Earnings Play: The AES Corporation

On Friday, before market, The AES Corporation (AES) is expected to report third quarter EPS of $0.43 compared to $0.48 last year on revenue of approximately $2.7 billion vs. $2.6 billion a year earlier. AES Corporation is a global power generation company and its expected move based on front-month options is 6.8%. The last time the company reported earnings the stock spiked 7.5%.

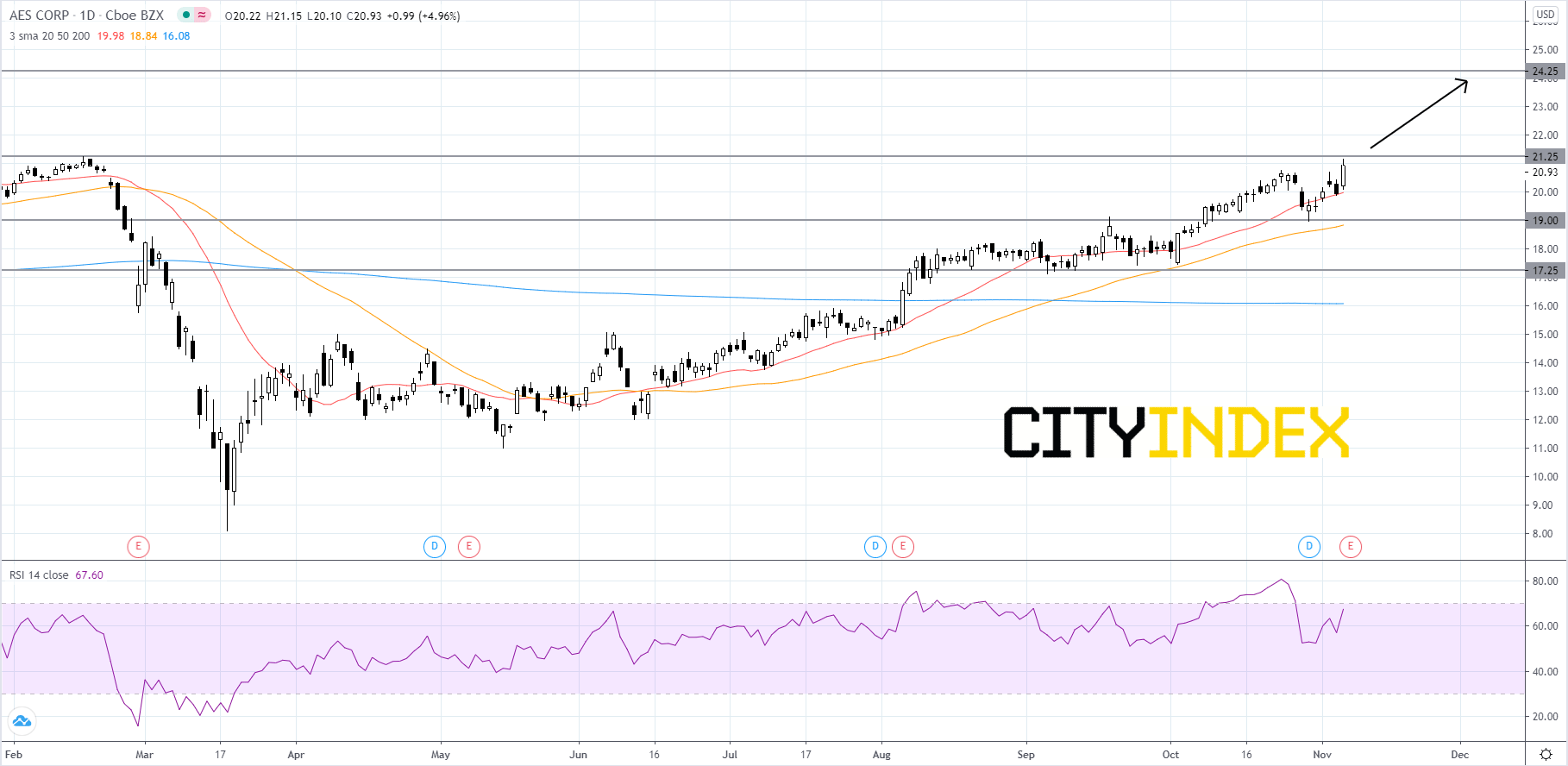

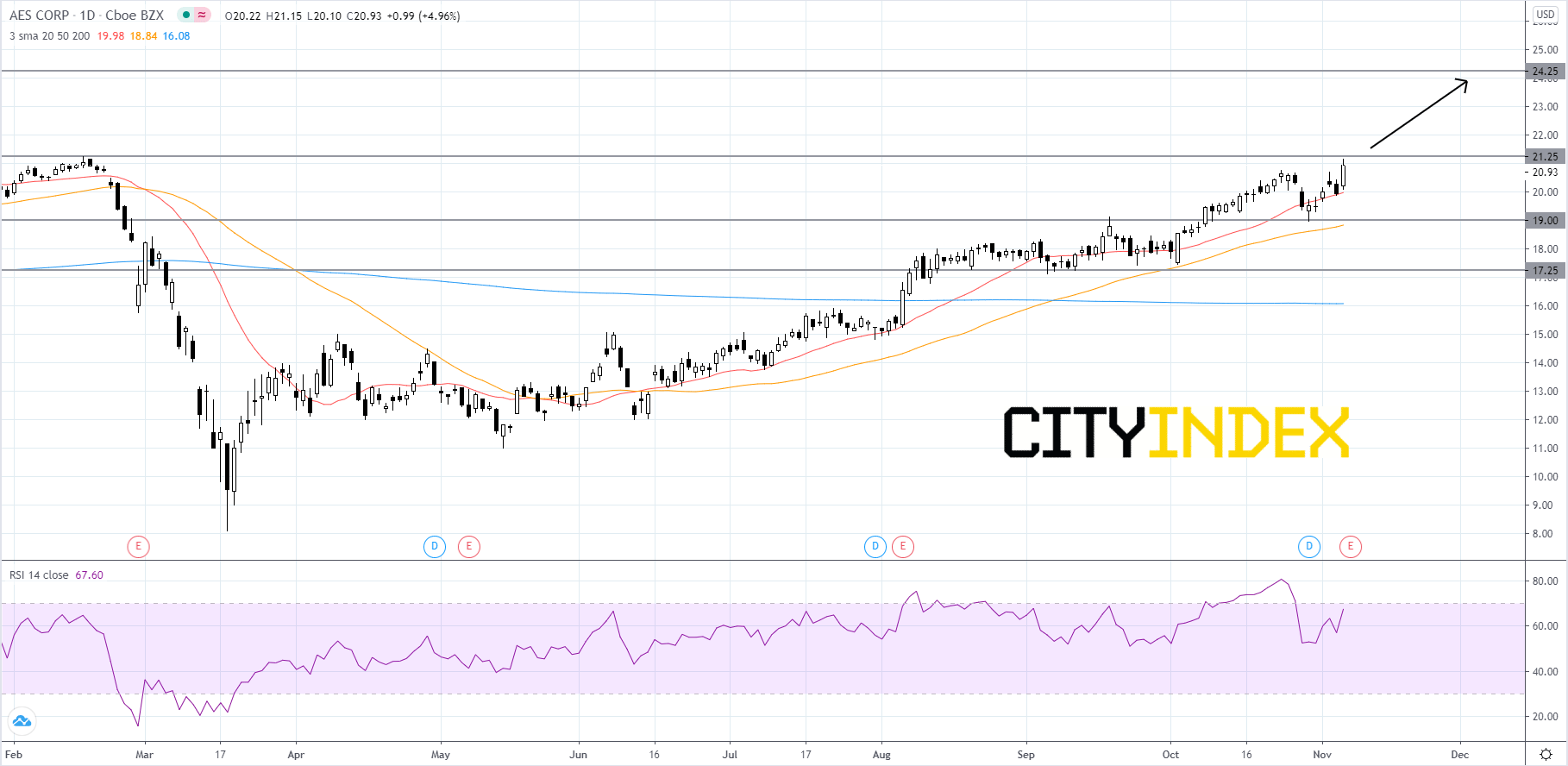

Looking at a daily chart, AES's stock price has been in an uptrend since mid-March and is currently sitting just below the 2020 high of 21.23. The RSI is over 65 and showing upside momentum. Price has been using its 20-day simple moving average as strong support since mid-June. Price will most likely continue to advance and breakout above the 2020 high of roughly 21.25. If price makes a new 2020 high, then its next target would be 24.25, a high last reached in 2007. On the other hand, if price slips then traders should look for a bounce off of the 19.00 support level. If price cannot manage to hold the 19.00 level, then it would be a bearish signal that could send price back down to 17.25.

Source: GAIN Capital, TradingView

Looking at a daily chart, AES's stock price has been in an uptrend since mid-March and is currently sitting just below the 2020 high of 21.23. The RSI is over 65 and showing upside momentum. Price has been using its 20-day simple moving average as strong support since mid-June. Price will most likely continue to advance and breakout above the 2020 high of roughly 21.25. If price makes a new 2020 high, then its next target would be 24.25, a high last reached in 2007. On the other hand, if price slips then traders should look for a bounce off of the 19.00 support level. If price cannot manage to hold the 19.00 level, then it would be a bearish signal that could send price back down to 17.25.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM