- Q1 2020 revenue per seat, an important metric for airlines jumped 8.8%.

- Total revenue +9.9% to £1.4 billion of which £1.1 billion ticket revenue.

- Passenger numbers +2.2% to 22.2 million = 1% increase in capacity

- Capacity expected to grow 1.5% vs 1.7% exp.

easyJet continued to benefit from the collapse of Thomas Cook, which has pushed more customers its way. As a result, its loss over the winter period (6 months to March) is set to shrink, allowing easyJet to raise H1 revenue guidance.

According to Chief Executive Officer Johan Lundgren, around 20% of the 8.8% increase in revenue per seat was owing to the collapse of Thomas Cooke with easyJet holidays quickly moving to fill the void.

Pick up extra demand going forward?

easyJet’s ability to pick up from rival’s shortcomings could continue across the summer. Rival Ryanair’s expansion will be limited in the coming months and possibly years by the grounding of Boeing’s 737 Max. Enabling easyJet to pick up the extra demand across the summer months as well.

With ¾ of seats for H1 already booked, easyJet is defying calls of soft demand across the industry amid Brexit and low consumer confidence. Let’s not forget it was only last week that Flybe hit troubled times.

Costs increase

Costs are also a key metric for easyJet, particularly as the airline has been trying to rein them in. Cost per seat excluding fuel increased 4.3%, in line with management expectations despite the ongoing cost cutting programme. This was slightly disappointing. Blame was apportioned to ground handling costs and French air traffic control strikes.

Chart thoughts

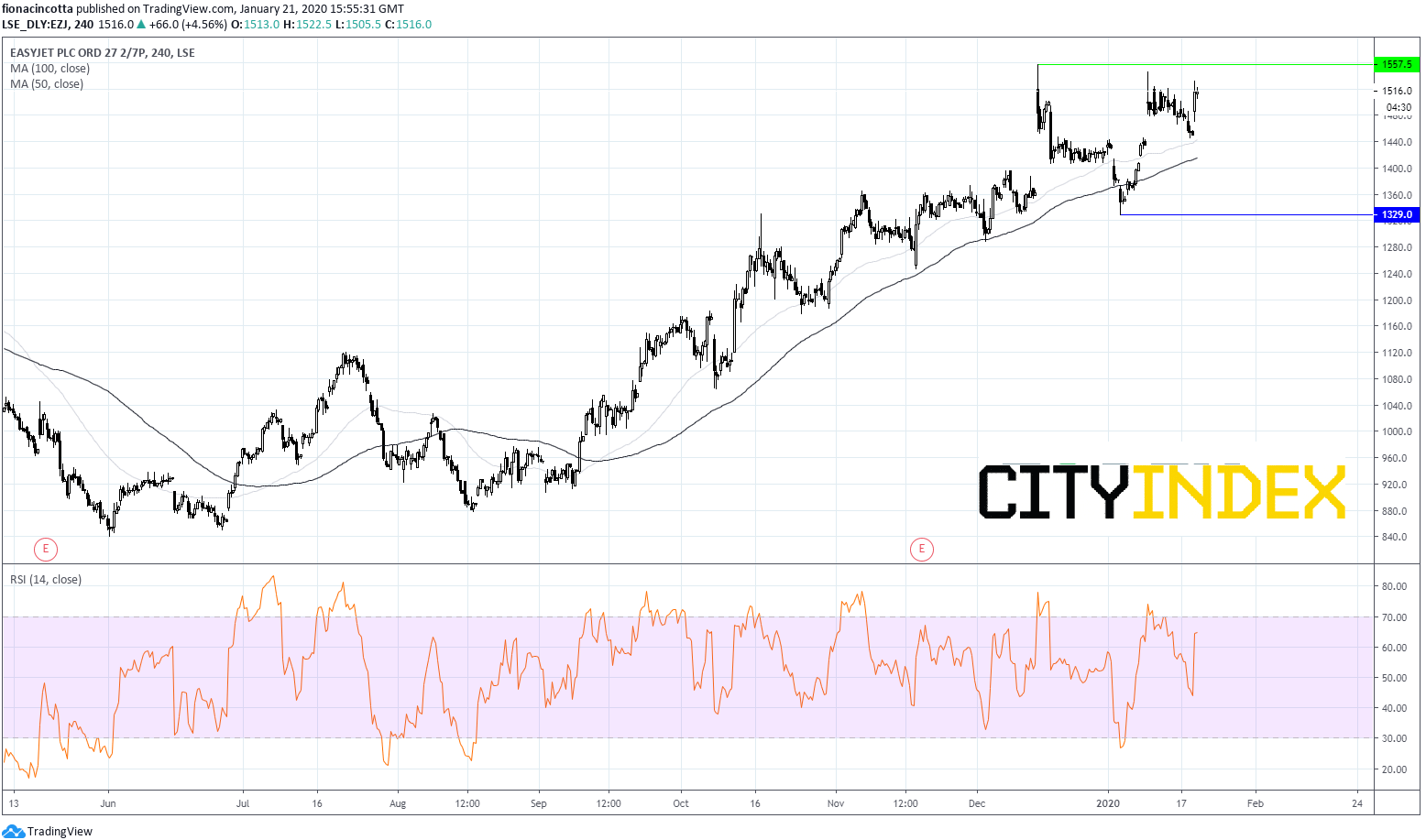

easyJet surged 4.5% on Tuesday and trades comfortably above its 50, 100 and 200 sma on 4 hour chart, showing strong bullish momentum. The RSI remains below 70 so not in over bought territory.

A move through 1440 (50 sma) and 1415 (100sma) could broaden the selloff, opening the door to support at 1329. A breakthrough this level is needed to negate the current uptrend.

Immediate resistance sits at 1557p (Dec 13th high).