Earnings Play: Tesla

Today, after market, Tesla (TSLA) is anticipated to report third quarter EPS of $0.55 compared to $0.37 a year ago on revenue of approximately $8.3 billion vs. $6.3 billion last year. The company manufactures electric-vehicles and its expected move based on front-month options is 7.7%. The last time the company reported earnings the stock dropped 5.0%.

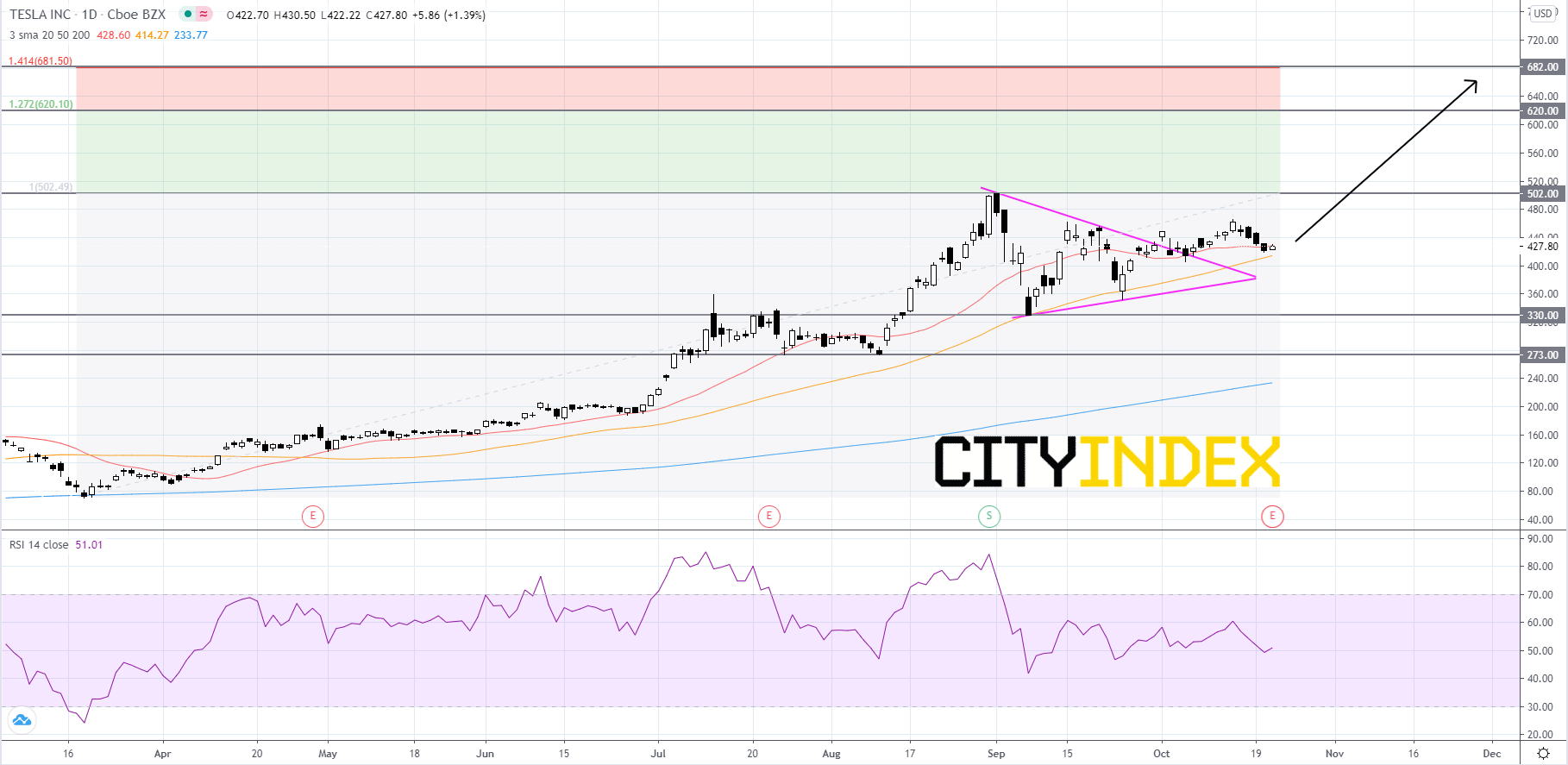

Looking at a daily chart, Tesla's stock price recently broke out to the upside of a short-term symmetrical triangle pattern that began to form in early-September. The RSI calls for caution as it is currently holding just above 50. A symmetrical triangle is considered to be a continuation pattern and Tesla has been in a strong uptrend since mid-March, therefore the bias remains bullish. Tesla's stock price will likely bounce off of the 50-day simple moving average (SMA) and advance to retest the all-time high of 502.00 and change. If price can breakout above the record high, than the next two targets would be 620.00 and 682.00. With that being said investors and traders should be very cautious because if Tesla closes below its 50-day SMA, it would be a very bearish signal. The last time that Tesla's stock price closed below its 50-day SMA, price dropped roughly 40% in 7 trading days. Given the RSI reading and how Tesla appears to only use a SMA as support for roughly 2 bounces, their is a chance that Tesla could break down, and if it does, price does not have strong support until 330.00.

Source: GAIN Capital, TradingView

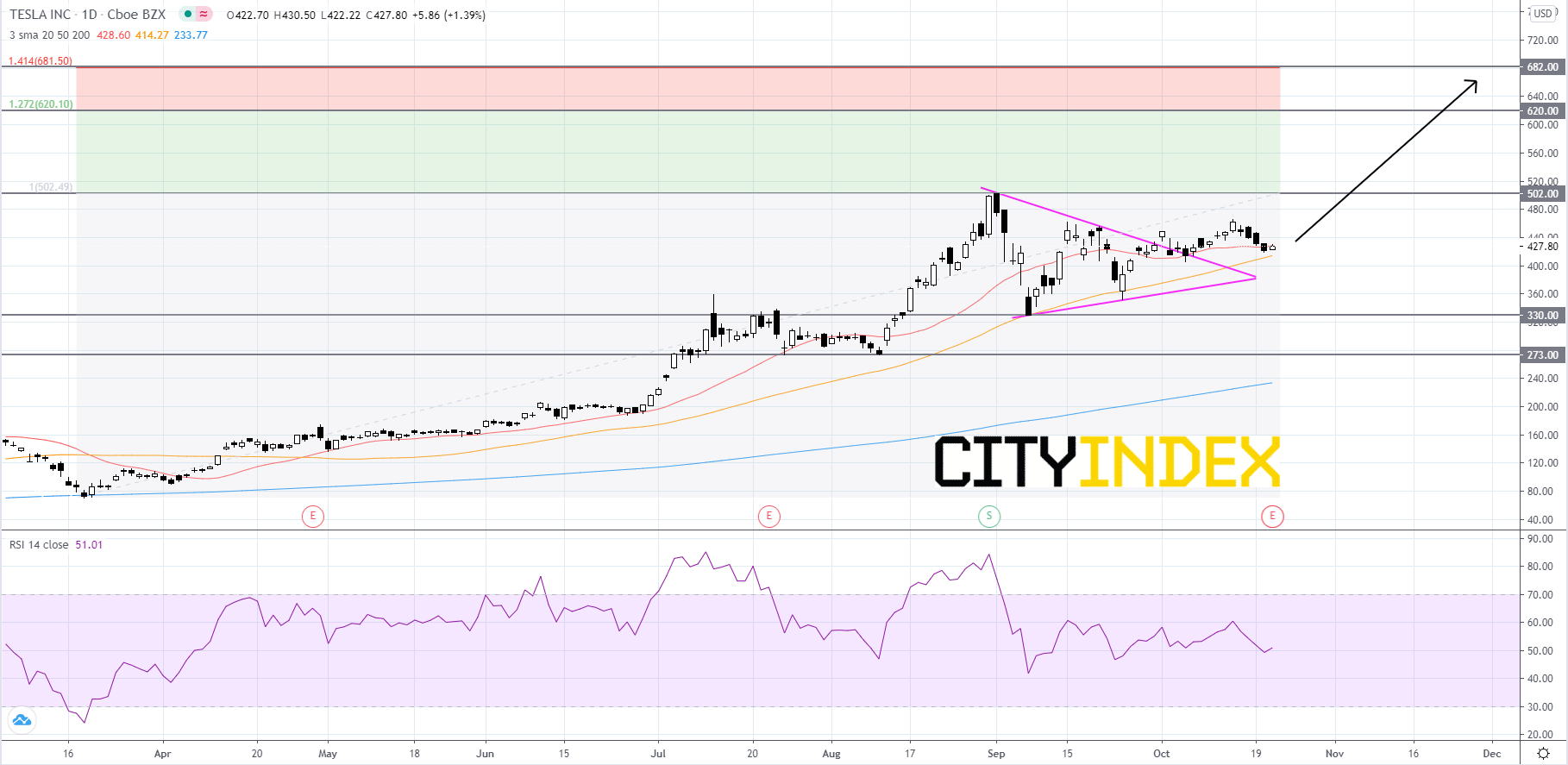

Looking at a daily chart, Tesla's stock price recently broke out to the upside of a short-term symmetrical triangle pattern that began to form in early-September. The RSI calls for caution as it is currently holding just above 50. A symmetrical triangle is considered to be a continuation pattern and Tesla has been in a strong uptrend since mid-March, therefore the bias remains bullish. Tesla's stock price will likely bounce off of the 50-day simple moving average (SMA) and advance to retest the all-time high of 502.00 and change. If price can breakout above the record high, than the next two targets would be 620.00 and 682.00. With that being said investors and traders should be very cautious because if Tesla closes below its 50-day SMA, it would be a very bearish signal. The last time that Tesla's stock price closed below its 50-day SMA, price dropped roughly 40% in 7 trading days. Given the RSI reading and how Tesla appears to only use a SMA as support for roughly 2 bounces, their is a chance that Tesla could break down, and if it does, price does not have strong support until 330.00.

Source: GAIN Capital, TradingView

Latest market news

Today 07:55 AM

Today 04:47 AM

Yesterday 11:23 PM

Yesterday 10:19 PM

Yesterday 08:00 PM