Earnings Play: Verizon Communications

On Wednesday, before market, Verizon Communications (VZ) is expected to release third quarter EPS of $1.22 compared to $1.25 last year on revenue of approximately $31.6 billion vs. $32.9 billion a year earlier. Verizon is the largest wireless provider in the U.S. and on October 20th, the company reported that it teamed up with Nokia to offer private 5G capabilities to enterprises in Europe and Asia-Pacific.

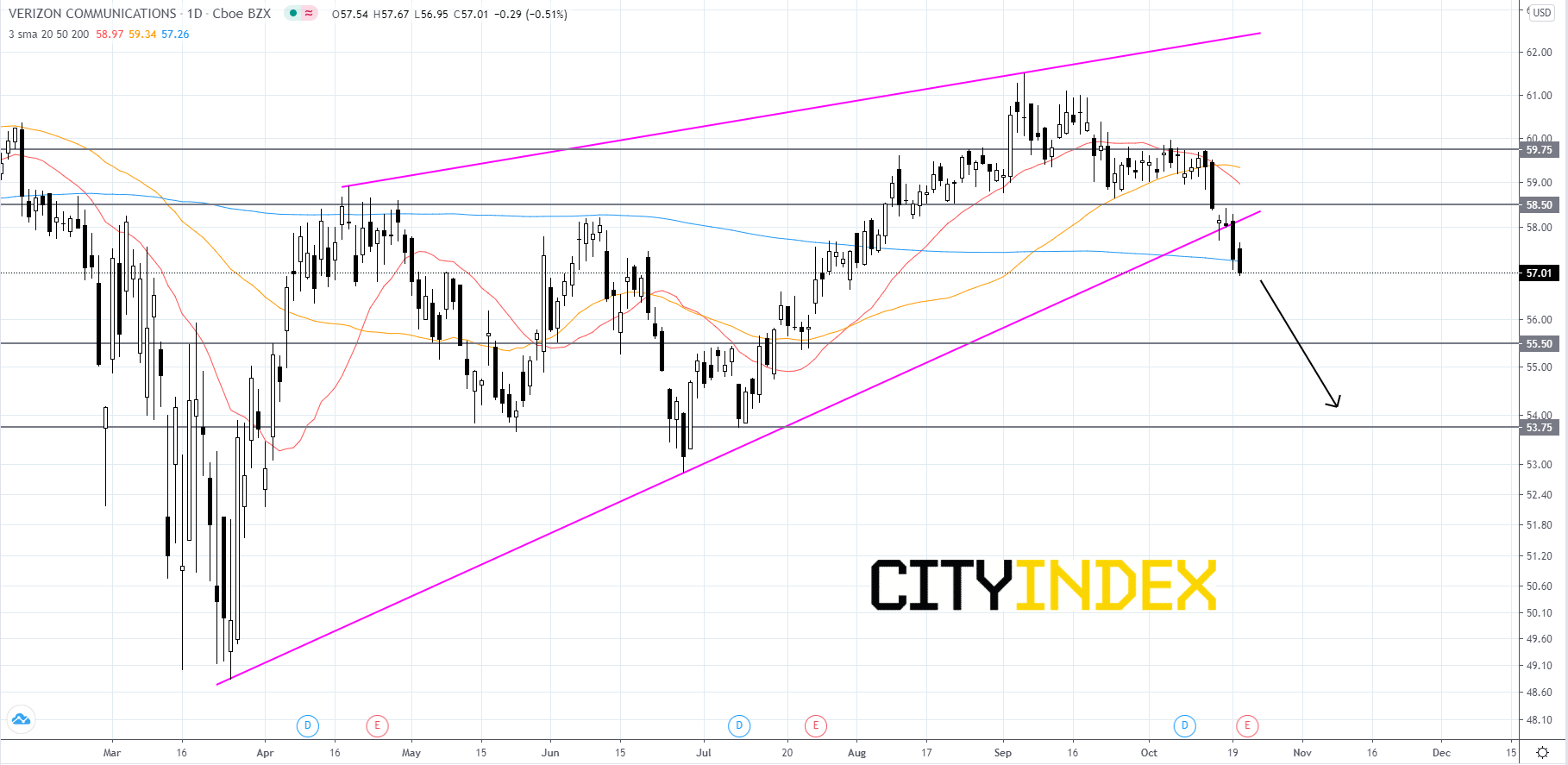

Looking at a daily chart, in logarithmic scale, Verizon's stock price broke out to the downside of an ascending wedge pattern that price had been rising within since late-March. Price has also penetrated to the downside of the 200-day simple moving average (SMA). Price will most likely continue to fall until it reaches its first support level at 55.50. At 55.50 price could possibly consolidate and attempt to rebound. If the rebound fails then price could break below 55.50 and decline further to 53.75. If price happens to rebound, traders should first look to the 200-day SMA as resistance. If prices rises back above the 200-day SMA then traders should look to the lower trendline for resistance. If price re-enters the pattern, then the breakout has failed.

Source: GAIN Capital, TradingView

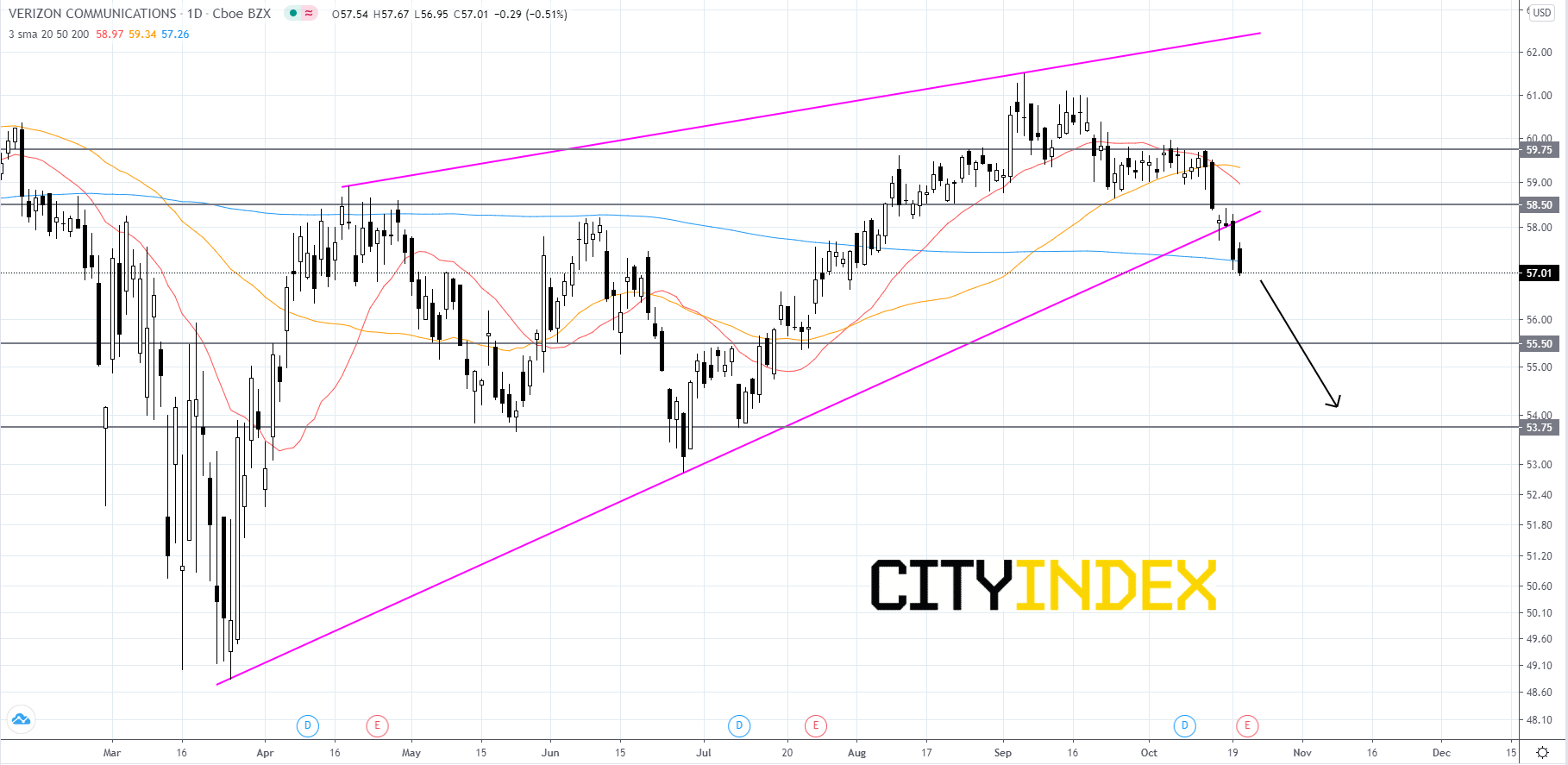

Looking at a daily chart, in logarithmic scale, Verizon's stock price broke out to the downside of an ascending wedge pattern that price had been rising within since late-March. Price has also penetrated to the downside of the 200-day simple moving average (SMA). Price will most likely continue to fall until it reaches its first support level at 55.50. At 55.50 price could possibly consolidate and attempt to rebound. If the rebound fails then price could break below 55.50 and decline further to 53.75. If price happens to rebound, traders should first look to the 200-day SMA as resistance. If prices rises back above the 200-day SMA then traders should look to the lower trendline for resistance. If price re-enters the pattern, then the breakout has failed.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM