Earnings Play: PVH Corp.

On Thursday, after market, PVH Corp. (PVH) is anticipated to report 1Q LPS of $1.68 compared to an EPS of $2.46 a year ago on revenue of approximately $1.3B vs. $2.4B last year. The company designs and markets branded apparel, and on June 2nd, it announced that the Chief Executive Officer of Tommy Hilfiger Global & PVH Europe, Daniel Grieder stepped down from his position to be succeeded by Martijn Hagman.

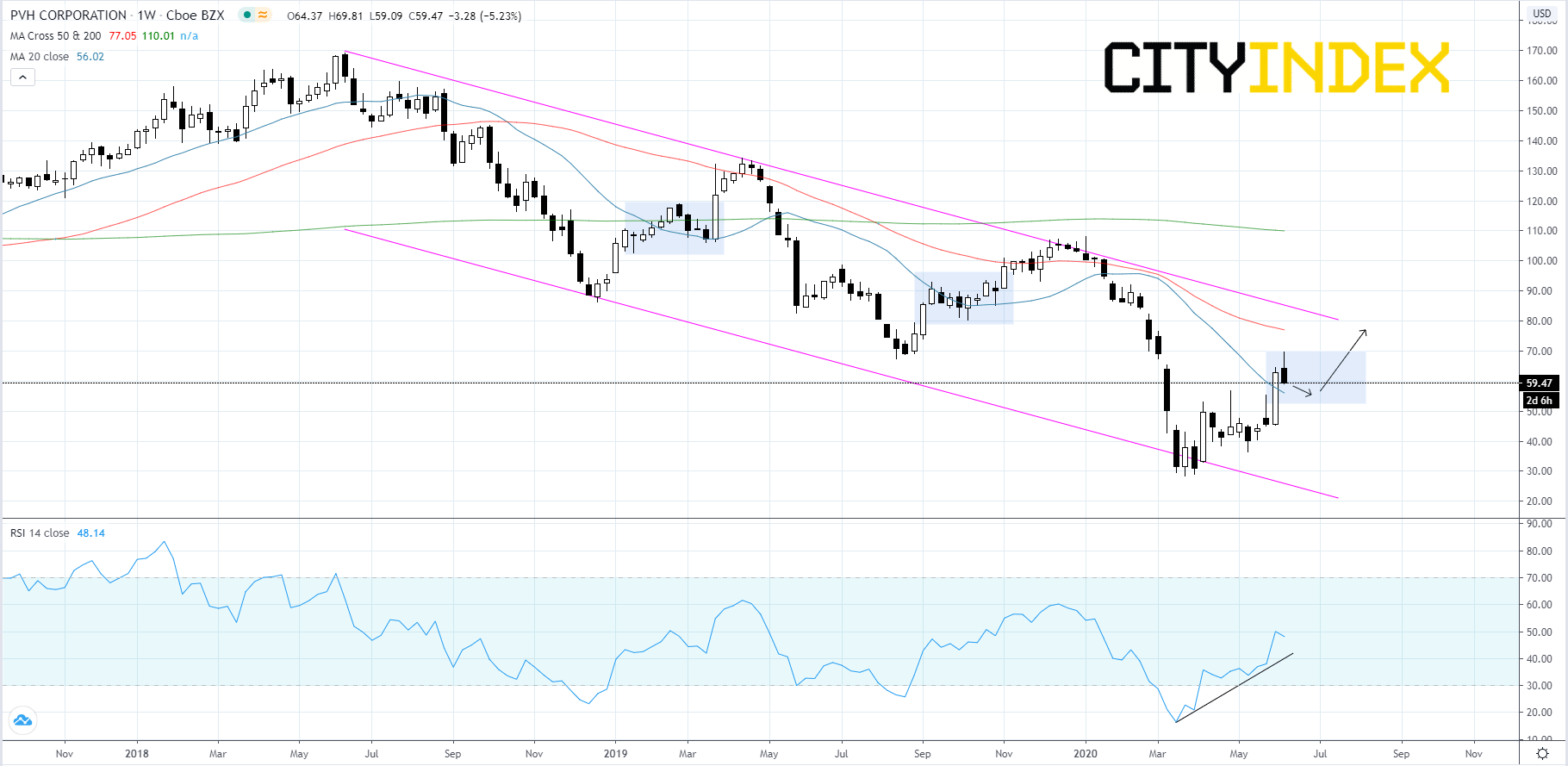

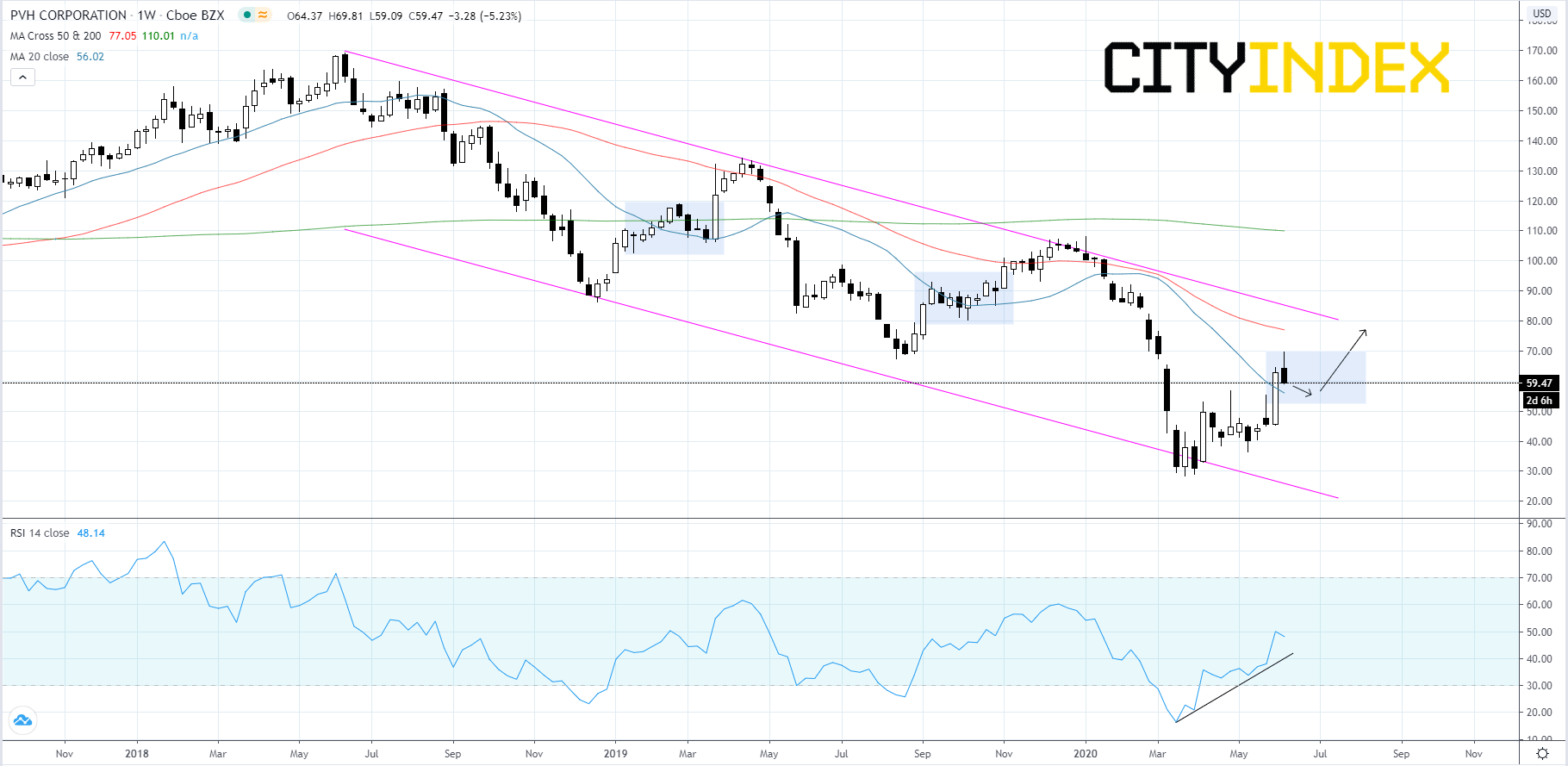

Looking at a weekly chart, PVH's stock price has been falling inside of a descending channel that began to form in June, 2018. Price is currently on a path towards trend channel resistance and the RSI is holding above a rising trend line. Looking over the last year and a half we can see that when price reaches the 20-week moving average after bouncing off trend channel resistance, the stock tends to consolidate before advancing. We may see some choppy price action before a potential breakout.

Source: GAIN Capital, TradingView

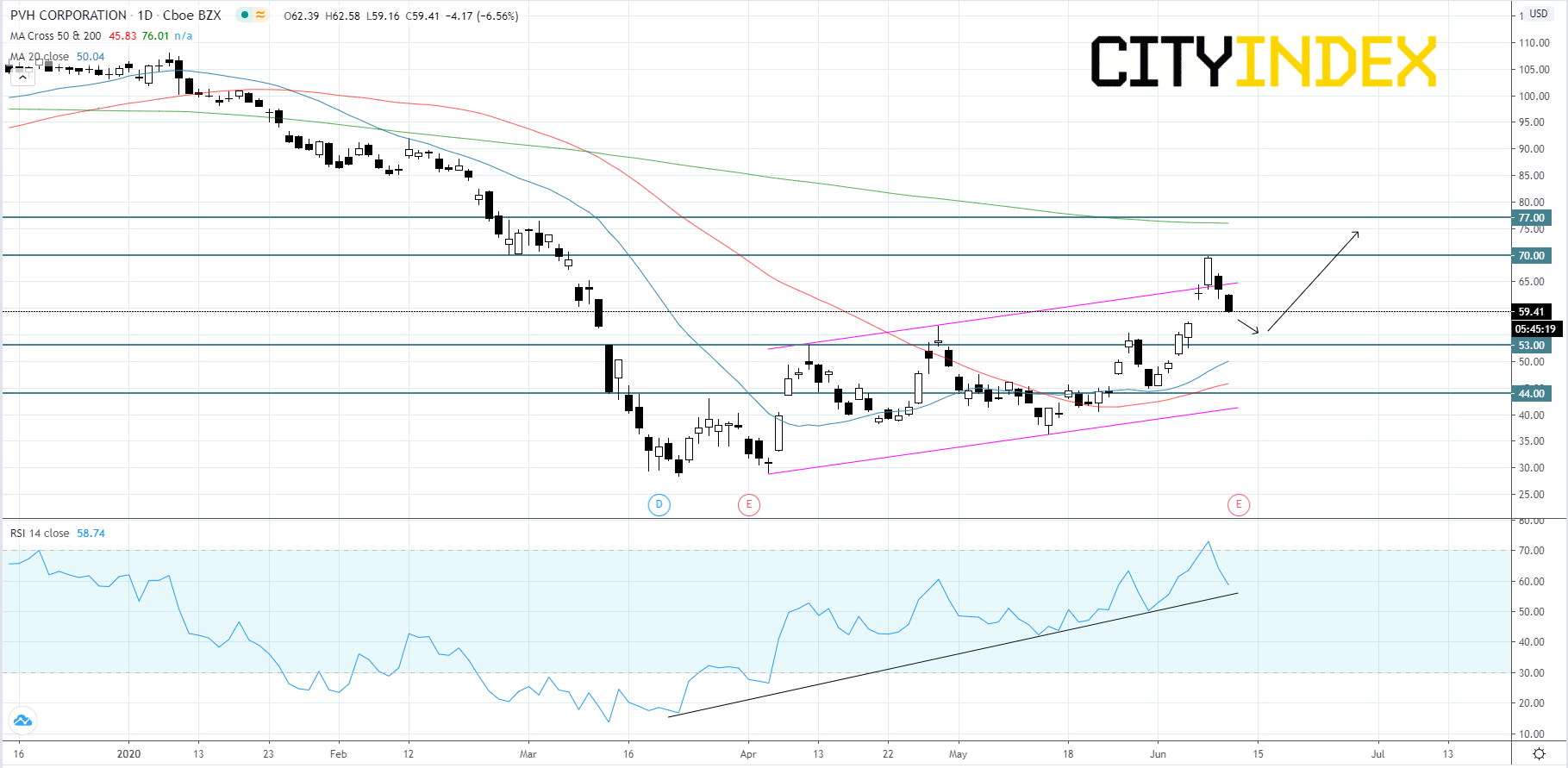

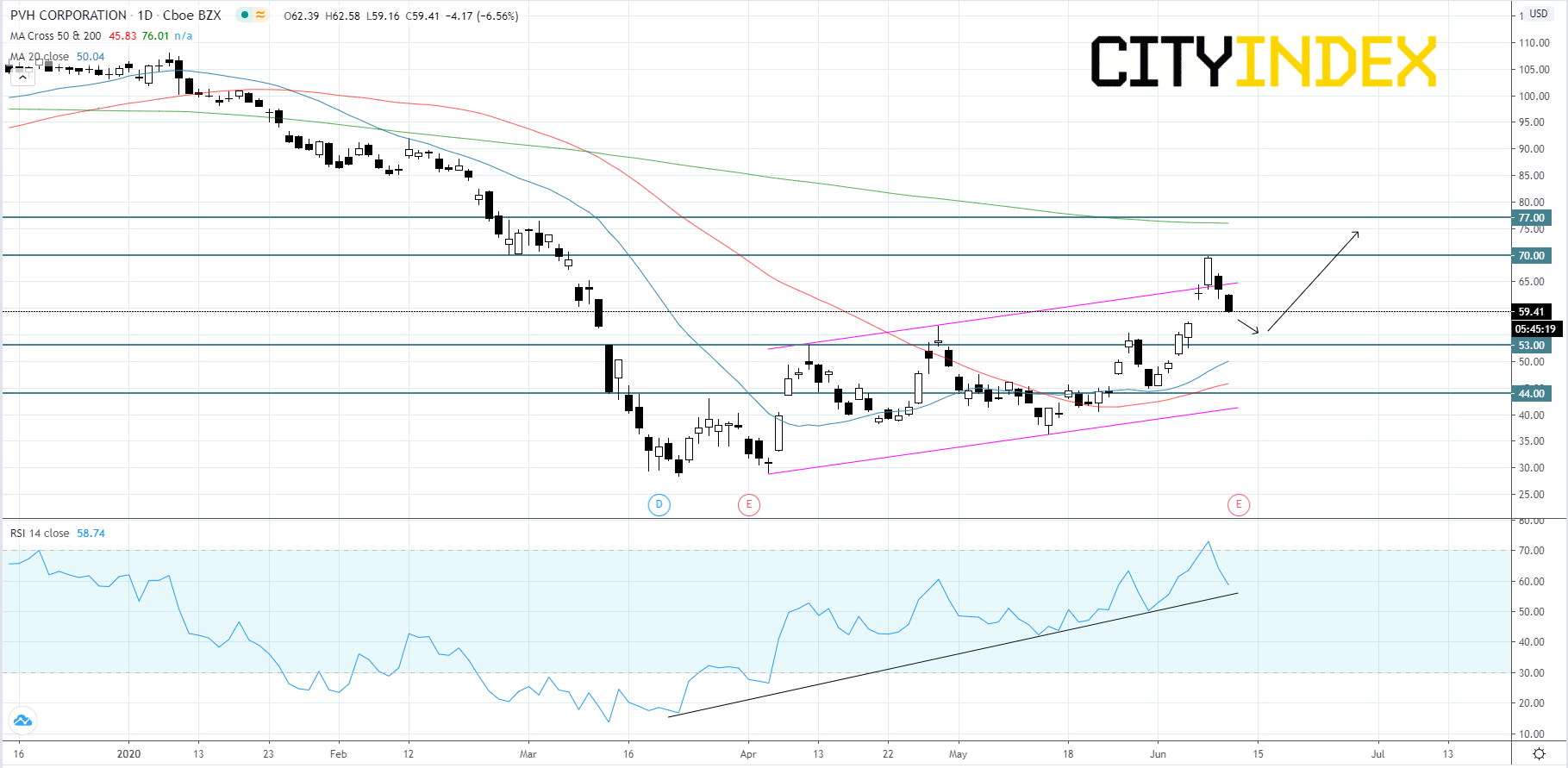

Looking at a daily chart, PVH's stock price is pulling back after breaking to the upside of a rising channel. The RSI is over 50 and also holding above a bullish trend line. The stock may find support around the $53.00 level before a rebound takes place. If the stock price can break above the $70.00 level then look for a target of $77.00. If price cannot hold above $53.00 support, look for a decline towards the $44.00 support level.

Source: GAIN Capital, TradingView

Looking at a weekly chart, PVH's stock price has been falling inside of a descending channel that began to form in June, 2018. Price is currently on a path towards trend channel resistance and the RSI is holding above a rising trend line. Looking over the last year and a half we can see that when price reaches the 20-week moving average after bouncing off trend channel resistance, the stock tends to consolidate before advancing. We may see some choppy price action before a potential breakout.

Source: GAIN Capital, TradingView

Looking at a daily chart, PVH's stock price is pulling back after breaking to the upside of a rising channel. The RSI is over 50 and also holding above a bullish trend line. The stock may find support around the $53.00 level before a rebound takes place. If the stock price can break above the $70.00 level then look for a target of $77.00. If price cannot hold above $53.00 support, look for a decline towards the $44.00 support level.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM