European stocks are pointing to a mostly positive start on Thursday following a strong finish on Wall Street overnight, although caution lingers ahead of the ECB monetary policy announcement.

Overnight the tech heavy Nasdaq reported is strongest rise in over 4 months, surging 2.7% snapping a three-day losing streak which had traders questioning the valuations of big tech stocks. The Dow Jones & S&P 500 closed +1.6% and 2% higher respectively. It’s still early days and too early to make a call either way, this could just be a healthy correction in tech stocks, although this could also be the start of a longer-term rotation out of these stocks.

ECB to talk down the Euro?

All eyes will now turn to the ECB who will announce their monetary policy decision at 11:45 GMT followed by a news conference from Christine Lagarde. The ECB are not expected to adjust policy at this meeting so the focus will be firmly on the new economic projections and comments from Christine Lagarde.

It was reported yesterday that the ECB were confident in the outlook for the bloc’s recovery, the upbeat comments sent the EURO higher. However, attention will also be on Christine Lagarde and whether she will build on Chief Economist Philp Lane’s concerns over the strength of the Euro. Will Christine Large try to talk down the value of the Euro in light of how important the export sector is to the bloc.

Oil is on the back foot in early trade, unable to shake off lingering concerns over the demand outlook, particularly as the US driving season comes to an end. A rise in inventories has fuelled these concerns further. The API reported 2.97 million barrel build in crude stockpiles, following a 1.4 million draw expected. EIA data is expected later today. WTI

US jobless claims

Looking ahead attention will shift to the US labour market. Investors will be scanning the market for signs that the US labour market recovery remains on track. Initial claims are expected to slip slightly lower to 846k, down from 881k. The is would represent a slow recovery but at least it still represents a recovery.

Looking ahead attention will shift to the US labour market. Investors will be scanning the market for signs that the US labour market recovery remains on track. Initial claims are expected to slip slightly lower to 846k, down from 881k. The is would represent a slow recovery but at least it still represents a recovery.

FTSE housebuilders

On the FTSE, housebuilders could find support after RICS data revealed that the post lockdown jump in house prices continued in August, with prices surging to a 4 year high. According to the Institute of Chartered Surveyors (RICS) prices soared +44 in August from +13 in July. We still consider this to be a false dawn with house prices likely to come under pressure as unemployment rises. House builders are cyclical, a prolonged recession could drag on this sector.

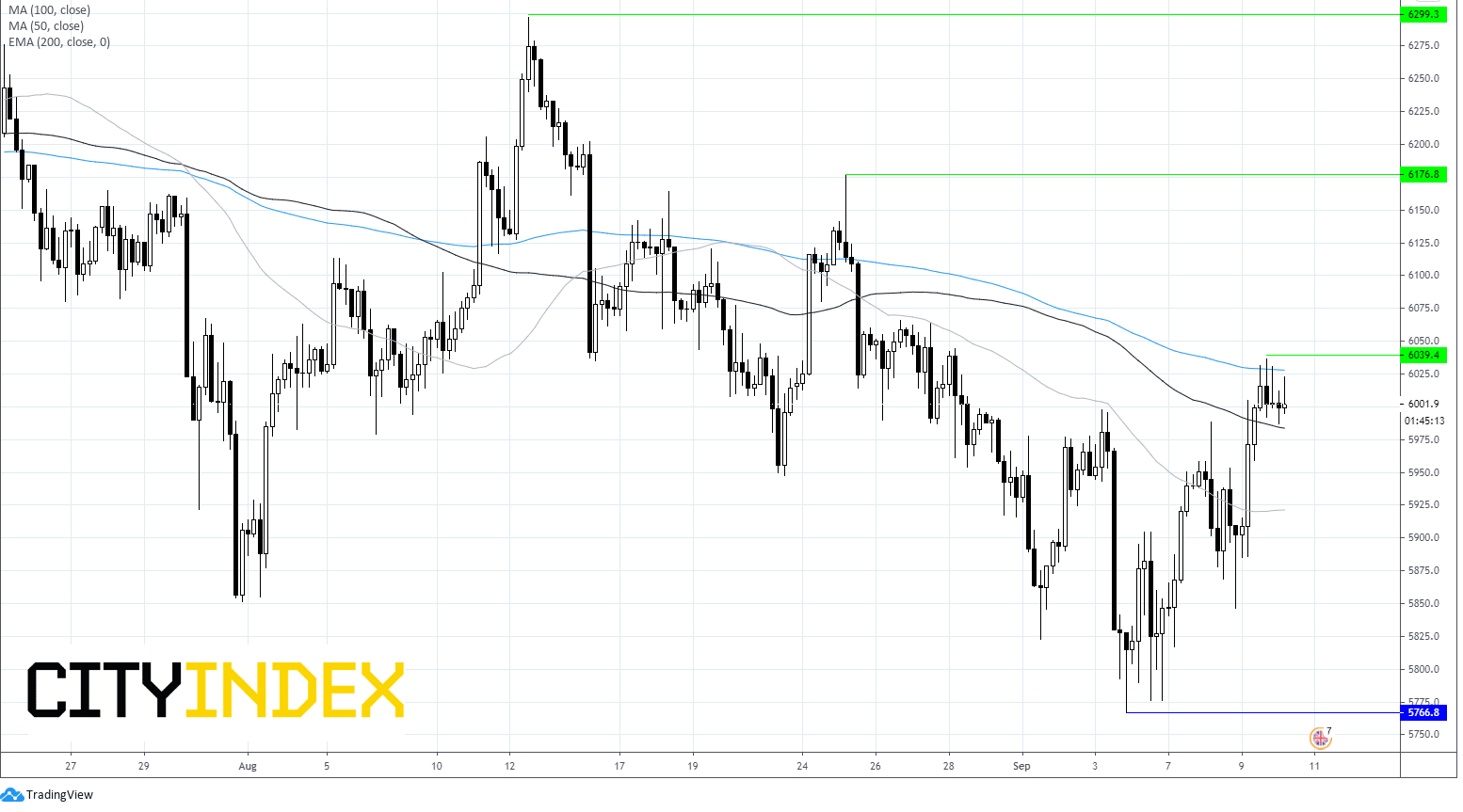

FTSE Chart