Earnings Play: Palo Alto Networks

On Monday, before market, Palo Alto Networks (PANW) is anticipated to release first quarter EPS of $1.33 compared to $1.05 a year ago on revenue of approximately $926.6 million vs. $771.9 million last year. The company is a global cybersecurity leader and on November 11th, the Co announced that it entered into a definitive agreement to acquire Expanse Inc, a leader in attack surface management, for roughly 800 million dollars. The deal is expected to close during Palo Alto's fiscal second quarter.

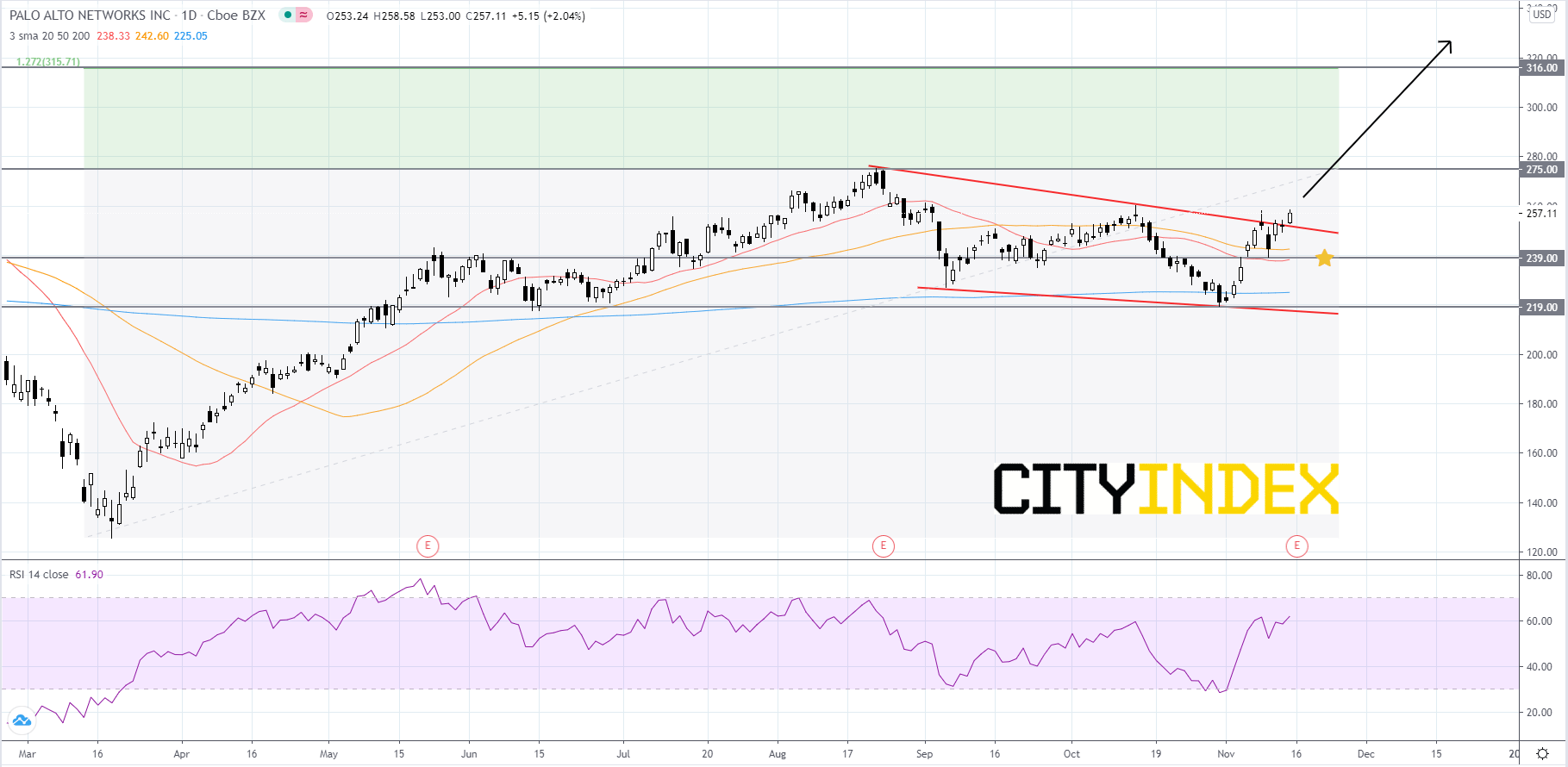

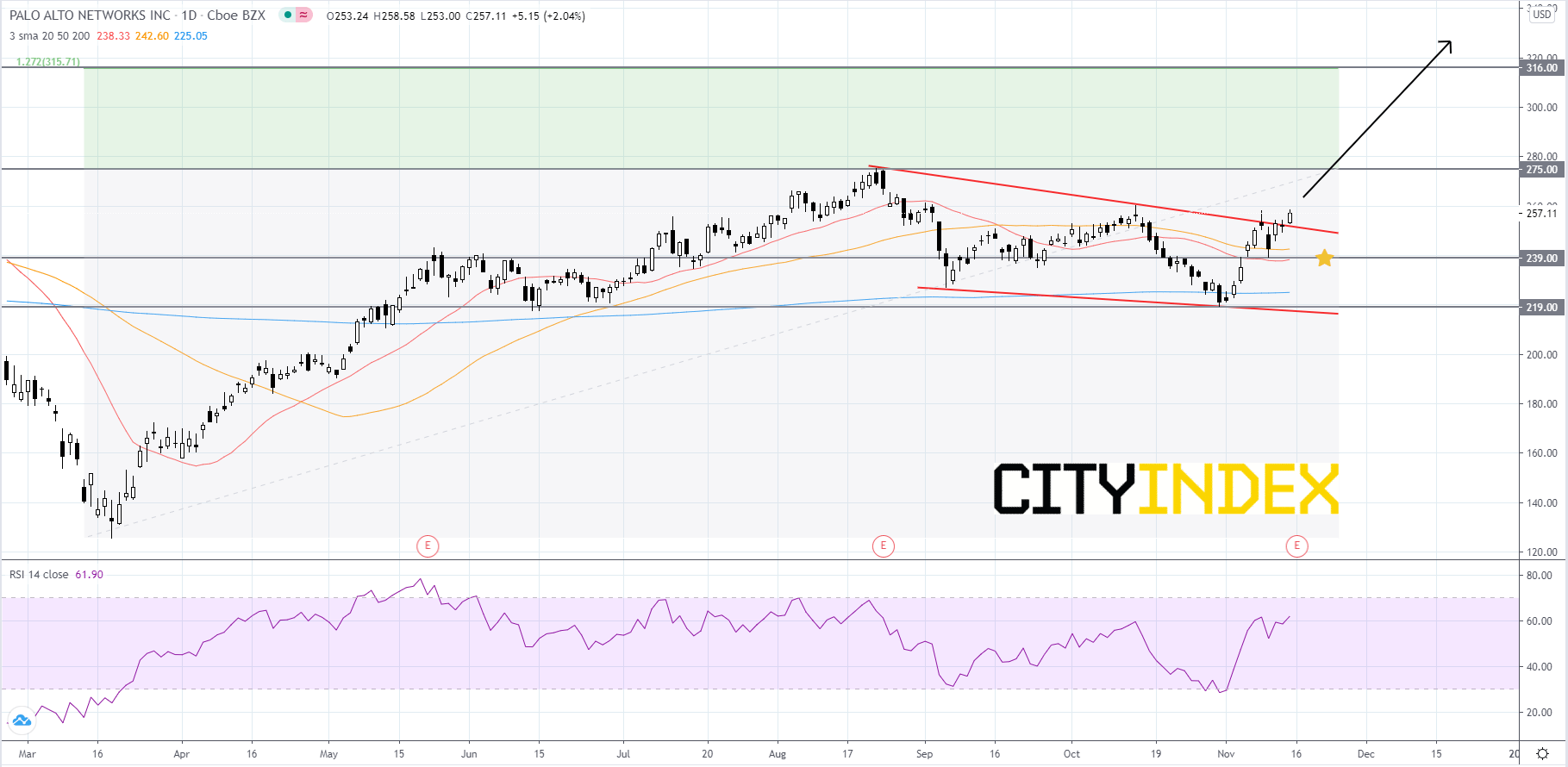

Technically speaking, on a daily chart, Palo Alto's stock price appears to have broken out to the upside of a falling wedge pattern that began to form after price made a record high of 275.03 in mid to late-August. The RSI is showing bullish momentum and currently above 60. The simple moving averages (SMA) are currently mixed to positive, however if the 20-day SMA crosses above the 50-day SMA it would be a bullish signal. Palo Alto's stock price will likely continue advancing towards the all-time high of roughly 275.00. If price can breakout to the upside of 275.00, then its first Fibonacci target would be 316.00. If price can get above 316.00 it could potentially continue to run. If price falls below the upper trendline of the pattern the bias should remain bullish due to the extreme volatility of recent market conditions. Therefore, the 239.00 support level seems to be a more reasonable place for a possible bounce. However, if price falls below 239.00 it would be a negative signal that could send price back down to 219.00. If price does not rebound off of 219.00, then it could be the beginning of a new downtrend.

Source: GAIN Capital, TradingView

Technically speaking, on a daily chart, Palo Alto's stock price appears to have broken out to the upside of a falling wedge pattern that began to form after price made a record high of 275.03 in mid to late-August. The RSI is showing bullish momentum and currently above 60. The simple moving averages (SMA) are currently mixed to positive, however if the 20-day SMA crosses above the 50-day SMA it would be a bullish signal. Palo Alto's stock price will likely continue advancing towards the all-time high of roughly 275.00. If price can breakout to the upside of 275.00, then its first Fibonacci target would be 316.00. If price can get above 316.00 it could potentially continue to run. If price falls below the upper trendline of the pattern the bias should remain bullish due to the extreme volatility of recent market conditions. Therefore, the 239.00 support level seems to be a more reasonable place for a possible bounce. However, if price falls below 239.00 it would be a negative signal that could send price back down to 219.00. If price does not rebound off of 219.00, then it could be the beginning of a new downtrend.

Source: GAIN Capital, TradingView

Latest market news

Today 08:15 AM

Today 05:45 AM

Yesterday 11:09 PM