Earnings Play: Peloton Interactive

On Thursday, after market, Peloton Interactive (PTON) is anticipated to report fourth quarter EPS of $0.12 compared to an LPS of $1.88 a year ago on revenue of approximately $581.1 million vs. $223.3 million last year. The company operates an interactive fitness platform and its expected move based on front-month options is 16.5%. The last time the company reported earnings it spiked 16.0%.

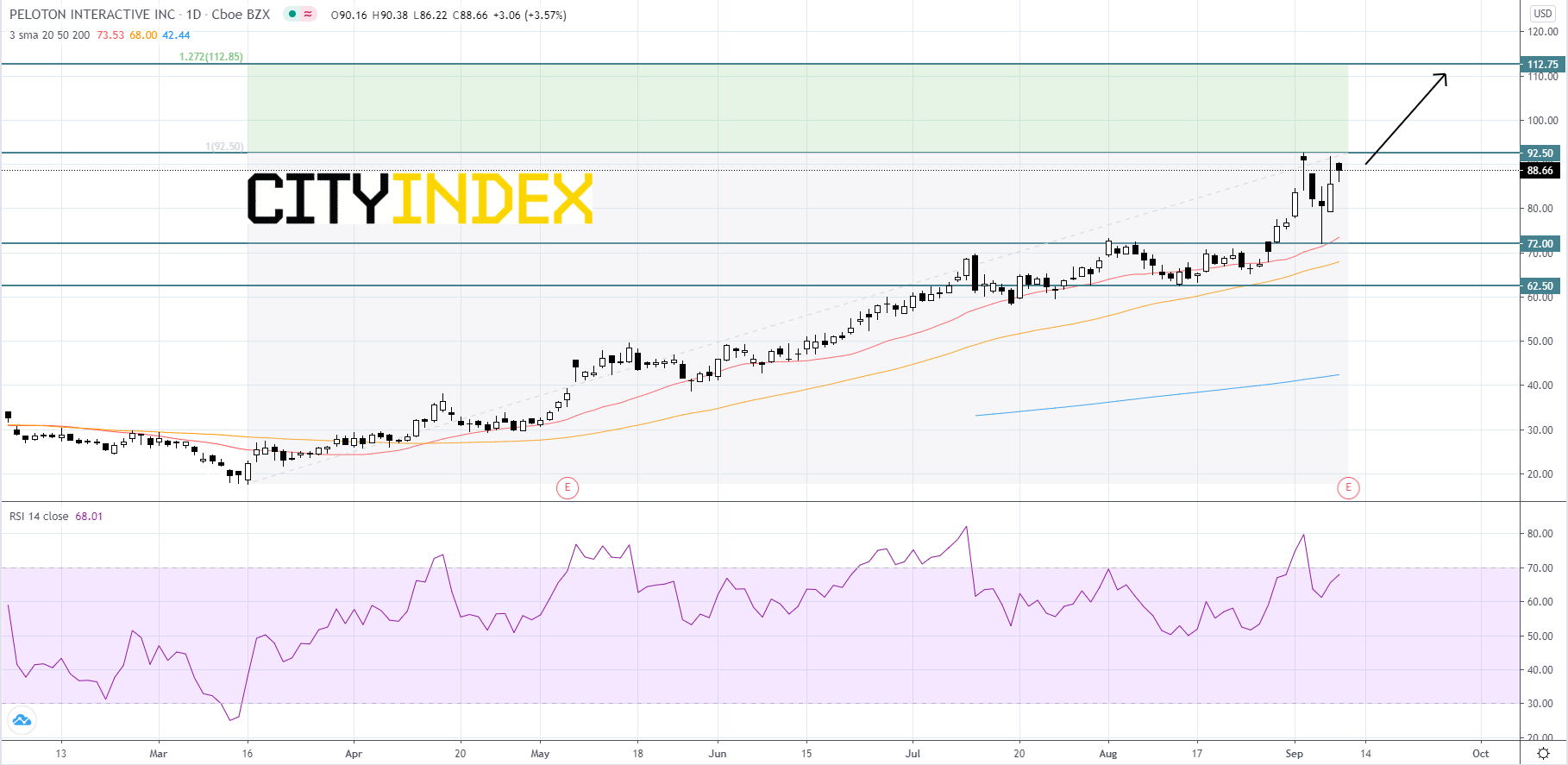

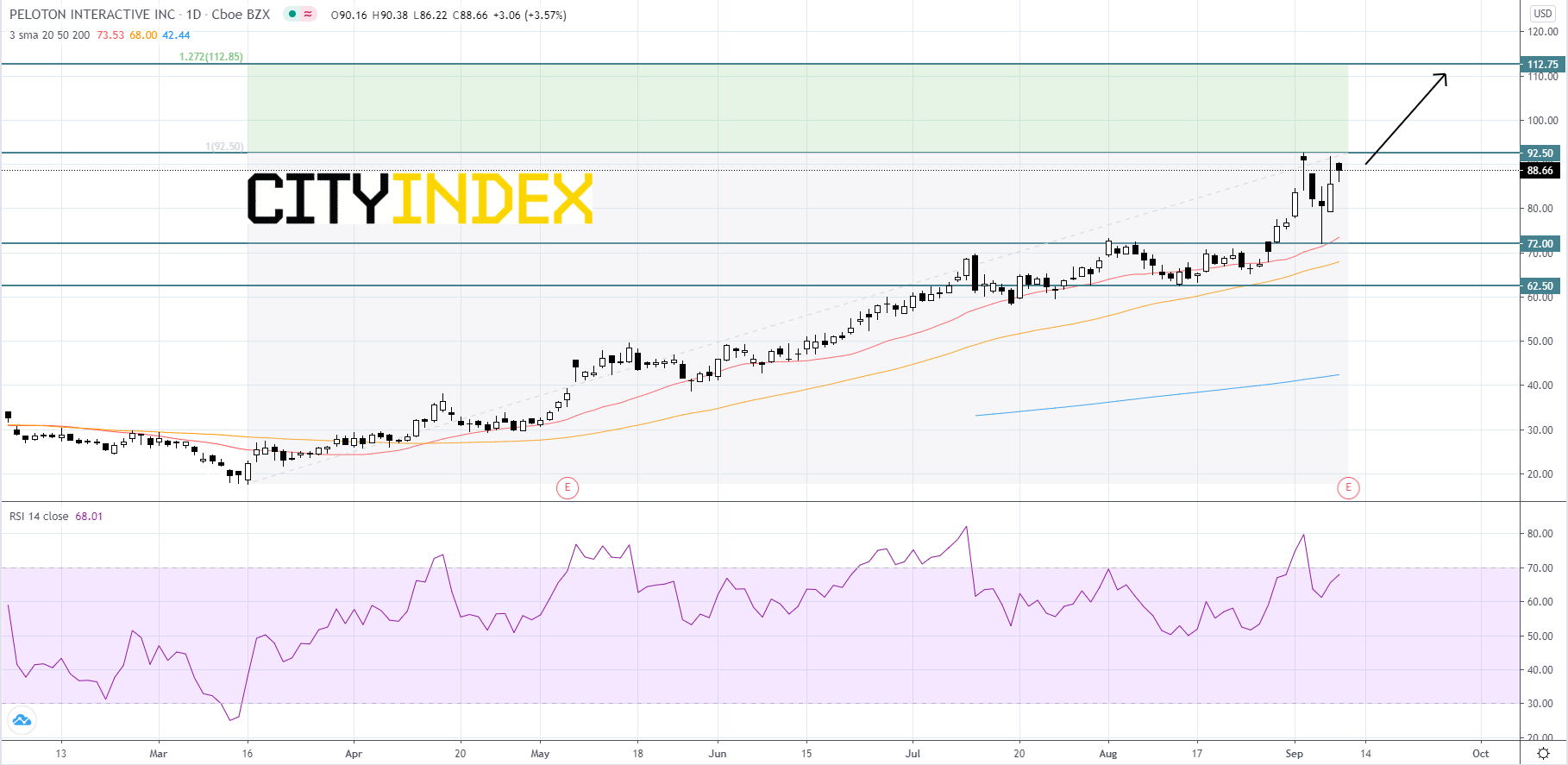

Looking at a daily chart, Peloton's stock price has been in an uptrend since mid-March. The RSI is bullish and sitting just below overbought territory at roughly 68. After price broke out above its 72.00 resistance level on August 28th, it has been making huge price swings and made a record high of 92.50 on September 2nd. Given that the trend is still bullish and that the RSI is bullish, price will likely breakout above its 92.50 high and advance towards its first Fibonacci target of about 112.75. However, if price pulls back to its 72.00 level, traders should look for a possible bounce. If price cannot manage to hold above its 72.00 support level, it would be a bearish signal and price could potentially fall further to 62.50. If price reaches its second support of 62.50, it could be signaling the beginning of a new downtrend.

Source: GAIN Capital, TradingView

Looking at a daily chart, Peloton's stock price has been in an uptrend since mid-March. The RSI is bullish and sitting just below overbought territory at roughly 68. After price broke out above its 72.00 resistance level on August 28th, it has been making huge price swings and made a record high of 92.50 on September 2nd. Given that the trend is still bullish and that the RSI is bullish, price will likely breakout above its 92.50 high and advance towards its first Fibonacci target of about 112.75. However, if price pulls back to its 72.00 level, traders should look for a possible bounce. If price cannot manage to hold above its 72.00 support level, it would be a bearish signal and price could potentially fall further to 62.50. If price reaches its second support of 62.50, it could be signaling the beginning of a new downtrend.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM