Earnings Play: Taiwan Semiconductor Manufacturing

On Thursday, Taiwan Semiconductor Manufacturing (TSM), the world's largest semiconductor fabrication plant, is anticipated to report third quarter EPS of $19.17 compared to $19.50 a year ago on revenue of approximately $337.3 billion vs. $293.0 billion last year.

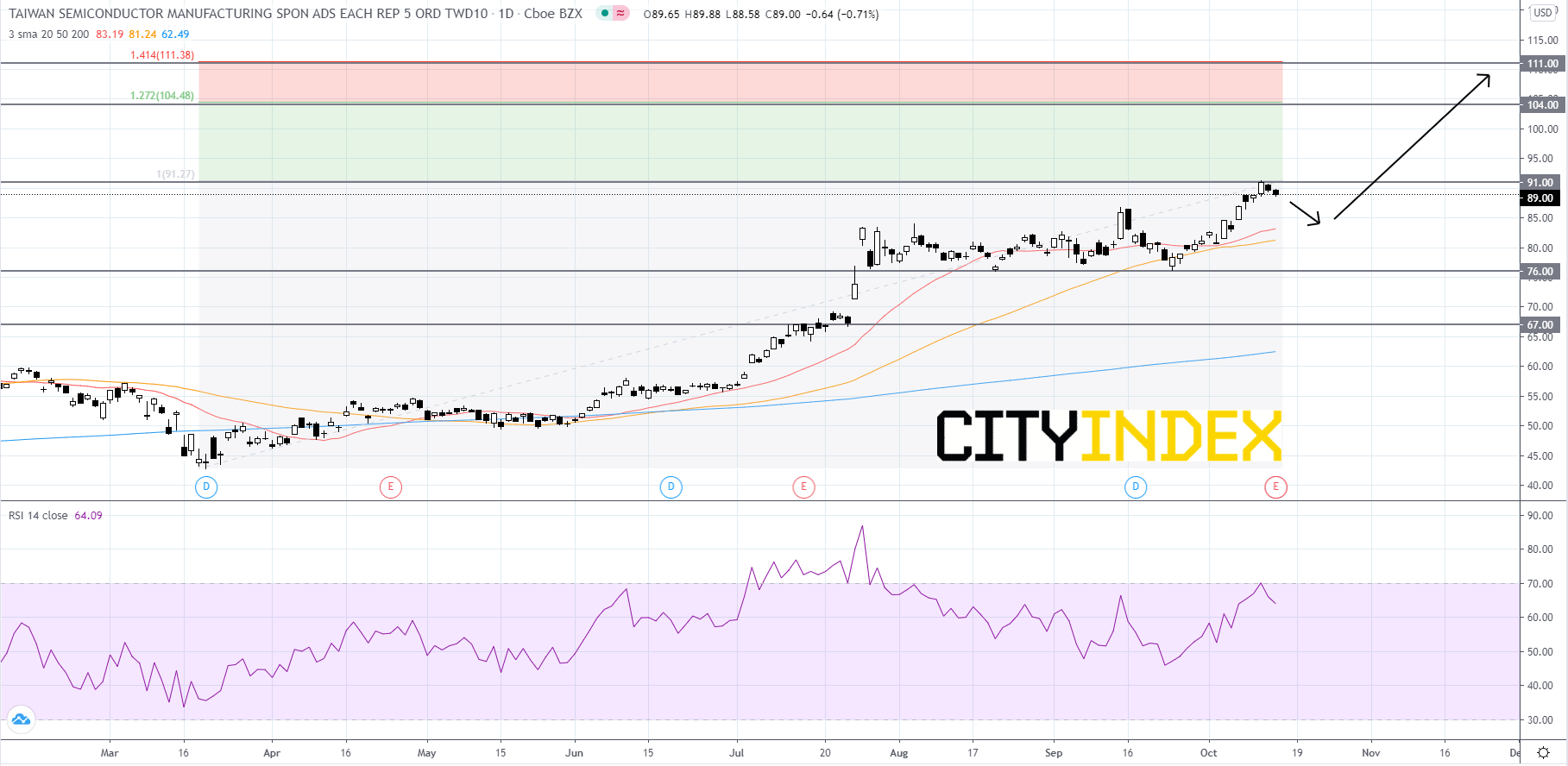

Looking at a daily chart, TSM's stock price has been in a strong uptrend since mid-March and is currently sitting just below its all-time high of 91.27. The RSI is over 50 and recently halted just before entering overbought territory. Price will probably pull back to its 50-day simple moving average (SMA), find support and then continue to advance. The 50-day SMA has been rough support since mid-May. If price can breakout above the 91.00 resistance level, then it will clear a path for 104.00 and 111.00. If price falls to far below its 50-day SMA, then traders should be cautious and look for a rebound off of the 76.00 support level. If price cannot find support at 76.00, it would be a bearish signal that could send prices tumbling back to 67.00

Source: GAIN Capital, TradingView

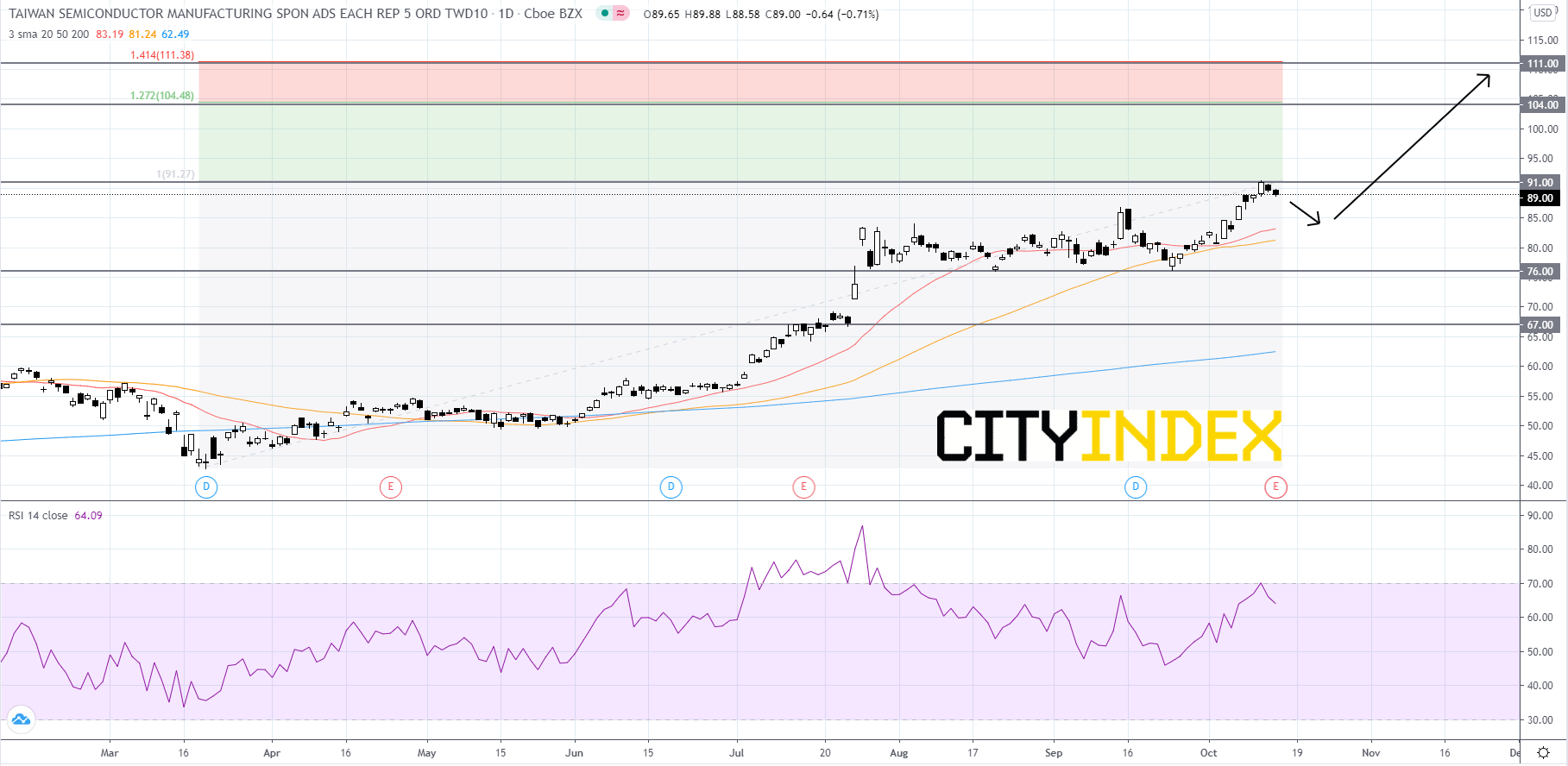

Looking at a daily chart, TSM's stock price has been in a strong uptrend since mid-March and is currently sitting just below its all-time high of 91.27. The RSI is over 50 and recently halted just before entering overbought territory. Price will probably pull back to its 50-day simple moving average (SMA), find support and then continue to advance. The 50-day SMA has been rough support since mid-May. If price can breakout above the 91.00 resistance level, then it will clear a path for 104.00 and 111.00. If price falls to far below its 50-day SMA, then traders should be cautious and look for a rebound off of the 76.00 support level. If price cannot find support at 76.00, it would be a bearish signal that could send prices tumbling back to 67.00

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM