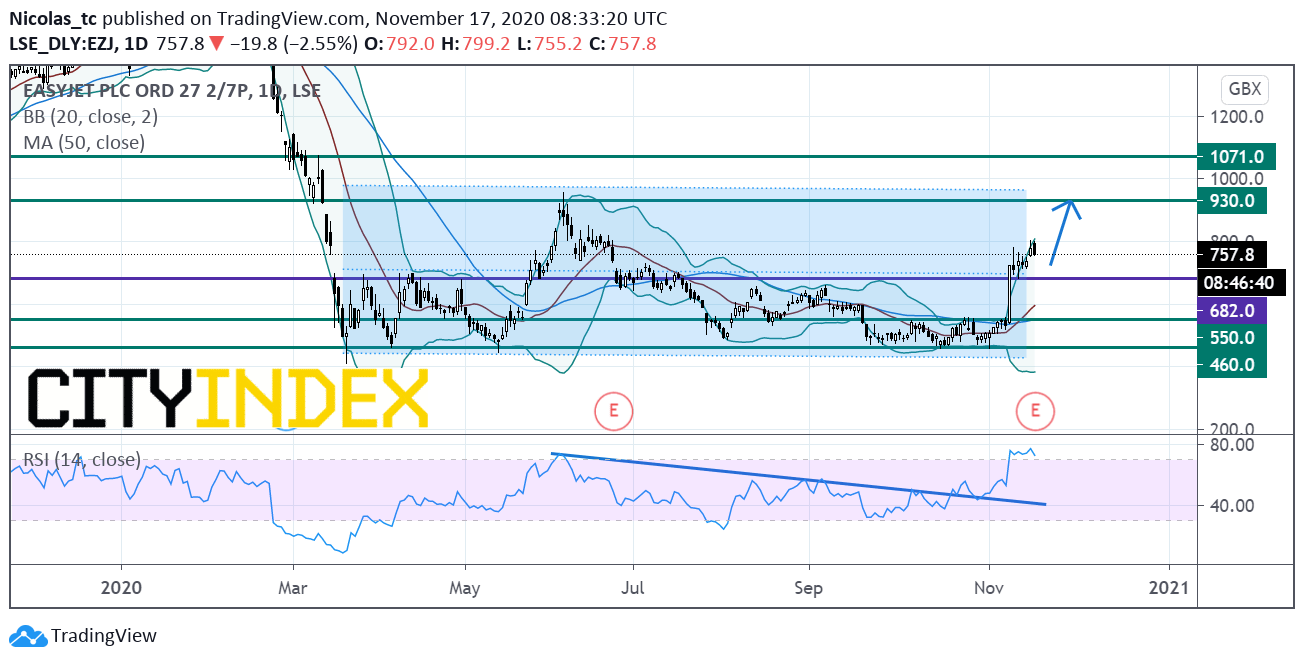

EasyJet: Watch the support level at 682p

EasyJet, a low-cost airline, posted full-year loss before tax of 1.27 billion pounds, compared with a profit before tax of 430 million pounds in the prior year, and revenue declined 52.9% on year to 3.01 billion pounds. The company has decided not to pay a dividend, compared with a dividend of 43.9p per share in the previous year. Regarding the outlook, the company stated: "Based on current travel restrictions in the markets in which we operate, easyJet expects to fly no more than c.20% of planned capacity for Q1 financial year 2021."

From a chartist's point of view, the stock price is posting a short term rebound within a medium term trading range between 460p and 930p. The daily RSI (14) is bullish but highly overbought. Bollinger bands are widening. Prices need to stand above 682p to maintain the bullish bias. Caution: a break below 682p would call for correction move towards 550p and 460p.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM