Earnings Play: Splunk

On Wednesday, after market, Splunk (SPLK) is anticipated to report second quarter LPS of $0.34 compared to an EPS of $0.30 last year on revenue of approximately $520.7 million vs. $516.6 million a year earlier. The company provides software for machine log analysis and its current analyst consensus rating is 31 buys, 7 holds and 2 sells, according to Bloomberg.

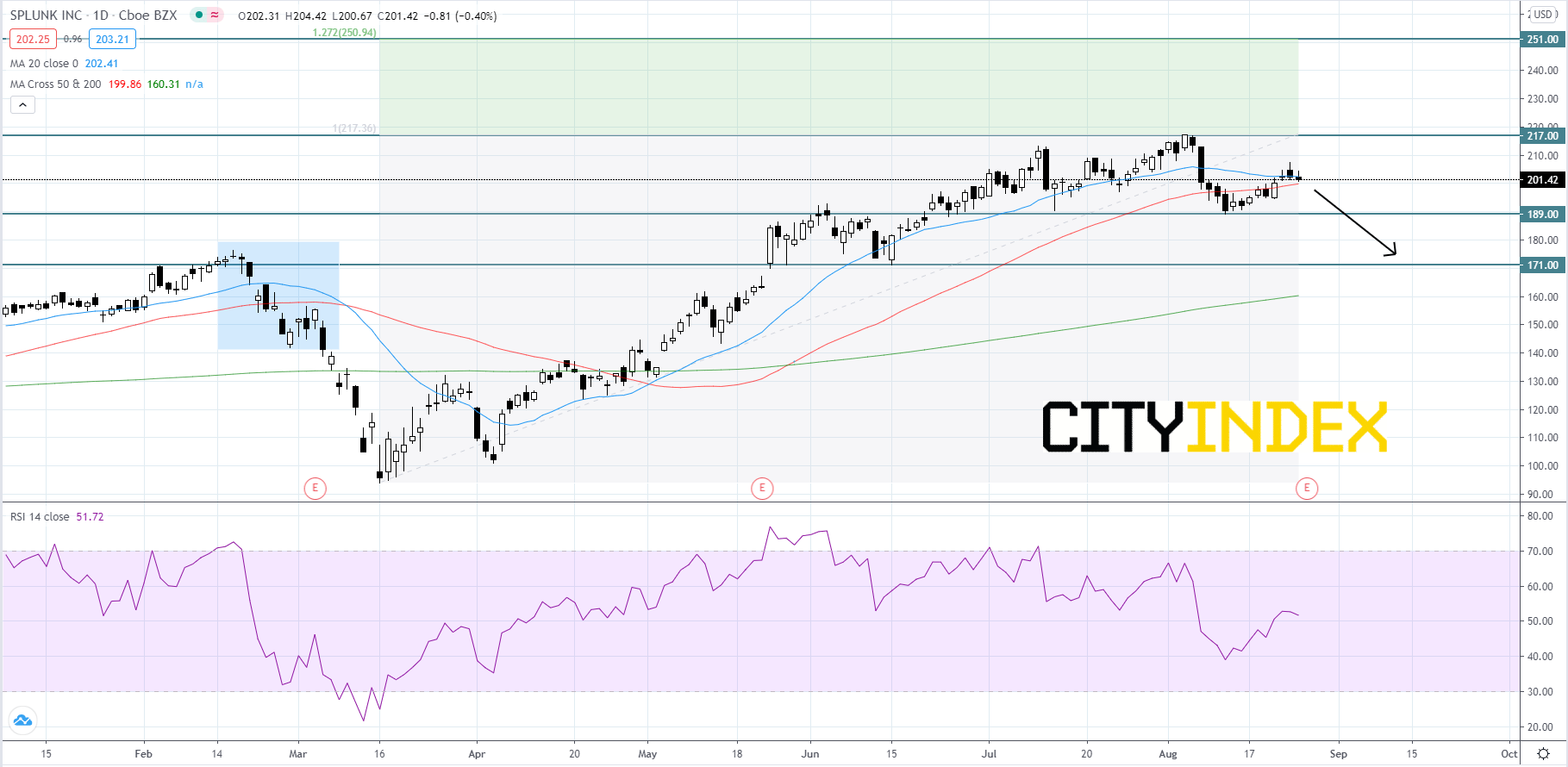

Technically speaking, on a daily chart, Splunk's stock price has been holding an uptrend that began in mid-March and has been using the 20-day simple moving average (SMA) as support. Almost 3 weeks ago price crossed under the 20-day SMA and 50-day SMA, a bearish signal. Looking back to mid-Febraury traders can observe that price began a new downtrend the last time it fell below the 50-day SMA. The RSI is currently holding just above 50 and has been trending downward since late-May, which could possibly be unconfirmed bearish divergence. Price appears to have found resistance at the 20-day SMA. Price will likely continue to trend lower and break below the 189.00 support level, confirming a new bearish structure in price action. From there price will presumably decline to 171.00. If price manages to hold above 189.00, price could pop back up to the all-time high of 217.00 and possibly reach for the first Fibonacci target of 251.00.

Source: GAIN Capital, TradingView

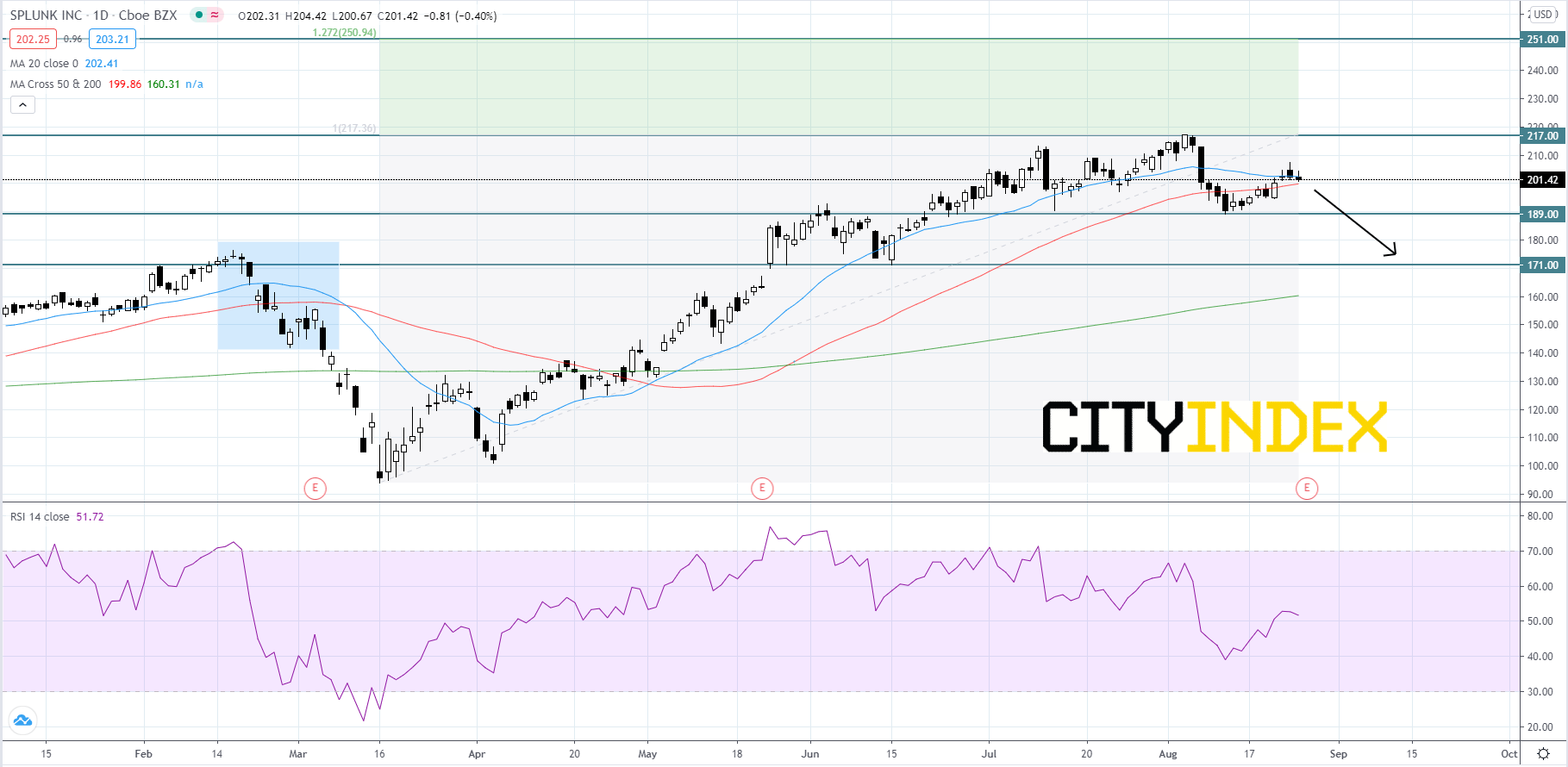

Technically speaking, on a daily chart, Splunk's stock price has been holding an uptrend that began in mid-March and has been using the 20-day simple moving average (SMA) as support. Almost 3 weeks ago price crossed under the 20-day SMA and 50-day SMA, a bearish signal. Looking back to mid-Febraury traders can observe that price began a new downtrend the last time it fell below the 50-day SMA. The RSI is currently holding just above 50 and has been trending downward since late-May, which could possibly be unconfirmed bearish divergence. Price appears to have found resistance at the 20-day SMA. Price will likely continue to trend lower and break below the 189.00 support level, confirming a new bearish structure in price action. From there price will presumably decline to 171.00. If price manages to hold above 189.00, price could pop back up to the all-time high of 217.00 and possibly reach for the first Fibonacci target of 251.00.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM