Earnings Play: Square

On Thursday, after market, Square (SQ) is anticipated to release third quarter EPS of $0.16 compared to $0.25 a year ago on revenue of approximately $1.9 billion vs. $602.2 million last year. The company provides payment acquiring services to merchants and its expected move based on front-month options is 7.6%. The last time the company reported earnings the stock jumped 7.1%.

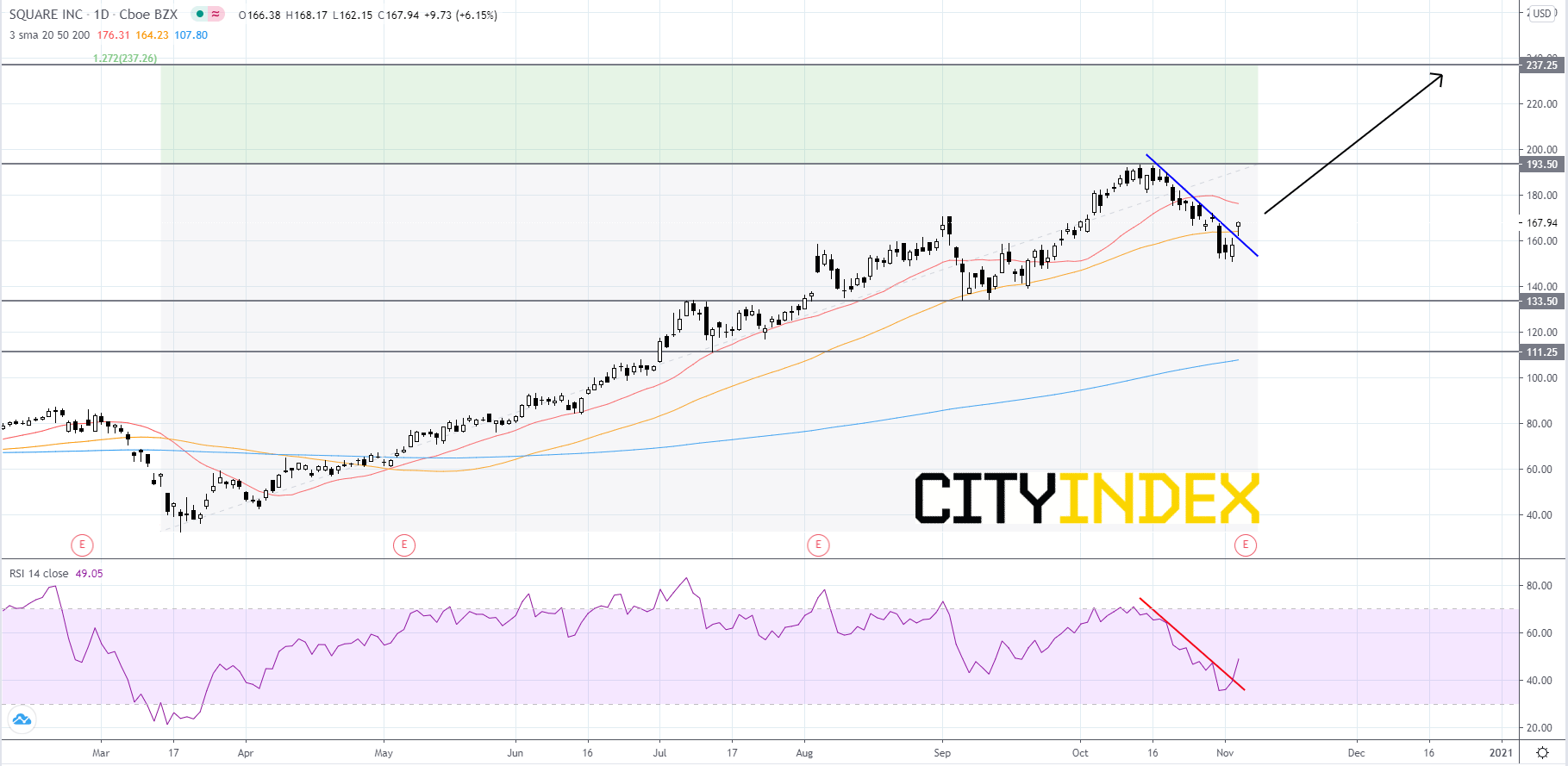

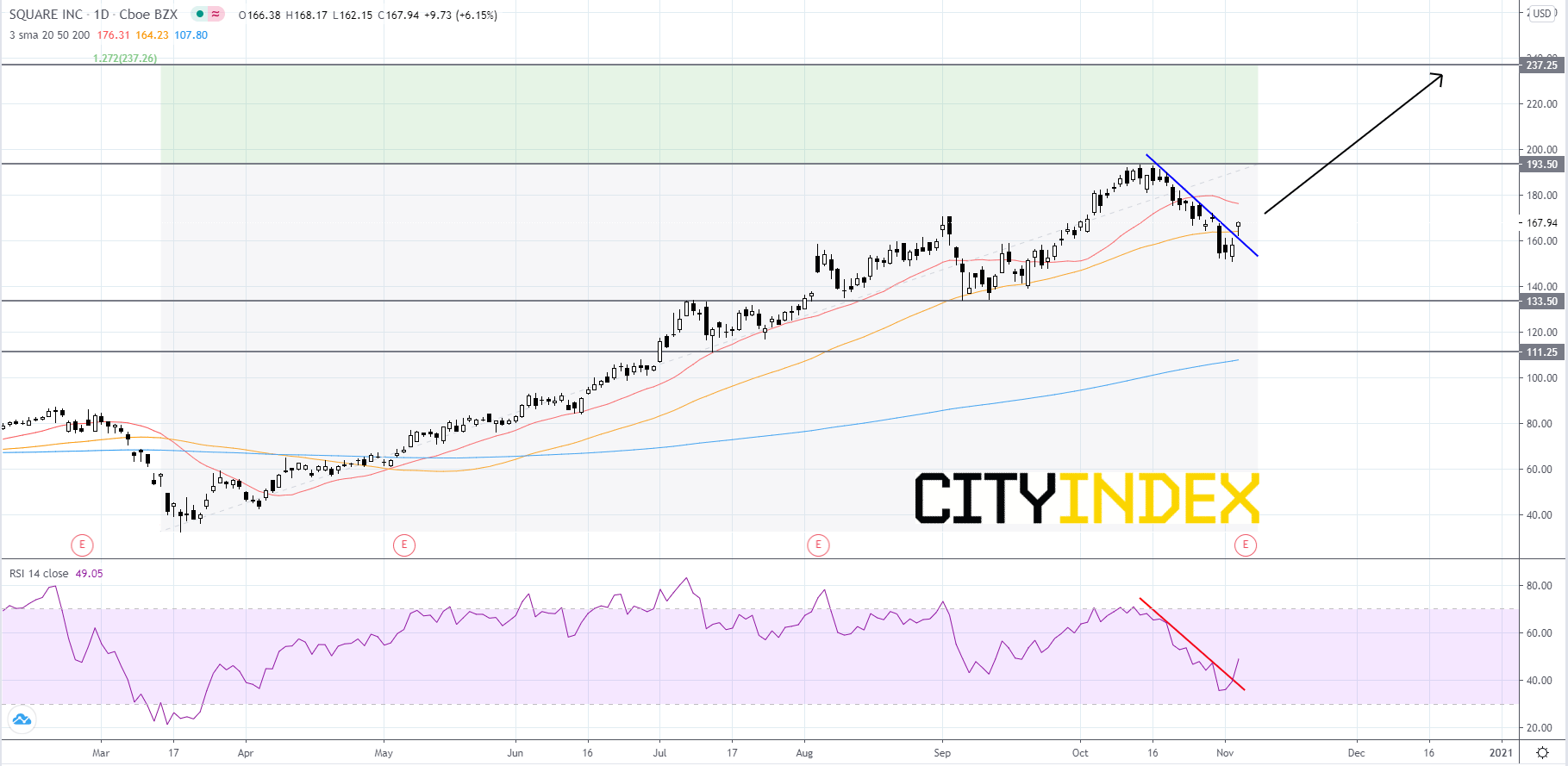

Technically speaking, on a daily chart, Square's stock price has just broken out to the upside of a short-term bearish trendline that price has been holding below since reaching a record high of 193.44 in mid-October. The RSI is currently just below 50 and has also just broken out above a bearish trendline. Looking at the intermediate-term, Square has been in an uptrend since mid-March, first using its 20-day simple moving average (SMA) as support and more recently using its 50-day SMA as support. Since the bias remains bullish, price will likely hold around its 50-day SMA before continuing to advance. Price will probably reach for its record high around 193.50. If price can get above 193.50, then its first Fibonacci target is 237.25. On the flip side, if price falls back below the short-term bearish trendline, it could send price back to the first support level at 133.50. If price cannot manage to rebound off of 133.50 it would be a bearish signal that could send price falling to 111.25.

Source: GAIN Capital, TradingView

Technically speaking, on a daily chart, Square's stock price has just broken out to the upside of a short-term bearish trendline that price has been holding below since reaching a record high of 193.44 in mid-October. The RSI is currently just below 50 and has also just broken out above a bearish trendline. Looking at the intermediate-term, Square has been in an uptrend since mid-March, first using its 20-day simple moving average (SMA) as support and more recently using its 50-day SMA as support. Since the bias remains bullish, price will likely hold around its 50-day SMA before continuing to advance. Price will probably reach for its record high around 193.50. If price can get above 193.50, then its first Fibonacci target is 237.25. On the flip side, if price falls back below the short-term bearish trendline, it could send price back to the first support level at 133.50. If price cannot manage to rebound off of 133.50 it would be a bearish signal that could send price falling to 111.25.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 08:33 AM