Earnings play: Paychex

On Wednesday, before market, Paychex (PAYX), a payroll services company, announced second quarter adjusted EPS of $0.73, exceeding the estimate, up from $0.70 a year ago on revenue of $983.7 million, also above the forecast, down from $990.7 million last year.

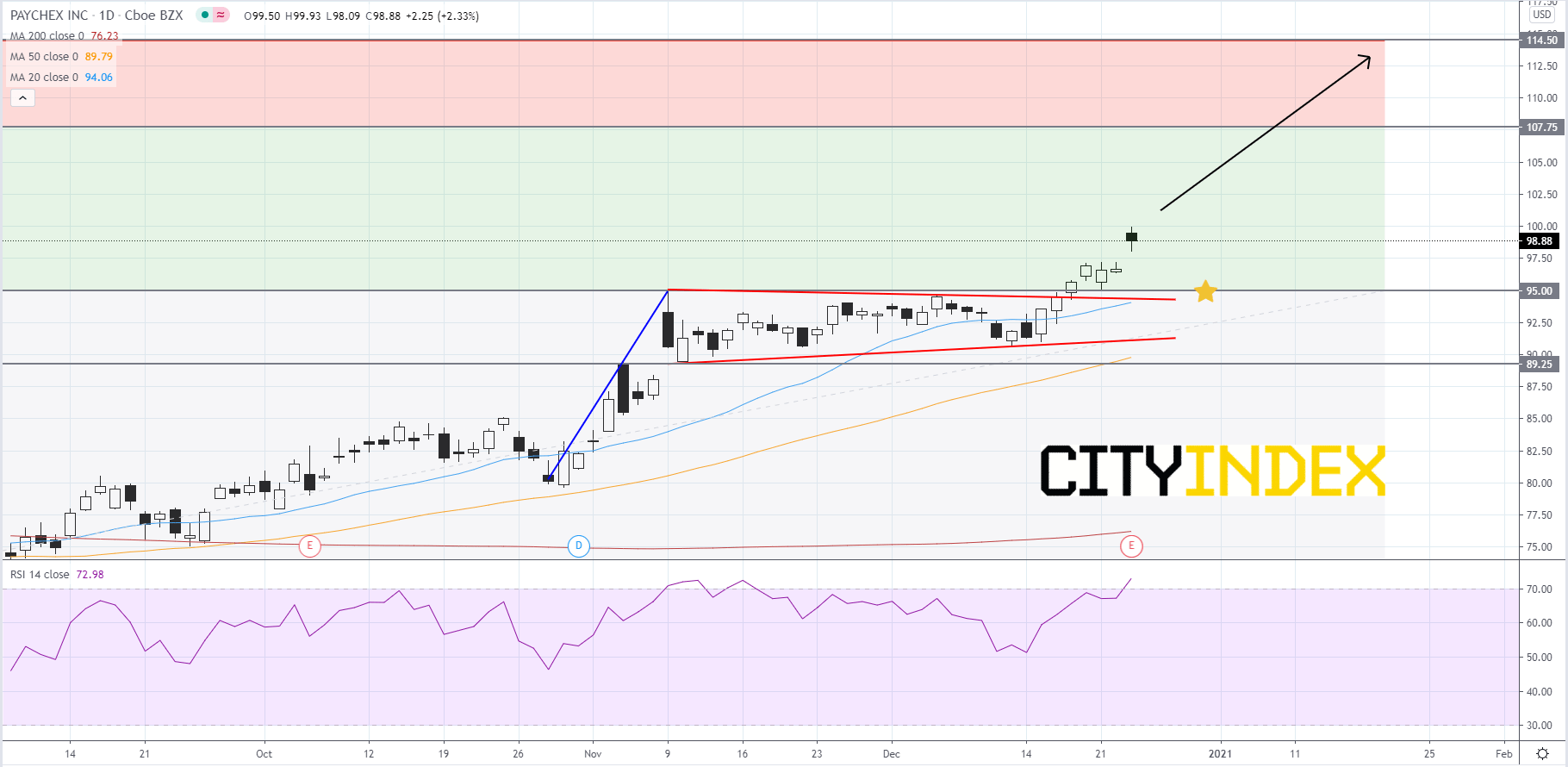

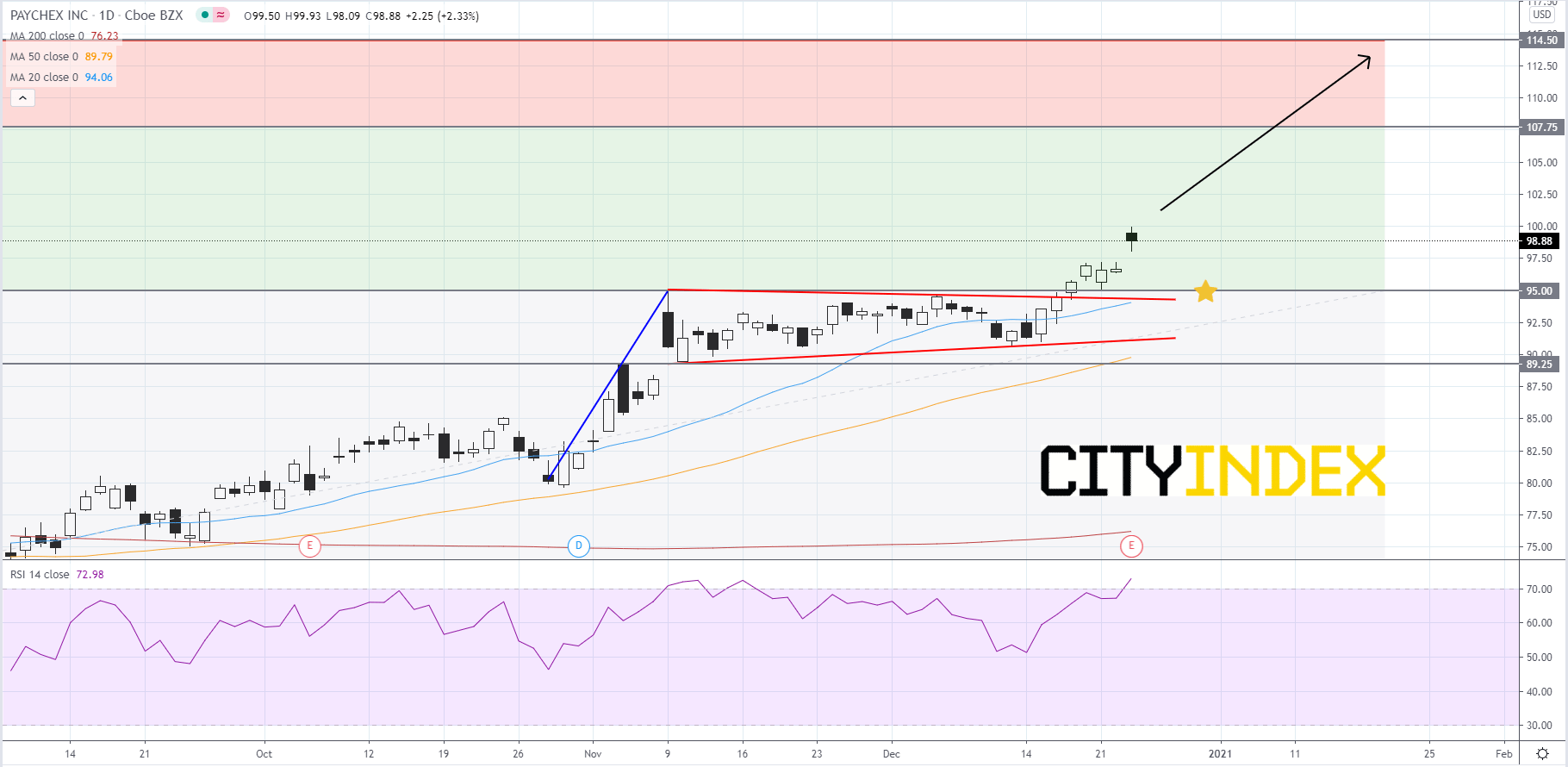

From a chartist's point of view, Paychex's stock price gapped up to an all-time high after the company reported earnings before the bell. On December 17th, Paychex's stock price broke out to the upside of a bull flag pattern that began to form in late-October. The simple moving averages (SMAs) are arranged in a bullish manner, as the 20-day SMA is above the 50-day SMA and the 50-day SMA is above the 200-day SMA. As long as price can hold above its breakout level around 95.00 it will likely grind towards its first Fibonacci target of 107.75. If price can get above 107.75 then it could rally to its second Fibonacci target of 114.50. On the other hand, if price slips below 95.00 traders should look for support at 89.25. If 89.25 fails to support price, it would be a bearish signal that could send prices lower.

Source: GAIN Capital, TradingView

From a chartist's point of view, Paychex's stock price gapped up to an all-time high after the company reported earnings before the bell. On December 17th, Paychex's stock price broke out to the upside of a bull flag pattern that began to form in late-October. The simple moving averages (SMAs) are arranged in a bullish manner, as the 20-day SMA is above the 50-day SMA and the 50-day SMA is above the 200-day SMA. As long as price can hold above its breakout level around 95.00 it will likely grind towards its first Fibonacci target of 107.75. If price can get above 107.75 then it could rally to its second Fibonacci target of 114.50. On the other hand, if price slips below 95.00 traders should look for support at 89.25. If 89.25 fails to support price, it would be a bearish signal that could send prices lower.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM