Earnings Play: PayPal

On Monday, after market, PayPal (PYPL) is anticipated to report third quarter EPS of $0.94 compared to $0.61 a year ago on revenue of approximately $5.4 billion vs. $4.4 billion last year. The company operates an online payment firm and on October 22nd, Bloomberg reported that PayPal is exploring the acquisitions of cryptocurrency companies including BitGo.

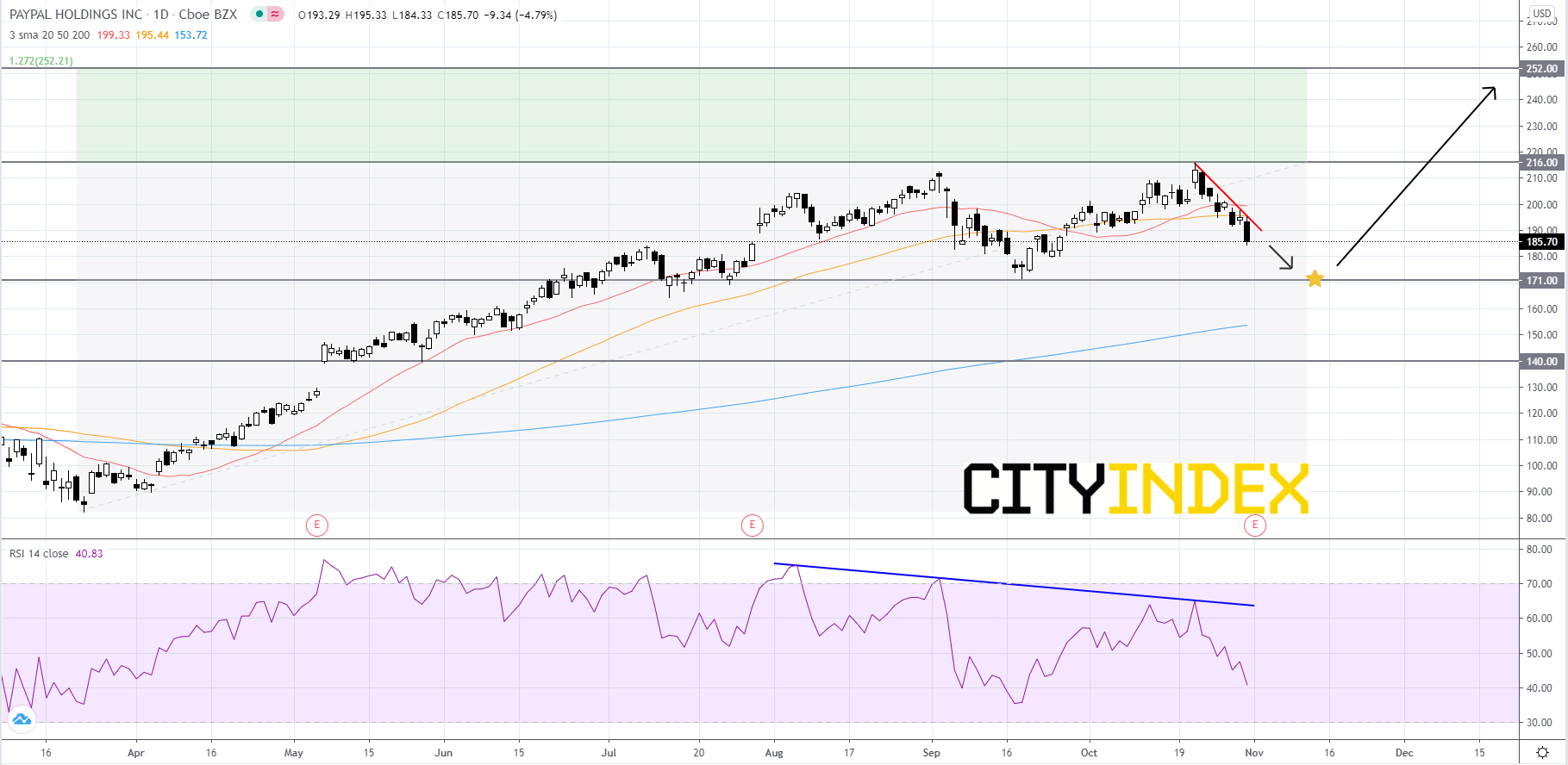

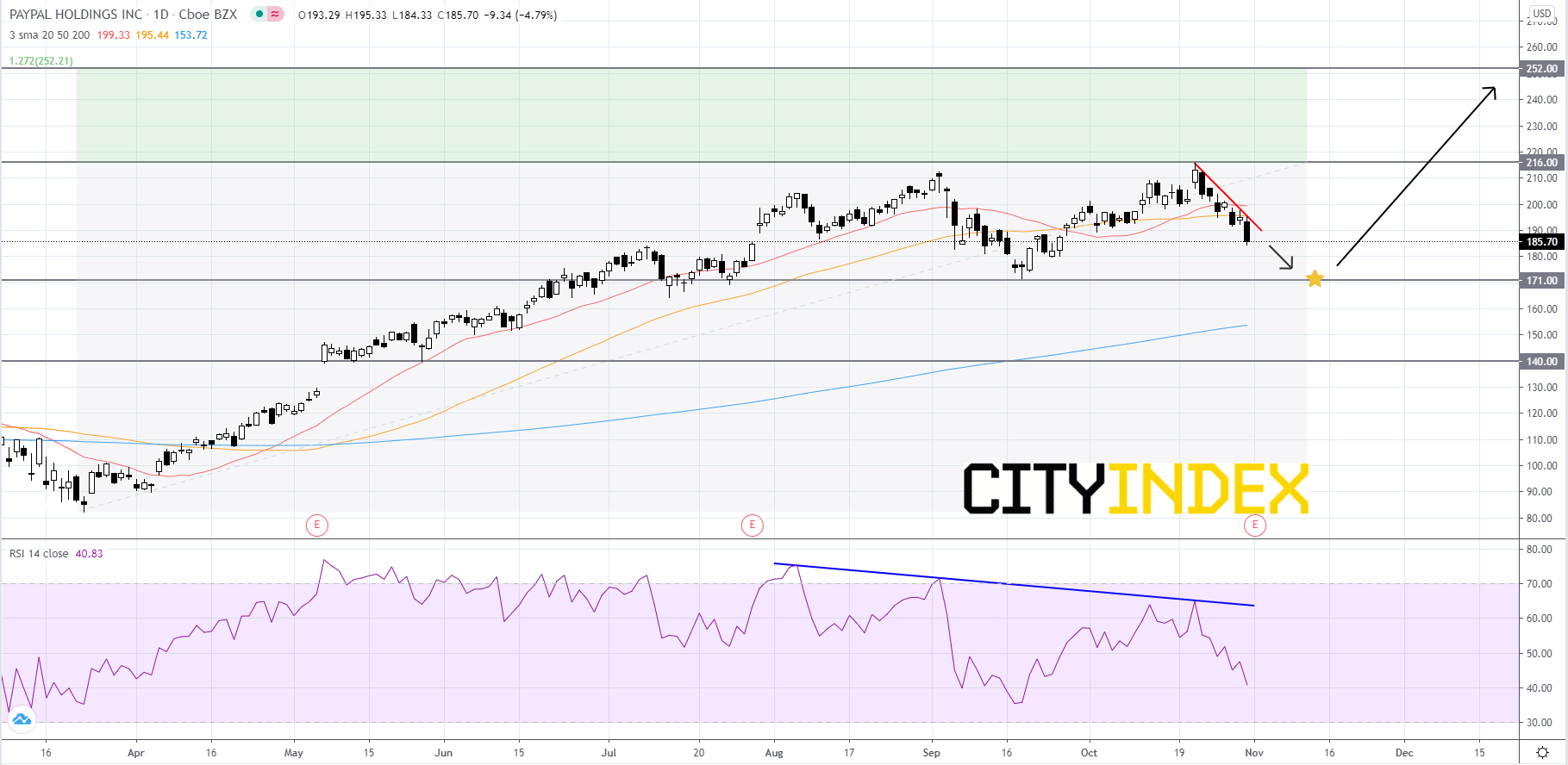

Looking at a daily chart, PayPal's stock price has been in a short-term downtrend since price made a record high of 215.83 last week on October 21st. The RSI is showing triple divergence, as price has made three higher highs since August and the RSI has made three lower highs. Price is currently below the 20-day simple moving average (SMA) and the 50-day SMA. Price will likely continue to decline until it reaches support at 171.00. Price will likely bounce off of 171.00 and retest the record high around 216.00. If price can breakout above 216.00 then price could reach for the first Fibonacci target of 252.00. On the other hand, given the negative divergence on the RSI and the weakness in the current overall market, there is a chance that price could breakout to the downside of 171.00. If that occurs it would be a bearish signal that could send price tumbling further to the 140.00 support level.

Source: GAIN Capital, TradingView

Looking at a daily chart, PayPal's stock price has been in a short-term downtrend since price made a record high of 215.83 last week on October 21st. The RSI is showing triple divergence, as price has made three higher highs since August and the RSI has made three lower highs. Price is currently below the 20-day simple moving average (SMA) and the 50-day SMA. Price will likely continue to decline until it reaches support at 171.00. Price will likely bounce off of 171.00 and retest the record high around 216.00. If price can breakout above 216.00 then price could reach for the first Fibonacci target of 252.00. On the other hand, given the negative divergence on the RSI and the weakness in the current overall market, there is a chance that price could breakout to the downside of 171.00. If that occurs it would be a bearish signal that could send price tumbling further to the 140.00 support level.

Source: GAIN Capital, TradingView

Latest market news

Today 08:18 AM

Yesterday 10:40 PM