Figures:

- Pre-tax profit £426 million vs £578 million a year earlier

- Revenue £6.3 billion vs £5.9 billion a year earlier

- Passenger no. exp. 8.6%

- Total revenue per seat exp. Fall 2.7% as capacity increases 10%

EasyJet updated the market in October, so we are not expecting too many surprises tomorrow. In its trading update last month, EasyJet said that its full year profit would be at the higher end of guidance between £420 – 430 million, from a previous guidance of £400 – 440 million.

Profits are in the upper end of management's earlier target is thanks to progress in non-fuel cost savings and increased passenger numbers as EasyJet benefits from strikes at rivals Ryanair and British Airways and the bankruptcy of Thomas Cook.

EasyJet has capitalised on sector peers’ troubles which have helped douse fierce competition. Less competition has been good news for prices as customers chase fewer seats.

However, EasyJet can’t rely on the misfortunes and problems at rival airlines. These problems are now likely to fade, and we will enter a period of more stable pricing.

As a result, EasyJet’s competitiveness and costs will be in focus. Non-fuel costs are set to increase, mostly due to the rising cost of fuel, a large yet unavoidable cost. However,investors will be looking for progress in non fuel cost saving. For example, investors will be looking for any progress in the “self-help initiative” to help offset rising costs. EasyJet will need to show that it can keep delivering on cost control in order for investors to jump in at its current valuation.

Traders will also want more detail on the 18 new airport slots that EasyJet purchased after the collapse of Thomas Cook left them vacant.

Looking ahead:

Brexit has been an ongoing source of concern for EasyJet investors. However, with the Tories holding a comfortable lead in the polls a Brexit deal is looking more likely than a no deal Brexit, easing some concerns. Slowing economic growth within the eurozone is also a factor to keep on monitoring.

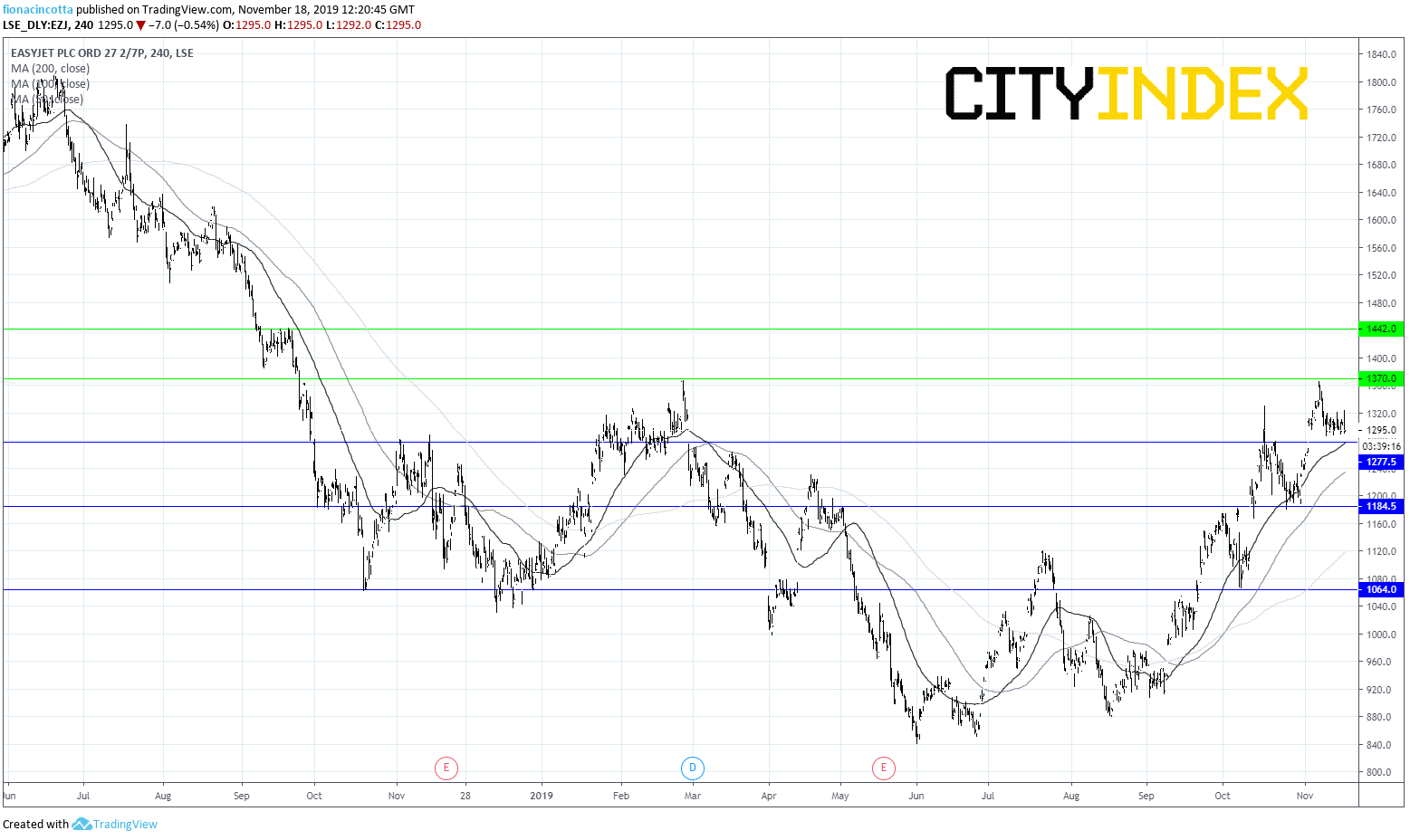

Levels to watch:

After slipping to a low of 840p in June, EasyJet has been rebounding. Even after an 8% decline in October following the release of its trading update, the stock has continued carving out a series of higher highs.

EasyJet trades comfortably above its 200, 100 & 50 ma, a bullish chart. Resistance can be seen at 1370p prior to 1440p. On the downside, immediate support is seen at 1280p, before 1185p and 1065p.