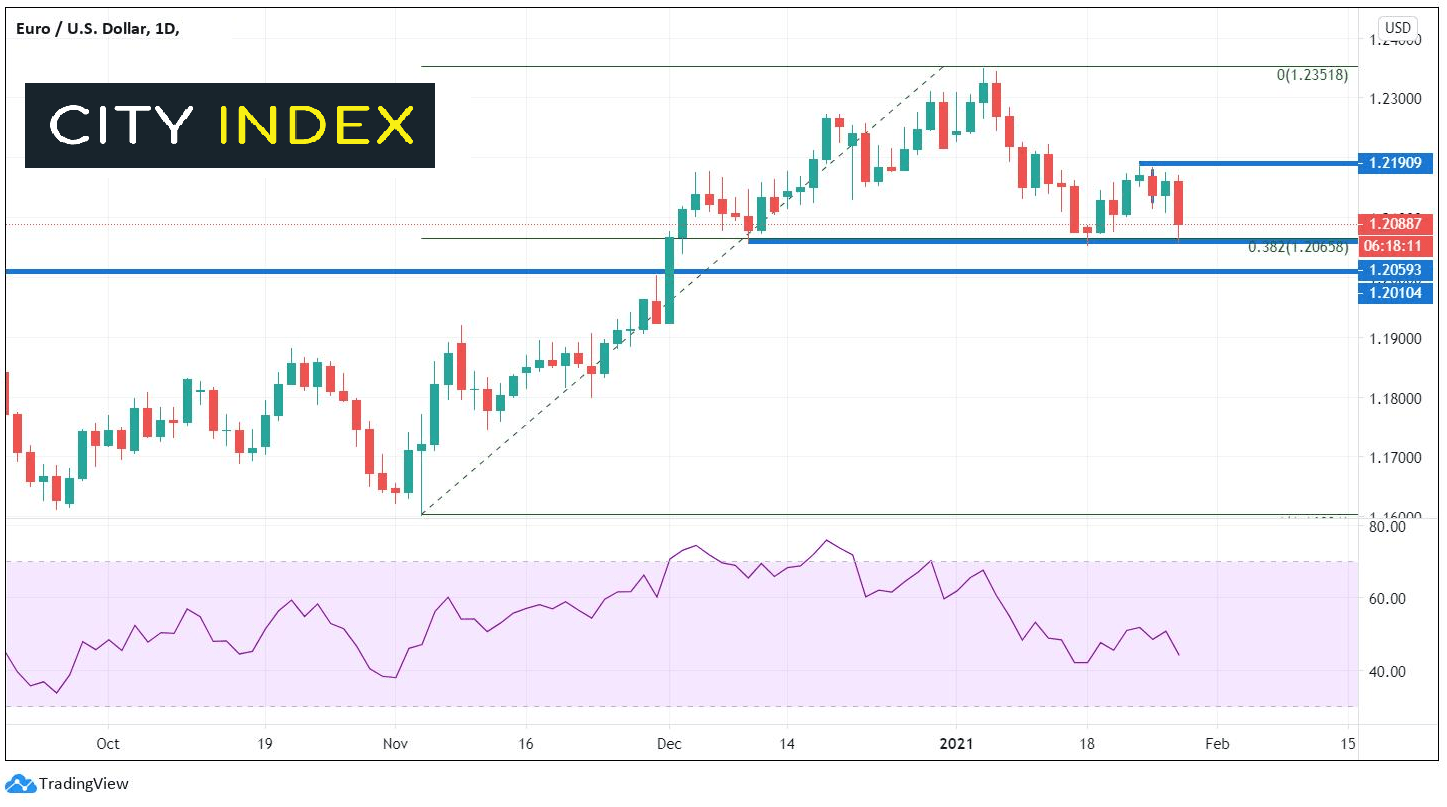

EUR/USD quickly moved lower on the ECB comments. For the moment, the pair is holding recent support at 1.2050 as the market begins to price in a rate cut. That level also confluences with the 38.2% Fibonacci retracement level from the November 4th, 2020 lows to the January 6th highs. Below that, previous resistance near 1.2010 is the next level traders will be eyeing for support. However, be aware that markets may slow ahead of the FOMC meeting later today.

Source: Tradingview, City Index

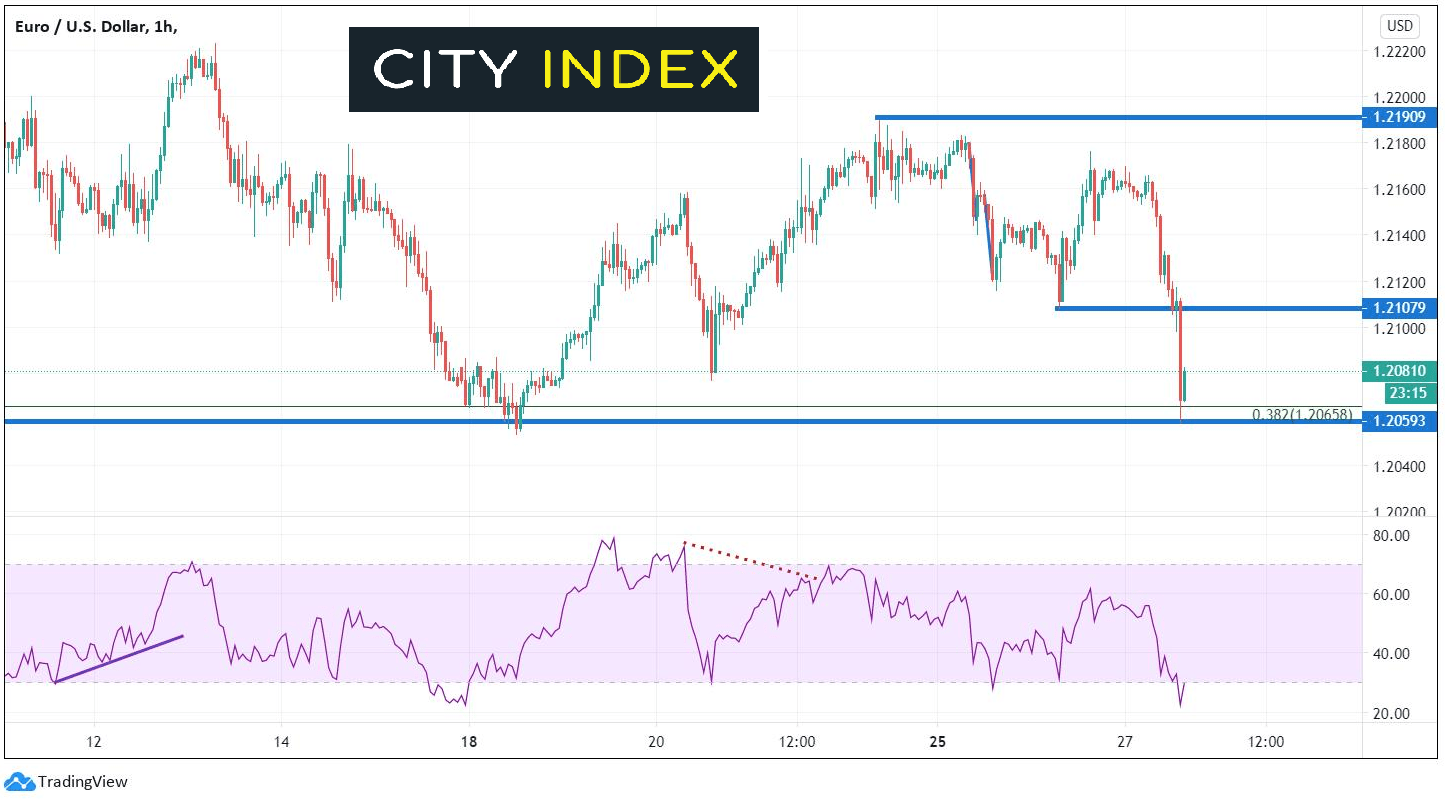

Intraday resistance is now at 1.2108.

Source: Tradingview, City Index

Although the ECB has indicated that they may be ready to cut rates, watch the FOMC meeting in a few hours to consider the US Dollar side of the equation and get a better picture for EUR/USD!

Learn more about forex trading opportunities.