Earnings Play: Nvidia

Today, after market, Nvidia (NVDA) is anticipated to release third quarter EPS of $2.58 compared to $1.78 a year ago on revenue of approximately $4.4 billion vs. $3.0 billion last year. The company is a leading designer of graphics processors and its current analyst consensus rating is 33 buys, 5 holds and 3 sells, according to Bloomberg.

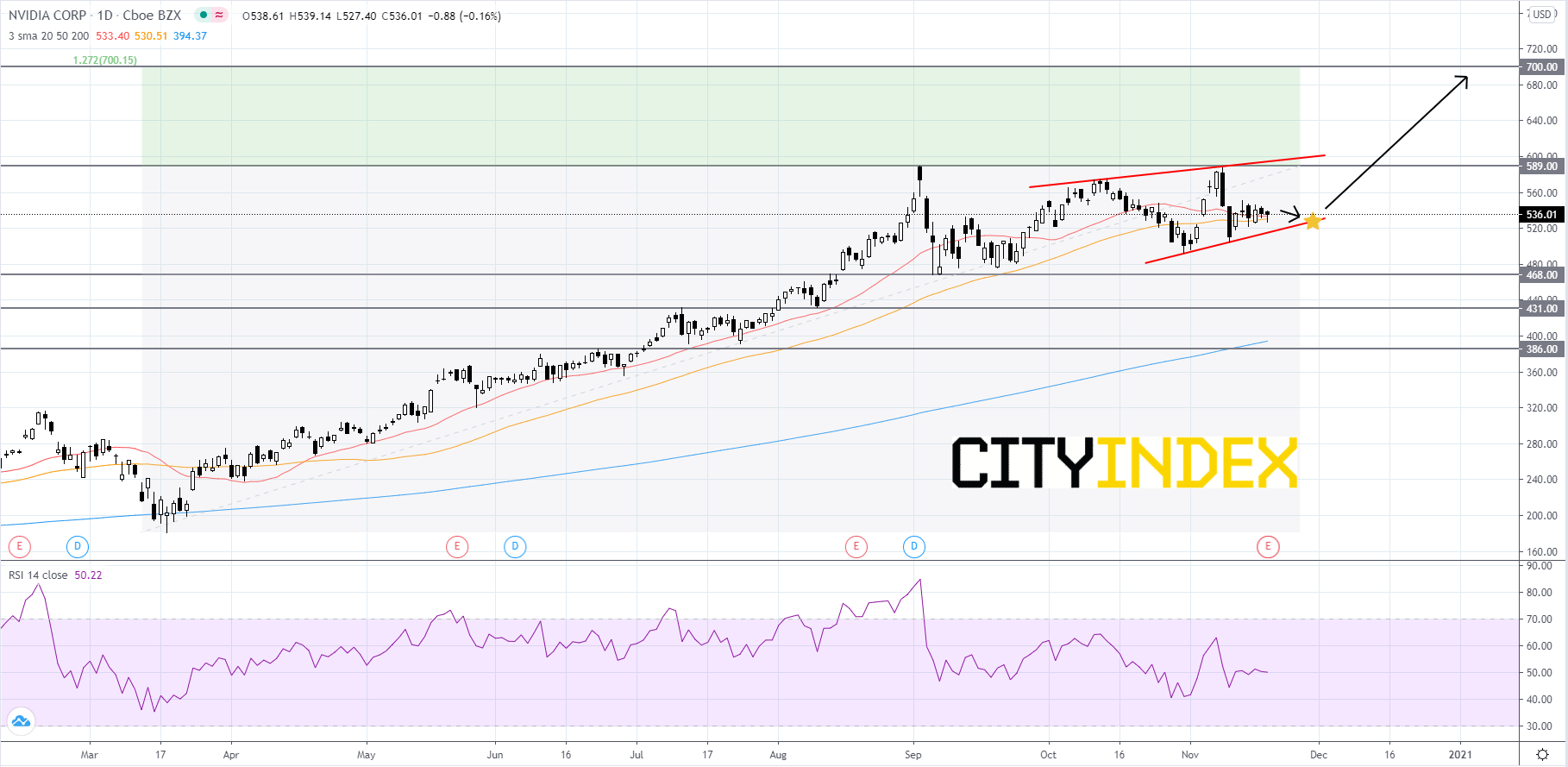

Technically speaking, on a daily chart, Nvidia's stock price appears to be rising within a short-term ascending wedge pattern that began to form in October. The RSI is mixed and holding around 50. The 20-day simple moving average (SMA) appears to be getting closer to the 50-day SMA, if the 20-day SMA crosses below the 50-day SMA it would be a bearish signal. Price will likely hold above the lower trendline, regain momentum and advance towards the record high of roughly 589.00. If price can breakout above 589.00, then its first Fibonacci target would be 700.00. If price falls below the lower trendline then investors should watch the 468.00 support level for a possible bounce. If price fails to bounce off of 468.00 it would be a negative signal that could send price down to 431.00. If price breaks below 431.00 then it could be the start of a new downtrend.

Source: GAIN Capital, TradingView

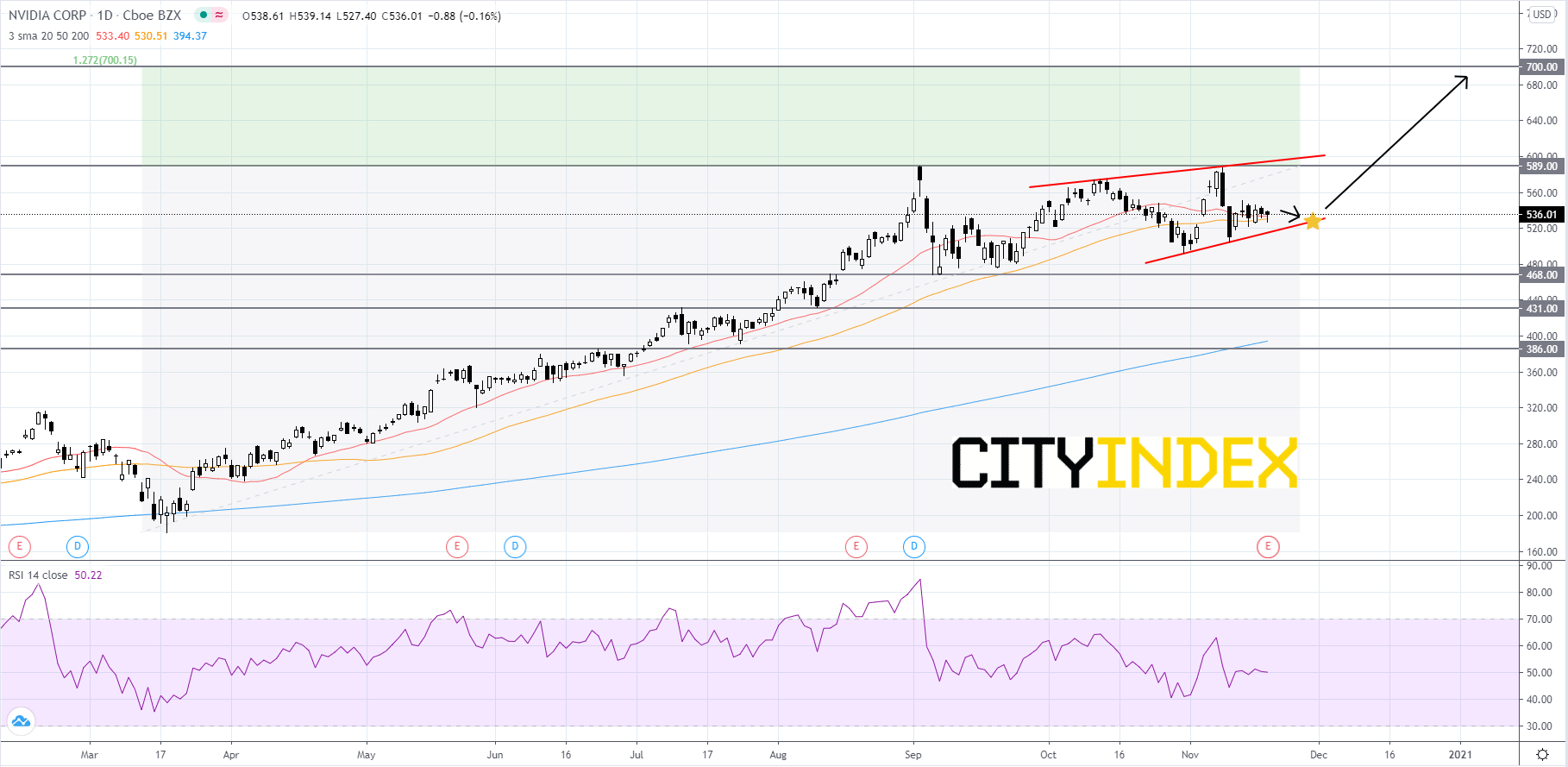

Technically speaking, on a daily chart, Nvidia's stock price appears to be rising within a short-term ascending wedge pattern that began to form in October. The RSI is mixed and holding around 50. The 20-day simple moving average (SMA) appears to be getting closer to the 50-day SMA, if the 20-day SMA crosses below the 50-day SMA it would be a bearish signal. Price will likely hold above the lower trendline, regain momentum and advance towards the record high of roughly 589.00. If price can breakout above 589.00, then its first Fibonacci target would be 700.00. If price falls below the lower trendline then investors should watch the 468.00 support level for a possible bounce. If price fails to bounce off of 468.00 it would be a negative signal that could send price down to 431.00. If price breaks below 431.00 then it could be the start of a new downtrend.

Source: GAIN Capital, TradingView

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM