Earnings Play: Wells Fargo

On Wednesday, before market, Wells Fargo (WFC), one of the big 5 banks in the U.S., is expected to release third quarter EPS of $0.45 compared to $1.03 last year. The company's expected move based on front-month options is 4.2%. The last time the company reported earnings the stock dropped 4.6%.

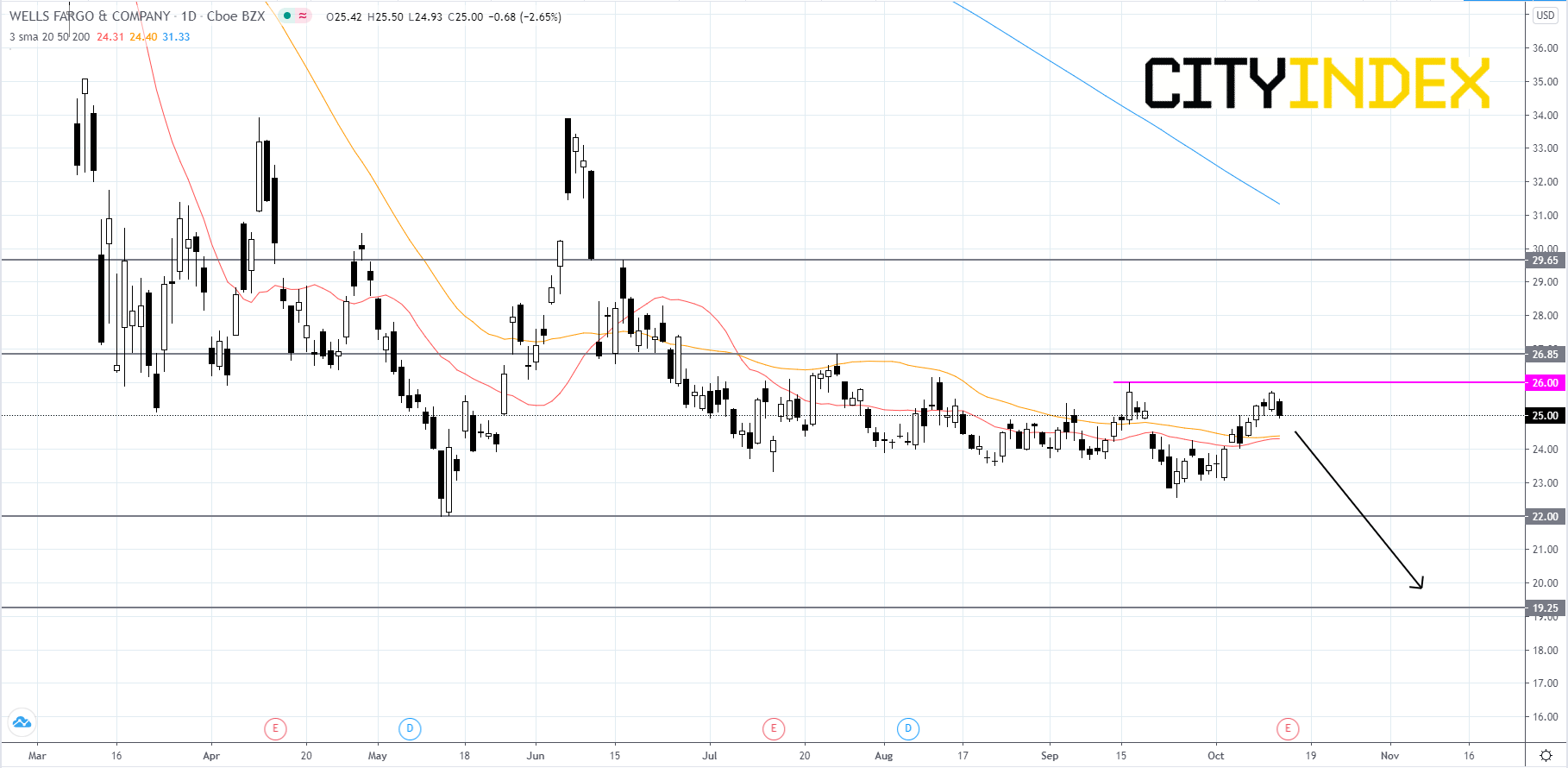

Technically speaking, on a daily chart, Wells Fargo's stock price has been consolidating after a large drop in the first quarter of 2020. Since late-June price has been holding under its 26.85 resistance level and chopping around. In late-September price made its lowest low since mid-July and has not been able to got above its last peak of 26.00. Price is above its 20-day and 50-day simple moving average (SMA), but far below its 200-day SMA. Price will likely lose its short-term bullish momentum and fade towards the 22.00 support level. If price does not find support at 22.00, it could fall all the way down to 19.25 support level, a price last seen in 2009. However, if price can get above its last peak of 26.00, then price could rise to 26.85. If price can manage to breakout above 26.85, then the stock could potentially reach for its 29.65 resistance level.

Source: GAIN Capital, TradingView

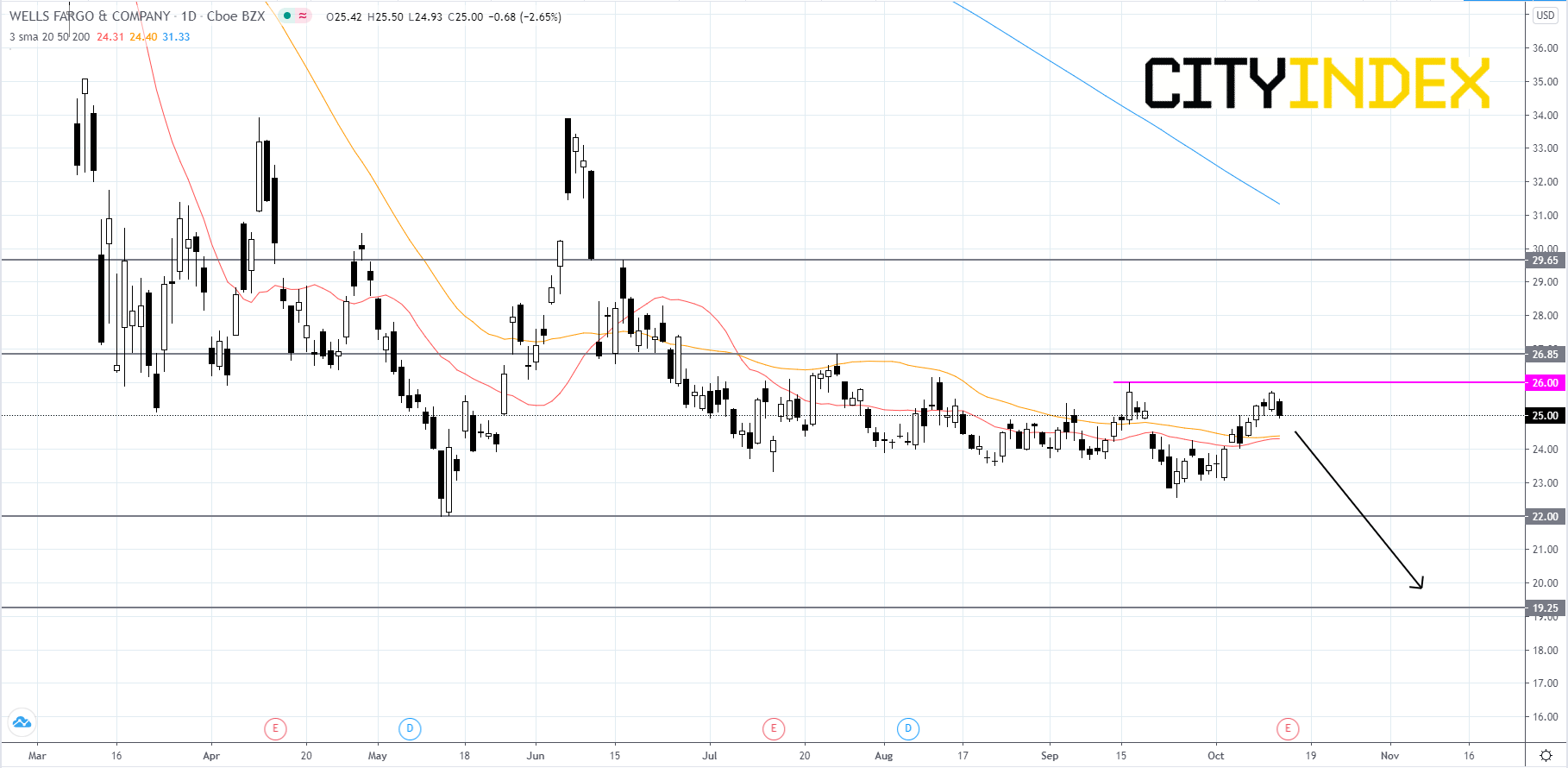

Technically speaking, on a daily chart, Wells Fargo's stock price has been consolidating after a large drop in the first quarter of 2020. Since late-June price has been holding under its 26.85 resistance level and chopping around. In late-September price made its lowest low since mid-July and has not been able to got above its last peak of 26.00. Price is above its 20-day and 50-day simple moving average (SMA), but far below its 200-day SMA. Price will likely lose its short-term bullish momentum and fade towards the 22.00 support level. If price does not find support at 22.00, it could fall all the way down to 19.25 support level, a price last seen in 2009. However, if price can get above its last peak of 26.00, then price could rise to 26.85. If price can manage to breakout above 26.85, then the stock could potentially reach for its 29.65 resistance level.

Source: GAIN Capital, TradingView