A double whammy of good news sent easyJet flying up the FTSE leader board. Strong Q3 results combined with news of poaching Peter Bellew as Chief operating officer from rival Ryanair sent shares 2% higher when the broader market was in decline.

A sharp increase in late bookings, which are usually more expensive has provided some relief for easyJet in what has become an increasingly challenging environment. Investors had been fearing that easyJet would have to warn on profits, particularly after May’s half year results made for dismal reading.

Points against

European carriers have seen margins squeezed owing to a glut in capacity across the region and as Brexit uncertainty has put holiday makers off booking another foreign excursion. With a lack of major sporting events and overall demand trending lower some carriers are struggling. there is no getting away from Brexit and the potential disruption that a disorderly exit from the European Union could have on easyJet. This has weighed on the price of the share which has lost 60% in 12 months.

Points for

However, today’s results and appointment could offer support to the price of easyJet shares. As will the fact that rival Ryanair will be cutting flights next summer because the grounding of Boeings 737 Max jets will delay the delivery of Ryanair’s new Max 200 aircrafts. easyJet, as an Airbus only fleet will be unaffected. Below the Brexit headwinds is hasn’t all been bad news, easyJet is still managing to grow its underlying business, whilst others fail. easyJet could emerge stronger after a difficult period for the aviation industry.

Analyst Consensus

7 Buy

16 Neutral

2 Sell

Analyst Price Target -1124.4. This offers 5.5% upside.

Levels to watch:

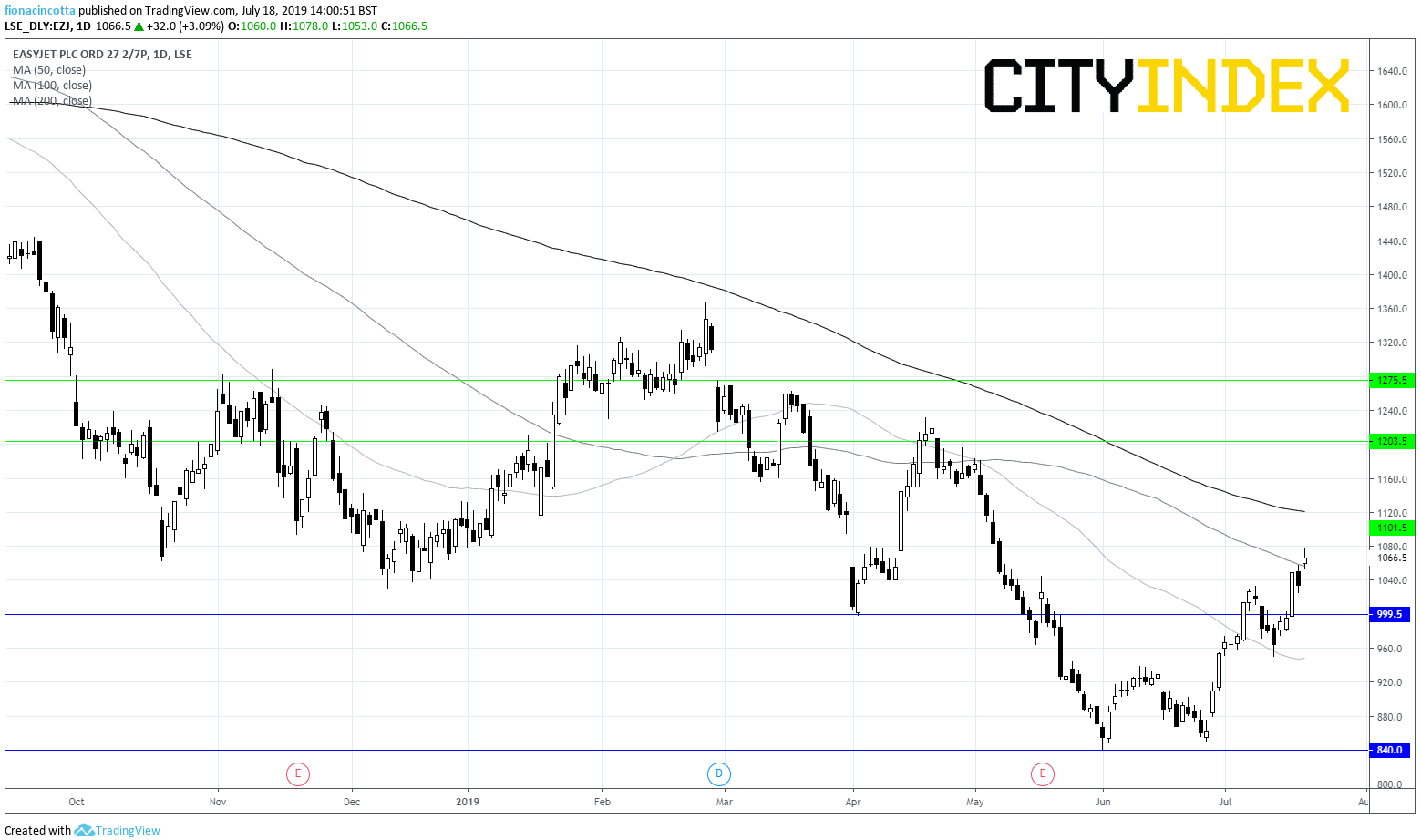

easyJet is trading below its 200 sma but above its 50 and 100 sma on the daily chart. Support can be seen at 1000p. A break above 1100p could indicate a stronger move higher towards 1200p.