Earnings Play: Qualcomm

On Wednesday, after market, Qualcomm (QCOM) is expected to report fourth quarter EPS of $1.19 compared to $0.78 last year on revenue of approximately $5.9 billion vs. $4.8 billion a year earlier. The company makes digital wireless communications equipment and on October 31st, Linksys and the Co introduced the first 5G and Wi-Fi 6 mobile Hotspot in Korea and Hong Kong.

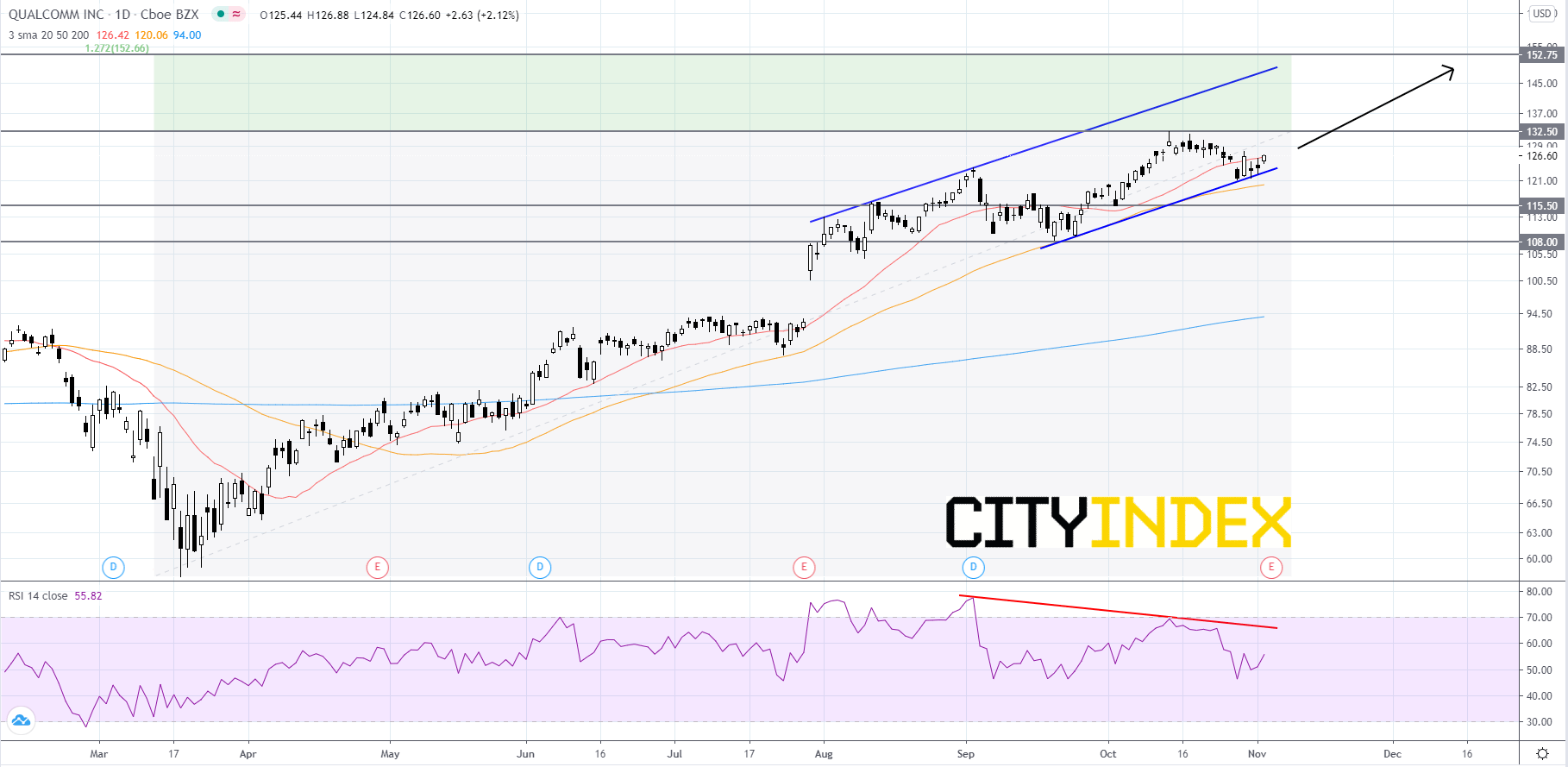

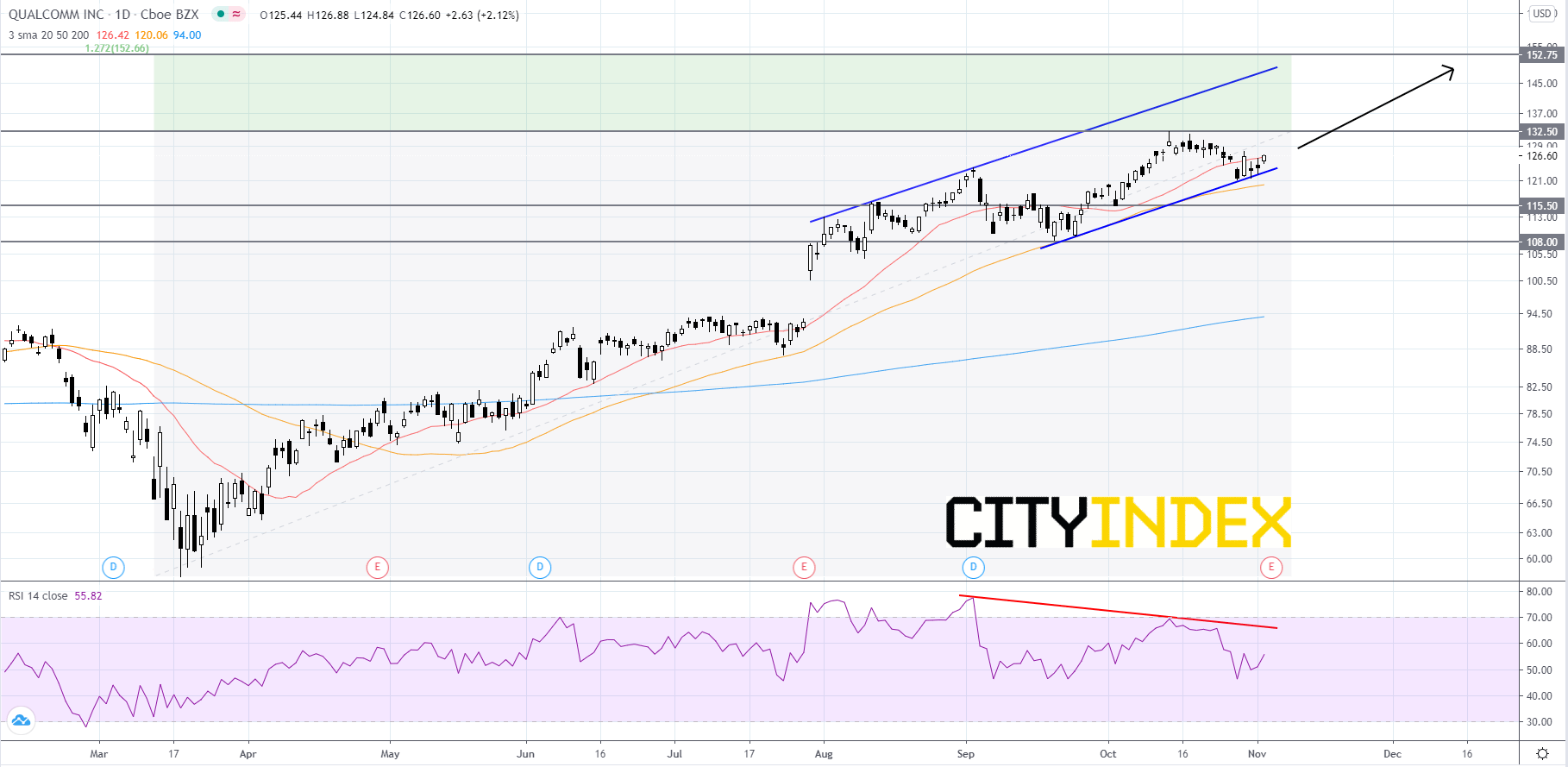

Looking at a daily chart, in logarithmic scale, Qualcomm's stock price is currently advancing within a short-term rising channel that began to form in August. The RSI is currently sitting over 50 and showing negative divergence. The pattern appears to be showing some weakness since price did not touch the upper trendline before finding support on the lower trendline. In the intermediate-term, price has been using the 50-day simple moving average (SMA) as major support, and the lower trendline of the pattern is very close to the 50-day SMA. Since the bias remains bullish, price will probably hold above the 50-day SMA before continuing to rise towards to the record high of roughly 132.50. If price can breakout above 132.50, then the next target would be 152.75. On the other hand, if price breaks below the lower trendline and the 50-day SMA, it would be a bearish signal. Price would then likely decline to its 115.50 support level, where a bounce could occur. If price fails to be supported at 115.50, then price could slip further to the 108.00 level.

Source: GAIN Capital, TradingView

Looking at a daily chart, in logarithmic scale, Qualcomm's stock price is currently advancing within a short-term rising channel that began to form in August. The RSI is currently sitting over 50 and showing negative divergence. The pattern appears to be showing some weakness since price did not touch the upper trendline before finding support on the lower trendline. In the intermediate-term, price has been using the 50-day simple moving average (SMA) as major support, and the lower trendline of the pattern is very close to the 50-day SMA. Since the bias remains bullish, price will probably hold above the 50-day SMA before continuing to rise towards to the record high of roughly 132.50. If price can breakout above 132.50, then the next target would be 152.75. On the other hand, if price breaks below the lower trendline and the 50-day SMA, it would be a bearish signal. Price would then likely decline to its 115.50 support level, where a bounce could occur. If price fails to be supported at 115.50, then price could slip further to the 108.00 level.

Source: GAIN Capital, TradingView

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM