Earnings Play: Schlumberger

On Friday, before market, Schlumberger (SLB) is expected to release third quarter EPS of $0.13 compared to $0.43 last year on revenue of approximately $5.4 billion vs. $8.5 billion a year earlier. Schlumberger is the world's largest supplier of oil and gas products, and the company's expected move based on front-month options is 4.5%. The last time the company reported earnings the stock rose 0.9%.

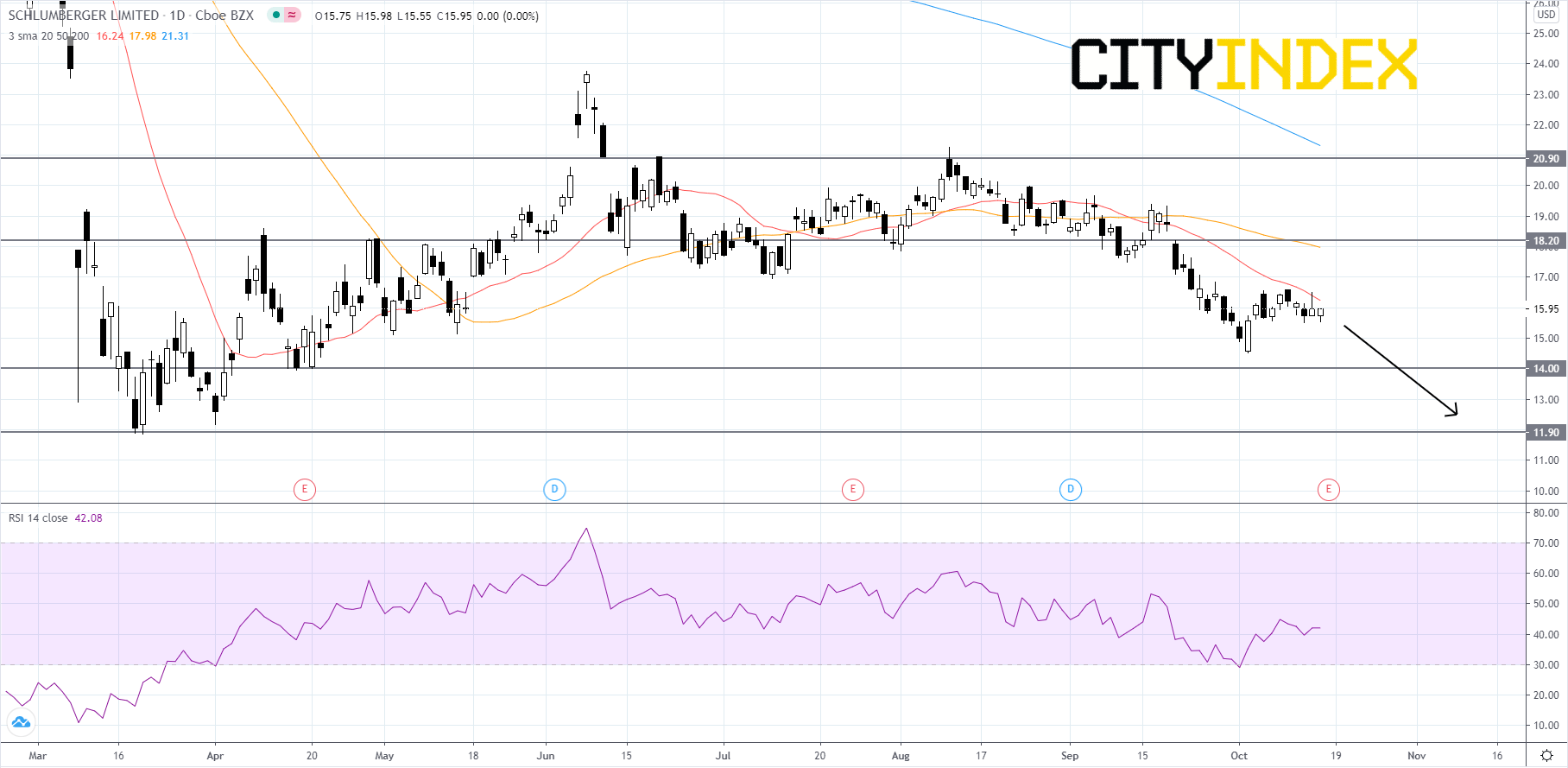

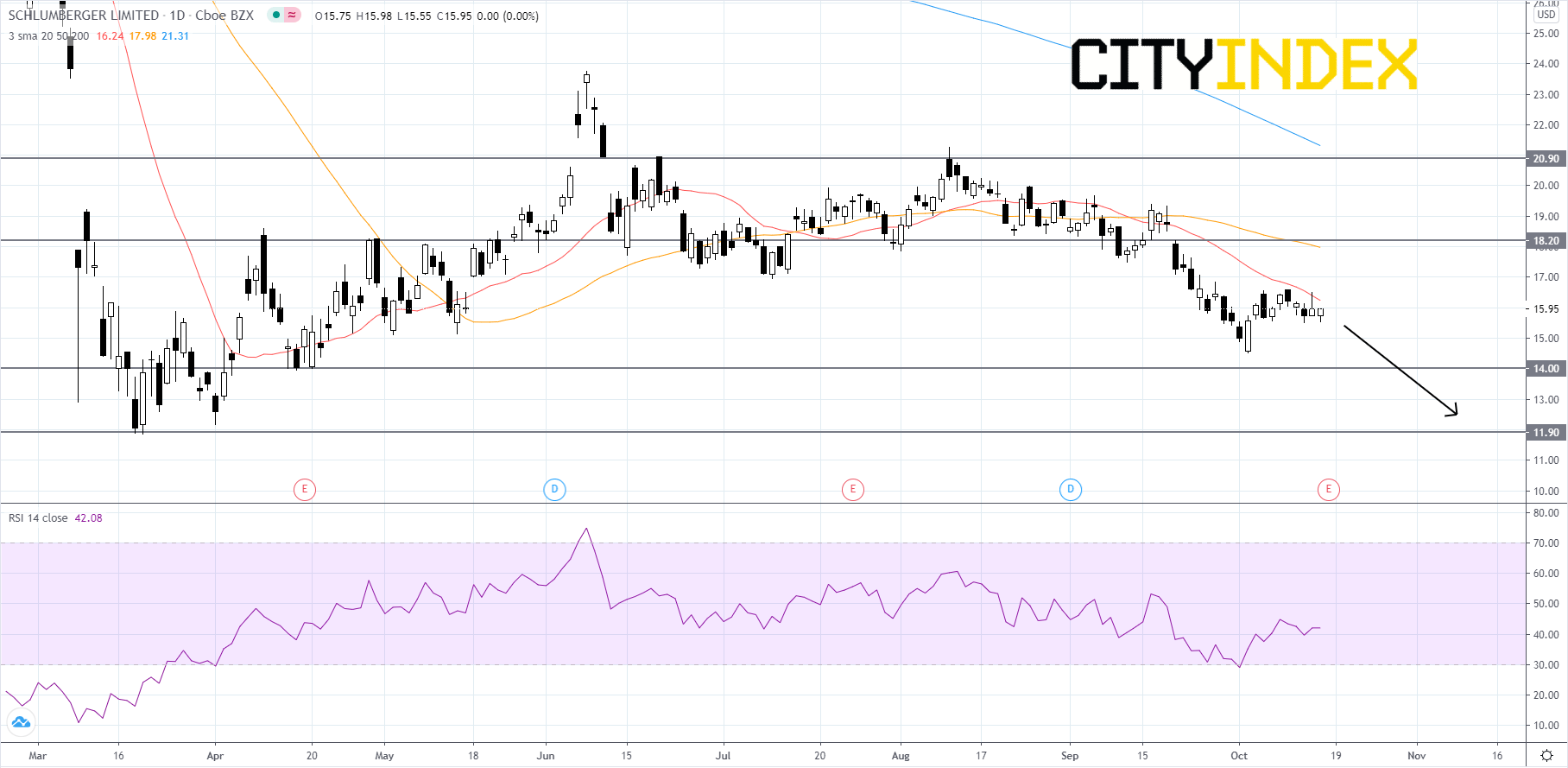

Technically speaking, on a daily chart, Schlumberger's stock price has been in an intermediate-term downtrend since early-June and the RSI is holding under 50. The simple moving averages (SMA) are arranged in a bearish manner and it appears that recent price action has been using the 20-day SMA as resistance. The company's stock price is likely to continue downward to the 14.00 support level. If price can breakout to the downside of 14.00, it could fall to the 2020 low of about 11.90. If price breaks down below 11.90, it would be a very bearish signal that could cause further price decline. On the other hand, if price can get above the 20-day SMA then traders should look to 18.20 for a halt of any advance. However, if price gets above 18.20 it could cause a jump back up to 20.90. But this is unlikely as the resurgence of coronavirus outbreaks worldwide has once again put city's back into lockdown and further discouraged travel.

Source: GAIN Capital, TradingView

Technically speaking, on a daily chart, Schlumberger's stock price has been in an intermediate-term downtrend since early-June and the RSI is holding under 50. The simple moving averages (SMA) are arranged in a bearish manner and it appears that recent price action has been using the 20-day SMA as resistance. The company's stock price is likely to continue downward to the 14.00 support level. If price can breakout to the downside of 14.00, it could fall to the 2020 low of about 11.90. If price breaks down below 11.90, it would be a very bearish signal that could cause further price decline. On the other hand, if price can get above the 20-day SMA then traders should look to 18.20 for a halt of any advance. However, if price gets above 18.20 it could cause a jump back up to 20.90. But this is unlikely as the resurgence of coronavirus outbreaks worldwide has once again put city's back into lockdown and further discouraged travel.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 08:33 AM