Expectations are for earnings to drop in comparison with the year before. Earnings per share are expected to be around 16.2% lower for the sector over the year. This is a smaller loss than in Q2 when banks were aggressively ramping up their reserves for potential loans losses.

1.Bad loans

One factor in the banks’ favour this quarter is that they are not expected to have to add much to bad loan reserves given the billions that they have already set aside in the past two quarters. Economic trends are improving, albeit slowly and impairment charges are not happening at the rate forecast in the prior quarters.

2.US fiscal stimulus

A US fiscal stimulus package could make a significant difference to the speed of the economic recovery and the amount of bad loans over the coming months. For now, there is no additional rescue package and after Trump's comments a deal prior to the elections just aint't going to happen. Small private business will be the biggest losers and bad loans will likely increase. That said, both Biden and Trump are in favour f further fiscal stimulus so this should just be a matter of weeks.

3.NII

Low interest rates are set to continue to weigh on net interest income against a back-drop of an improving, albeit very slowly, economy. The Fed has indicated that interest rates will remain at 0 or near to 0 for the next week years. This will keep pressure on bank’s net interest income for the foreseeable future. On a positive note, at least the Fed isn’t considering negative rates!

4.Trading

Trading and investment banking arms are still expected to be the star performers compared consumer banking divisions this quarter. Whilst Q3 trading revenue is not expected to be quite as robust as Q2 it is still expected to shine compared to the very slowly improving consumer arms. High volatility plus roaring market for IPO’s

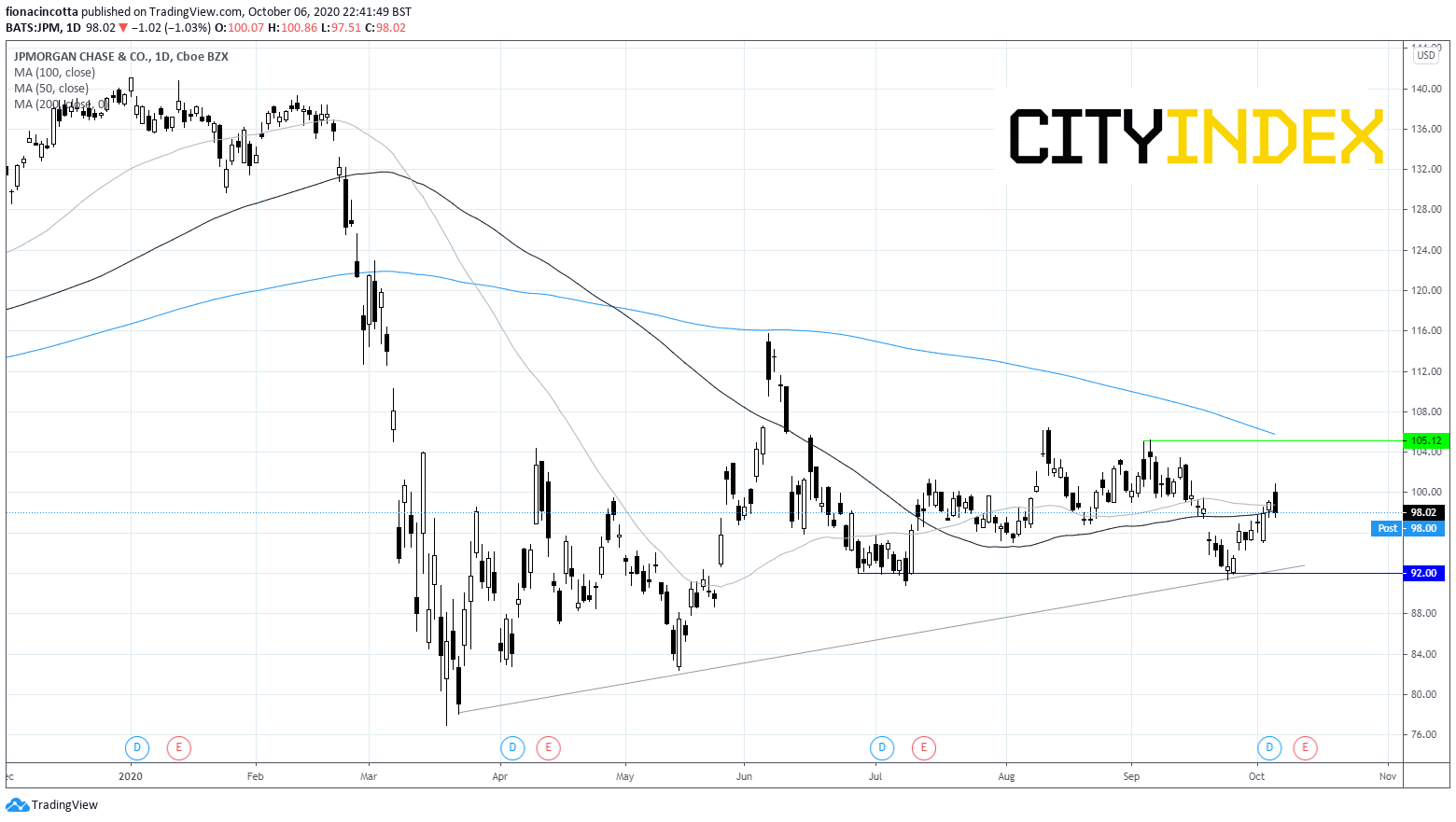

JP Morgan

In recent results there has been a distinct divergence in JP Morgan’s business. Consumer banking has suffered from lower spending and unfavourable interest rates whilst corporate and markets have saved the day. This trend is expected to remain for Q3, although potentially not to the same extent. Consumer spending is picking up, although it has hit some soft patches especially since the fiscal stimulus deadlock since September. On the corporate side, results are unlikely to be as robust as in Q2 +66% but a solid reading is still expected. Expectations: EPS $2.13 on revenue $28.05 billion.

Still trades -30% YTD after rallying from the mid-March low until early June. It trades below its 200 DMA, whilst currently testing the 50 and 100 DMA. The stock trades within a horizontal channel, since early September bound by $105 on the upside whilst $92 offers strong support of the down-side. At $98 the stock trades bang in the middle of the channel. It could be prudent to wait for a meaningful move outside of these boundaries.

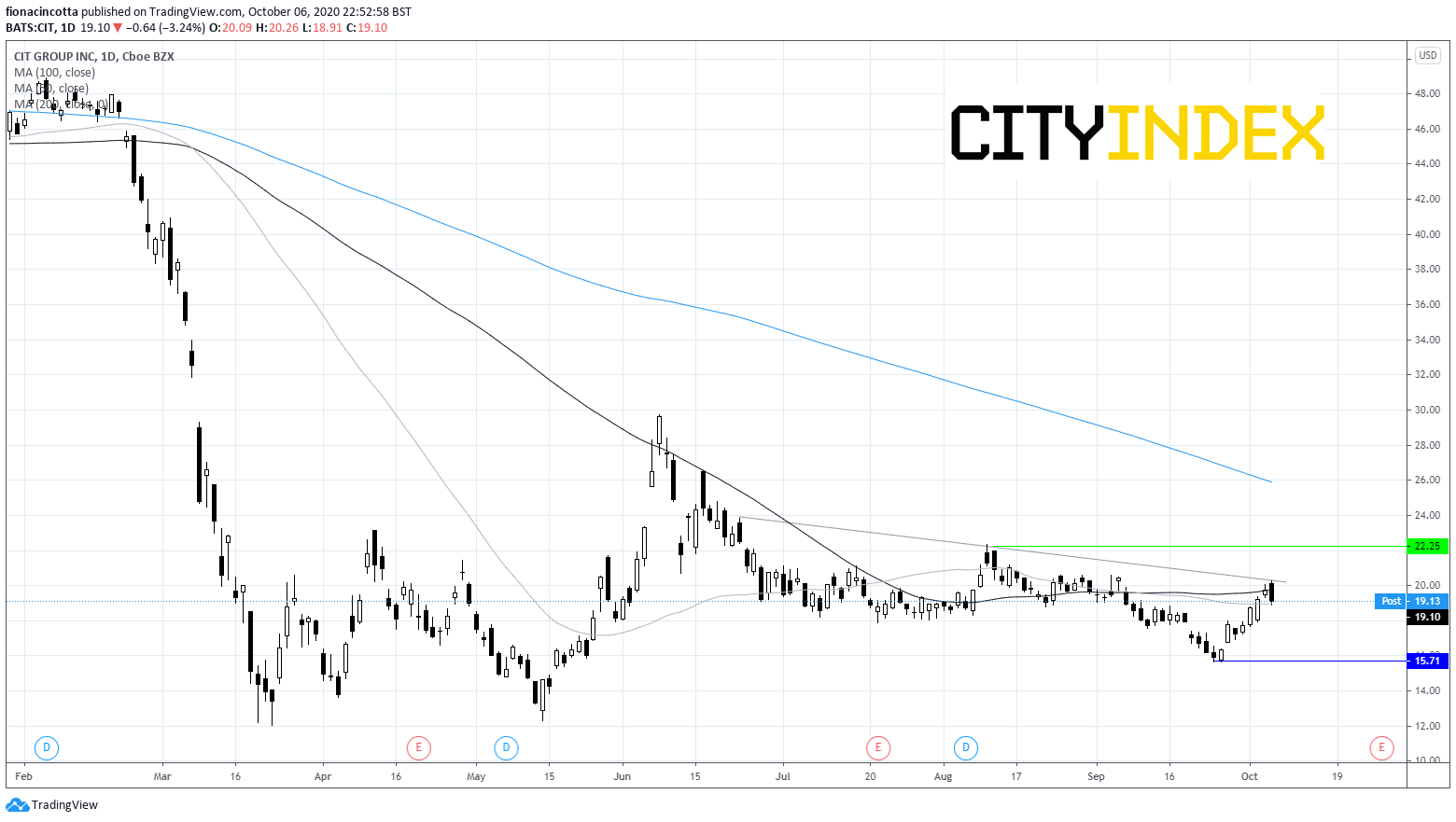

Citigroup

The overall picture has been one of steady improvement in the economy, however Citigroup has under-performed the broader market going into Q3 results. As with the other banks, Citigroup has been affected by the pandemic. However recent developments regarding faults in the company’s risk management systems is also proving to be a big drag. Citigroup could be weighed down by additional reserves, higher expenses and fresh regulatory concerns. Citigroup has already invested $1 billion in infrastructure and controls this year. These costs could continue climbing next year. Expectations: EPS $0.80 on revenue $17.1 billion.

Citigroup trades almost -60% YTD. It has been trading on the back foot since early June and below its descending trendline since mid-Jun, although could be on the cusp of pushing beyond the trendline resistance. $15 offers support of the downside, whilst a move above $22 could see more bulls jump in.

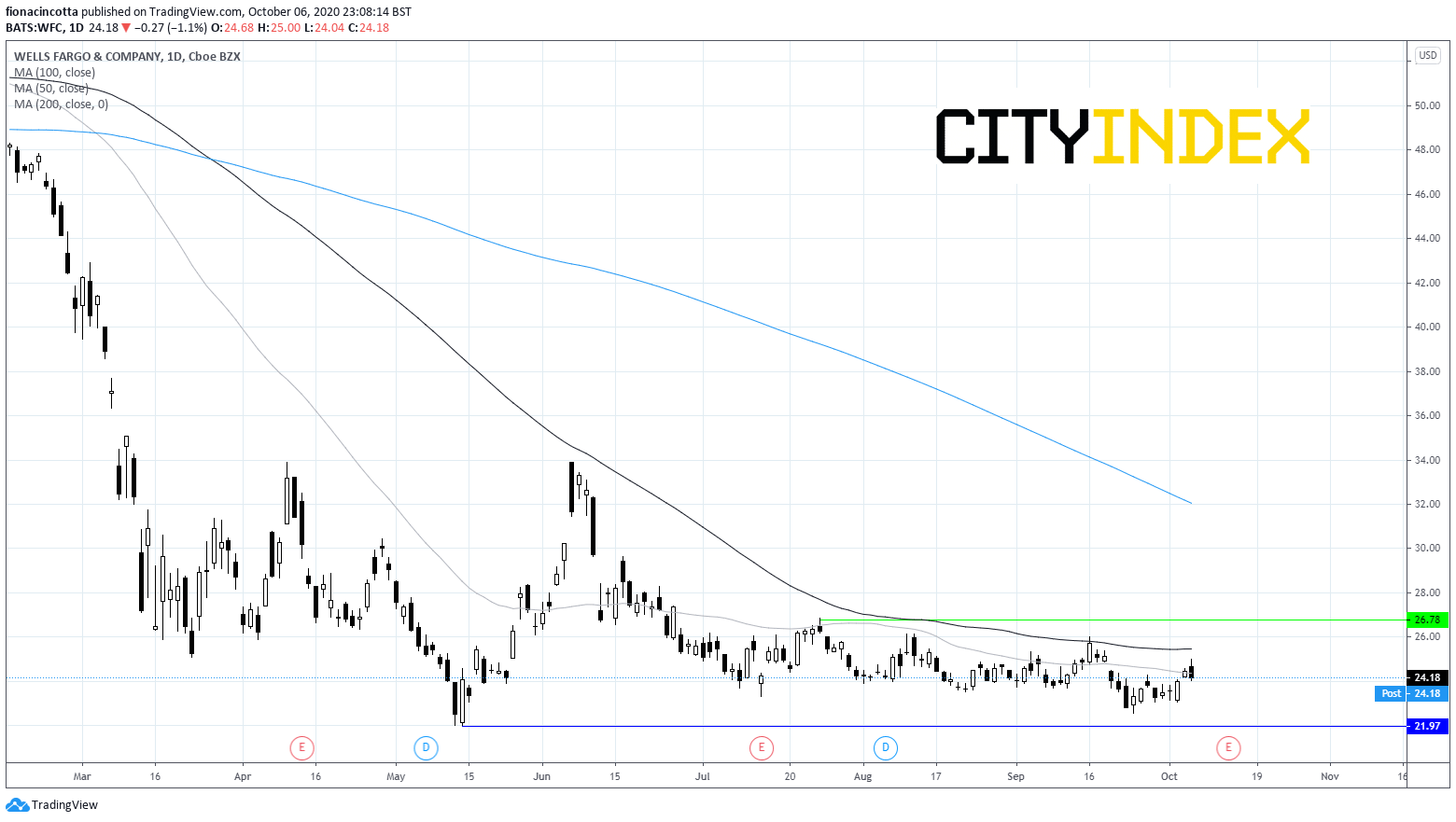

Wells Fargo

After a huge miss for Q2 earnings, investors will be hoping for a better performance this quarter. Wells Fargo continues to hover around covid lows. The Fed slashed rates to near 0 back at the start of the pandemic and the central bank has indicated that there is little prospect of a rate rise until 2023. The interest rate environment is particularly unfavourable and worrisome, and the bank is struggling with low net interest income from the low rates. That said, whilst Q3 was still a tough quarter, indications are that it has been better than Q2. Economic trends are improving, and impairment charges are not happening at the rate forecast in the prior quarter. Expectations: EPS $0.43 on revenue $17.8 billion.

The share price trades -50% year to date, as the tock continues to hover at pandemic lows. The share price has remained capped by the 100 DMA on several occasions over the past few months, a resistance it appears to respect. The 100 DMA sits at 25.55, a break above here could open the door to 26.75 (high 24th June). On the flip side support can be seen at $22, the mid-March low.

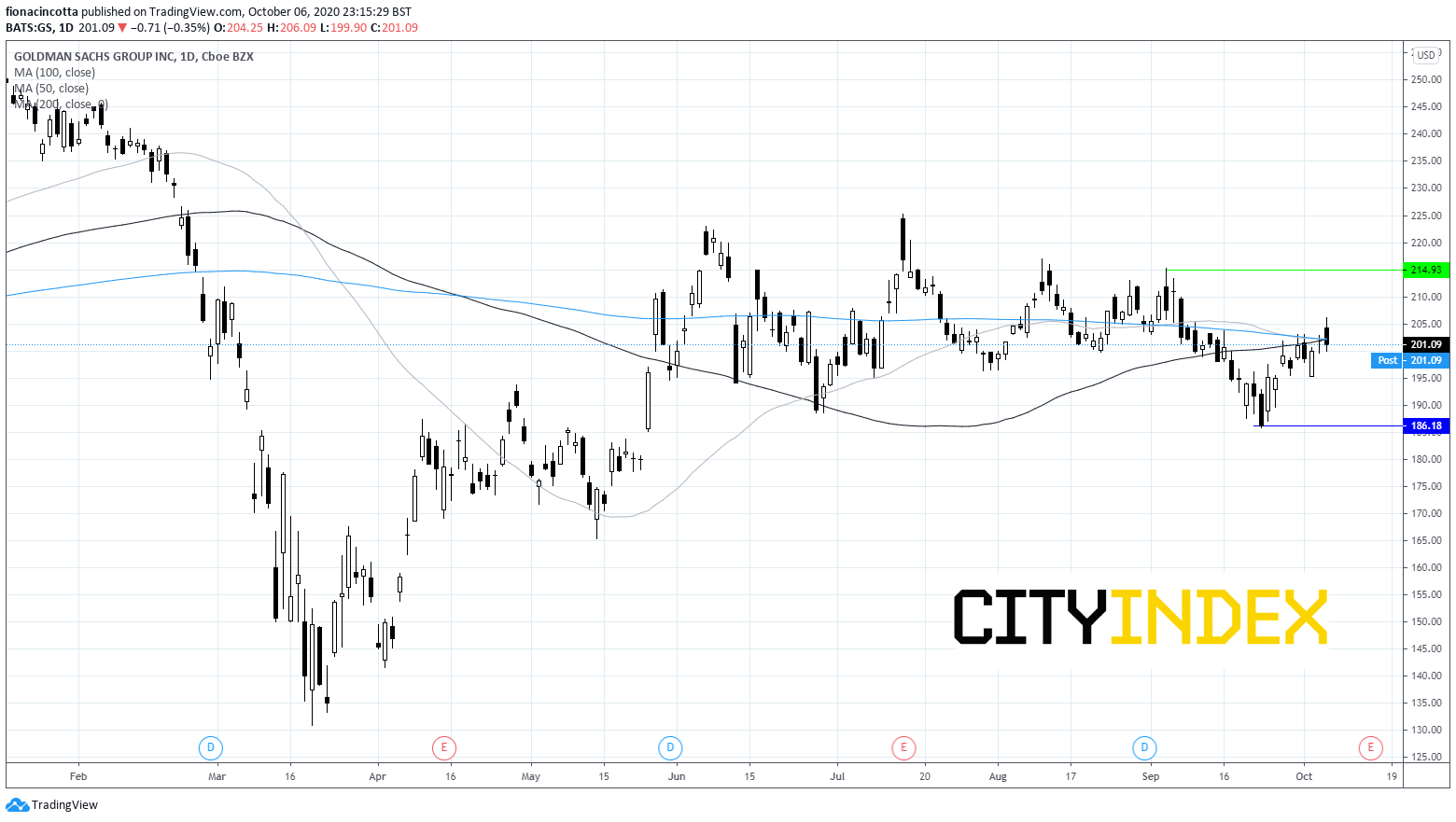

Goldman Sachs

Q2 saw a 41% increase in YoY revenue, way ahead of market expectations and a 60% beat on earnings- mainly driven by growth in its trading and investment banking business. However, that trend is expected to slow slightly in Q3. That said it is still a favourite among the big banks owing to its robust trading revenue and an increase in underwriting activity thanks to a surge in IPO and special purpose acquisitions this summer. The bank still trades 8% below levels seen in late 2019. Expectations: EPS $5.16 on revenue $13.3 billion.

GS trades just -10% YTD, making it the top preforming big bank, not that surprising given its focus on trading over consumer banking. Unlike its peers this is a more bullish chart as the tock makes a solid recovery from mid March lows and is attempting to push above its 50, 100 & 200 DMA, at the current level $202. Whilst the recent recovery is showing signs of stalling, a move above $214 could see more buyers jump in. Support can be seen at $186.

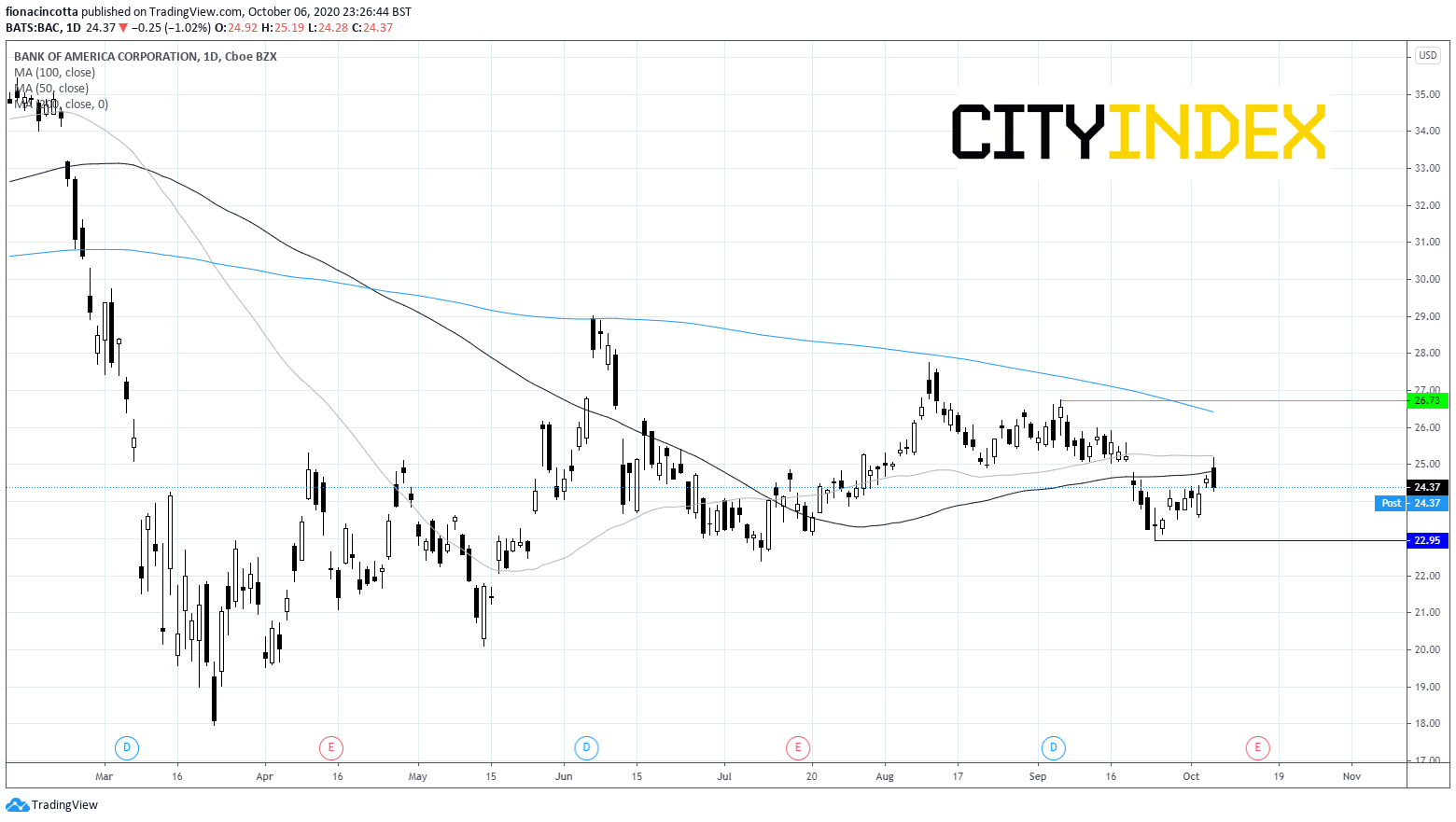

Bank of America

In Q2 BoA beat earnings expectations and roughly matched revenue forecasts. As with the other banks, BoA’s trading arm and investment banking business off-set some of the headwinds from Covid, such as losses in the consumer arm. BoA also reported at 52% decline in NII compared to the same period a year earlier. Whilst NII is likely to remain depressed, the broad expectation is that the worst has passed, and consumer spending is picking up along with mortgage lending. Warren Buffet upped his stake in BoA to 11.3% in July in a vote of confidence for the bank. Expectations: EPS $0.44 on revenue $20.83 billion.

Bank of America trades -30% YTD, under-performing the broader market. The share price has been on a steady downward trend since early June, with the 200 DMA acting as a strong resistance. Its currently testing resistance at 50 & 100 DMA around $25. Immediate support can be seen at $23. On the flip side a break above $26.70 could negate the current bearish trend.