EasyJet appears to have navigated, more fortunately than expected, around another summer of disruption, rival business collapses and barely relenting seat capacity that continues to weigh on prices. Passenger revenues and ancillary sales (AKA ‘extras’) outperformed, enabling the group to steer expectations to the upper end of 2019/20 earnings that will be released next month. Trouble is, its fourth-quarter trading statement is conspicuously silent about the outlook for the forthcoming 2020/21 year. That undermines the group’s attempt to emit a halo of confidence following investments in “operational resilience” that reduced the impact of disruptions. Investors, whose patience has been worn thin after years of geopolitical and labour disruptions plus over-capacity, aren’t impressed. That’s led to searing share price punishment, with a drop of as much as 6%, EZJ’s biggest since May. With the stock having gained as much as 32% from mid-August lows, the group either had to demonstrate a solid basis for a re-rating, or, at worst, face a return towards the year’s lows.

Silence on the outlook shifts attention back to less than solid aspects of recent trading and outlook comments limited to the current year. Headline costs are set to rise 12%, driven by fuel and adverse FX movements. Excluding fuel and using flat FX rates, cost per seat is falling. This suggests EZJ is currently on the wrong side of its fuel price hedges and that its intermittently poor currency risk management has returned.

The question of how firm revenue momentum was on an underlying basis in peak months also arises. The group has been clear about benefits from BA and Ryanair strikes and Thomas Cook’s collapse. Speaking of the latter, there are signs that some of the recent share price optimism, predicated on capacity reduction, may have run too far. The bankrupt group accounted for just 1.5% of medium-haul, according to Bloomberg data. That means airlines will need to keep statements about potential advantages quite limited. Furthermore, Thomas Cook’s exit is also expected to reduce airline lease rates, tempting capacities even higher. The anticipated return of Boeing’s Max in Q1 2020 should tend towards a similar effect.

Against that backdrop, easyJet’s tacit message about the forthcoming year, still speaks volumes.

EasyJet Plc. chart

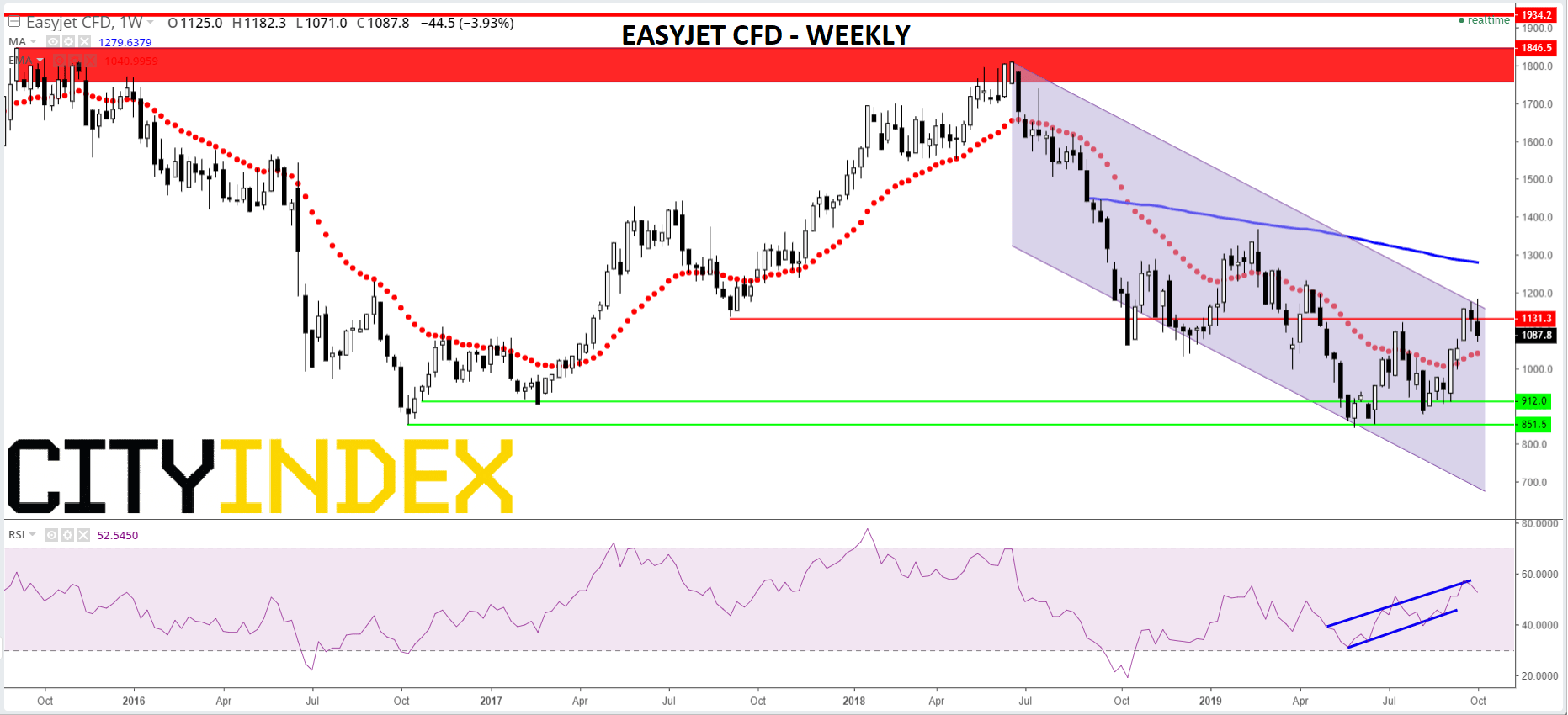

Indications that the shares were about to pull out of their dive since June have been disproved on Tuesday. The stock traded right into the top of its declining channel, backed by a rising RSI and 21-day exponential average, before being overcome. Price action confirms the validity of 1135p as resistance: it was initially an undeniable support on in September 2017, then resistance again earlier this year. Failure to stabilise here tends to suggest EZJ is on its way back down to long-term supports roughly between 850p-912p.

EasyJet plc. CFD – Weekly

Source: City Index