When is the ECB monetary policy announcement?

The ECB will make its monetary policy announcement is on Thursday 28th October at 12:45 BST.

What to expect?

In a world where major global central banks are adopting a more hawkish tone and considering raising interest rates, the ECB stands out as one of the more dovish major central bank.

ECB President Christine Lagarde has stuck to the script that higher inflation is transitory, despite signs of rising inflationary pressures. CPI in September jumped to 3.4% a 13 year high. However, core inflation rose to 1.9%, still below the ECB’s 2% target. Rising energy prices are one of the principle contributing factors to higher inflation.

ECB President Christine Lagarde reiterated earlier this month that the central bank would not overreact to rising energy process. Supporting her cautious tone, Chief economist Philip Lane stressed the need for patience. He does not consider Eurozone inflation to be in a red zone which requires immediate action. Compared to the US for example, where inflation reached 5.4% consumer prices the eurozone are comparatively low. Still the more dovish tone from the ECB compared to its peers has dragged on the value of the common currency in recent weeks.

Fresh GDP and inflation forecasts are due at the December meeting. Therefore, expect few fireworks this meeting and any decision regarding the PEPP programme which expires in March will most likely be pushed back to December. Instead, the market will likely scrutinize comments regarding inflation.

What to watch:

The market will be watching ECB commentary surrounding elevated inflation. Also under the spotlight will be commentary surrounding market pricing for a first interest rate hike. Earlier this month Philip Lane suggested that the market could have been overestimating the probability of a hike in 2022. The market currently prices in a 10-basis point hike by the end of next year and 4 by the end of 2023- which goes against the ECB’ more dovish tone.

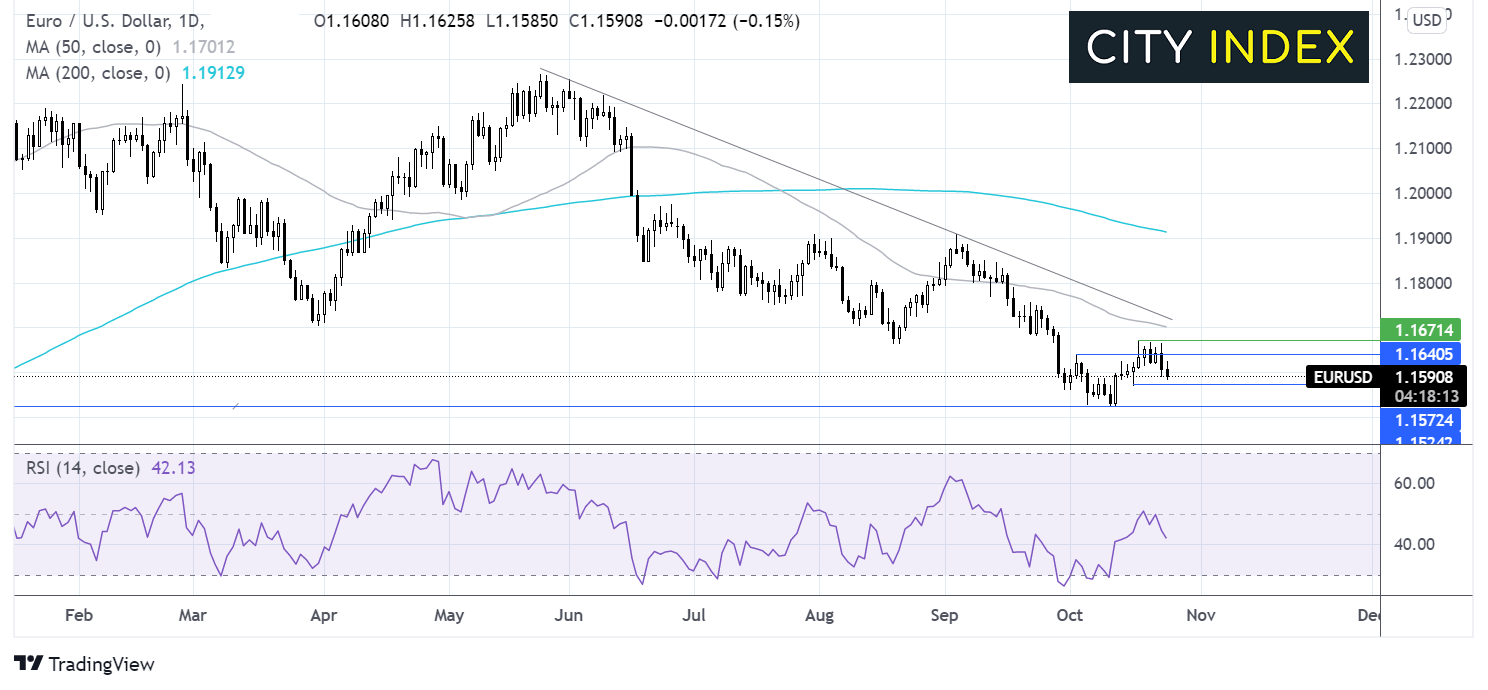

Learn more about the ECBExpectations are pretty low heading into the meeting, the EUR trades around its year to date low against both the USD and GBP on central bank divergence. Should Lagarde & Co stick to the current dovish rhetoric the Euro could sell off further. Even a more neutral tine from Christine Lagarde could prompt a pickup in the Euro. Furthermore, any clear signs of an exit strategy from the ultra-loose monetary policy could spark a bullish EUR/USD reaction.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.