Earnings Play: PPG Industries

On Monday, PPG Industries (PPG) is anticipated to report third quarter EPS of $1.92 compared to $1.67 a year ago on revenue of approximately $3.7 billion vs. $3.8 billion last year. The company produces paints and coatings, and its current analyst consensus rating is 15 buys, 13 holds and 1 sell, according to Bloomberg.

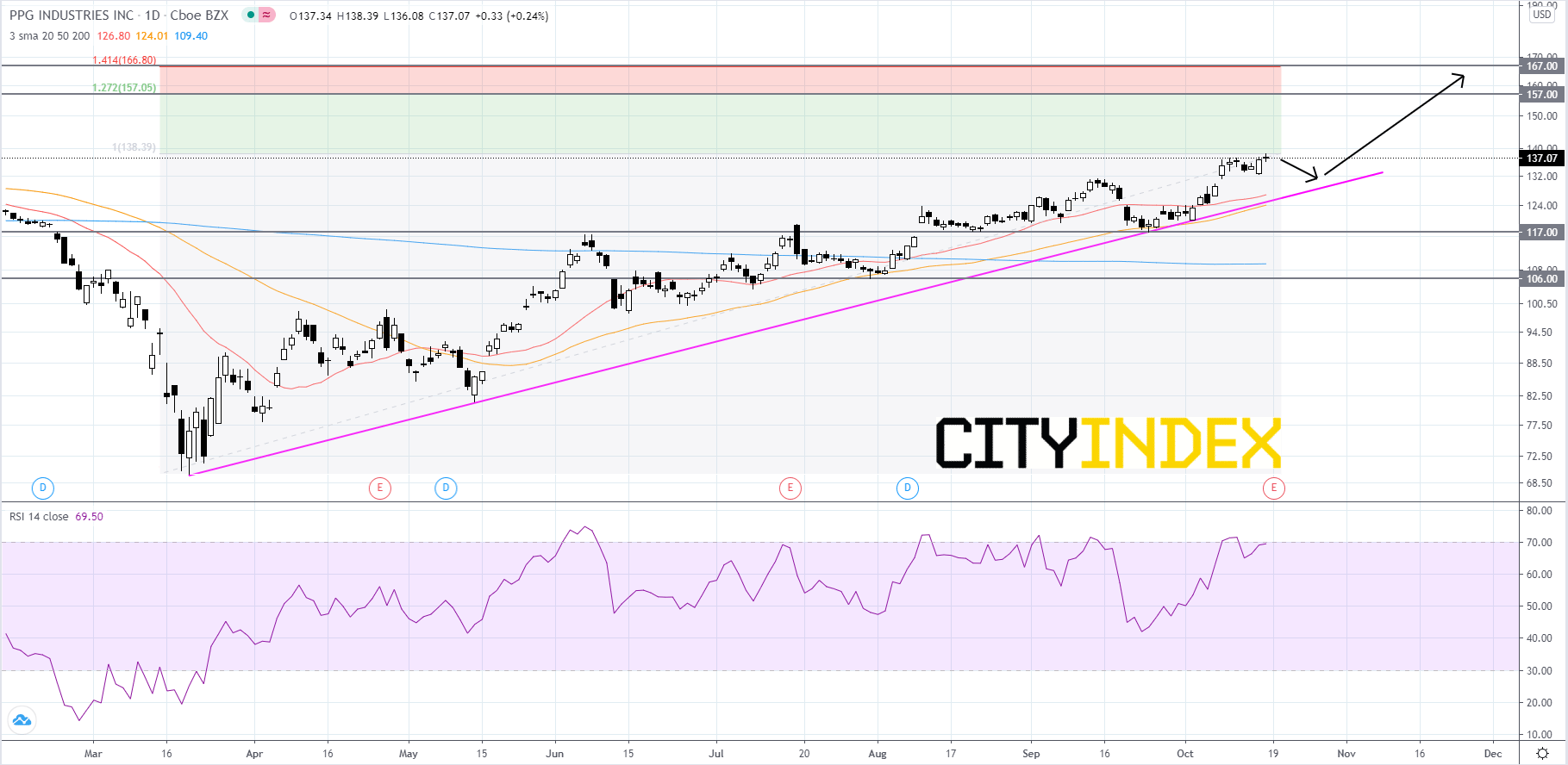

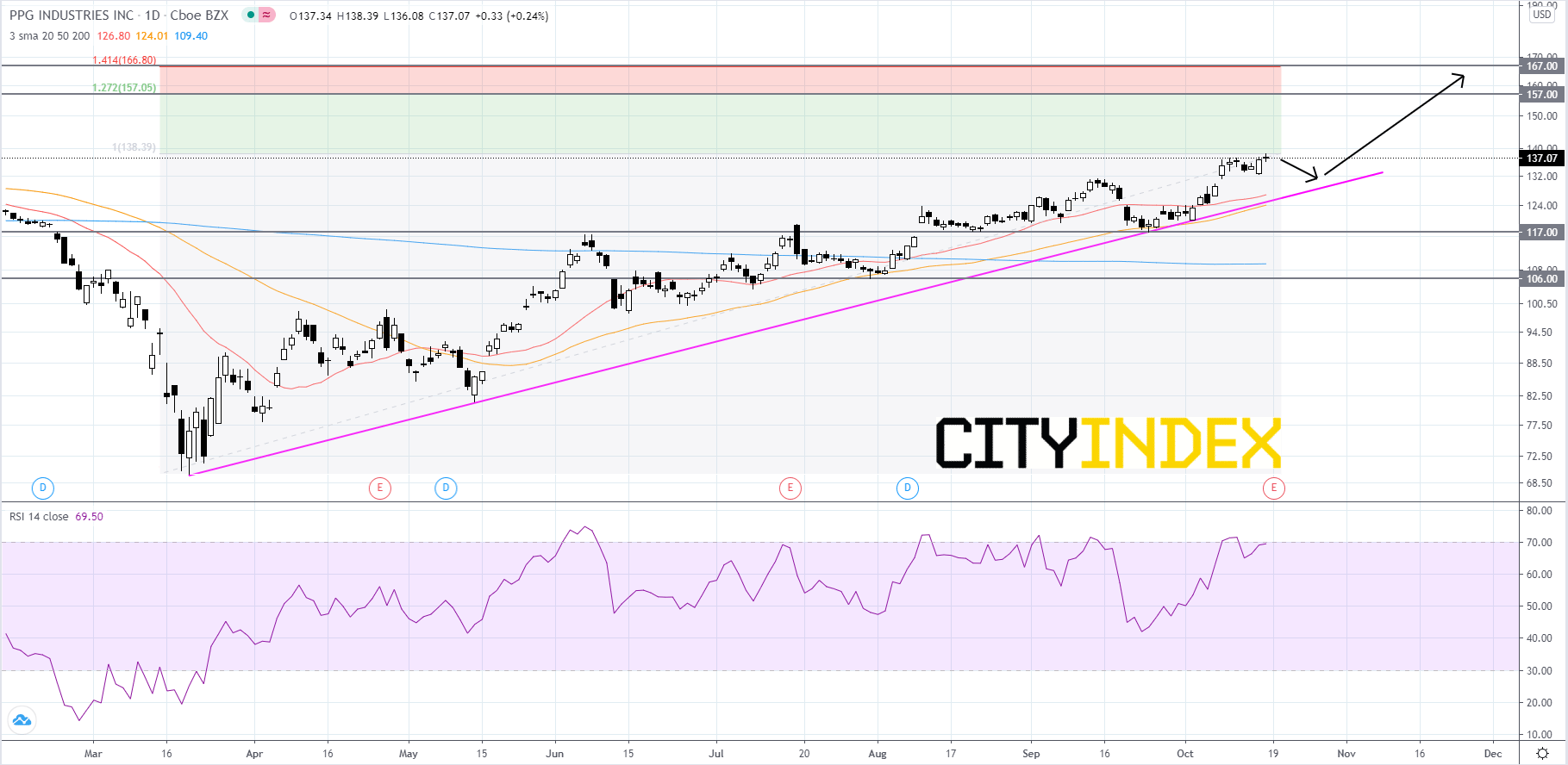

Looking at a daily chart, in logarithmic scale, PPG's stock price has just made a new record high of 138.39 and has been advancing in a strong uptrend since mid-March. The RSI is over 50 and appears to have halted at the threshold of overbought territory. The overall bias remains bullish, but in the short-term PPG's overbought RSI reading and recent short candlesticks could be hinting that price is getting ready to pull back. Price will likely pull back to the trendline, bounce and continue its climb. The next two targets are at 157.00 and 167.00. If price breaks out to the downside of the bullish trendline, it would be a bearish signal that could send price back to the 117.00 support level. Price could possible rebound off of 117.00 a continue its advance. However, if price breaks below 117.00, then price could fall further to 106.00.

Source: GAIN Capital, TradingView

Looking at a daily chart, in logarithmic scale, PPG's stock price has just made a new record high of 138.39 and has been advancing in a strong uptrend since mid-March. The RSI is over 50 and appears to have halted at the threshold of overbought territory. The overall bias remains bullish, but in the short-term PPG's overbought RSI reading and recent short candlesticks could be hinting that price is getting ready to pull back. Price will likely pull back to the trendline, bounce and continue its climb. The next two targets are at 157.00 and 167.00. If price breaks out to the downside of the bullish trendline, it would be a bearish signal that could send price back to the 117.00 support level. Price could possible rebound off of 117.00 a continue its advance. However, if price breaks below 117.00, then price could fall further to 106.00.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 08:33 AM