Earnings Play: Nike

Today, after market, Nike (NKE) is expected to release first quarter EPS of $0.46 compared to $0.86 last year on revenue of approximately $9.1 billion vs. $10.7 billion a year earlier. The company is the largest athletic footwear and apparel brand in the world, and its current analyst consensus rating is 28 buys, 5 holds and 2 sells, according to Bloomberg.

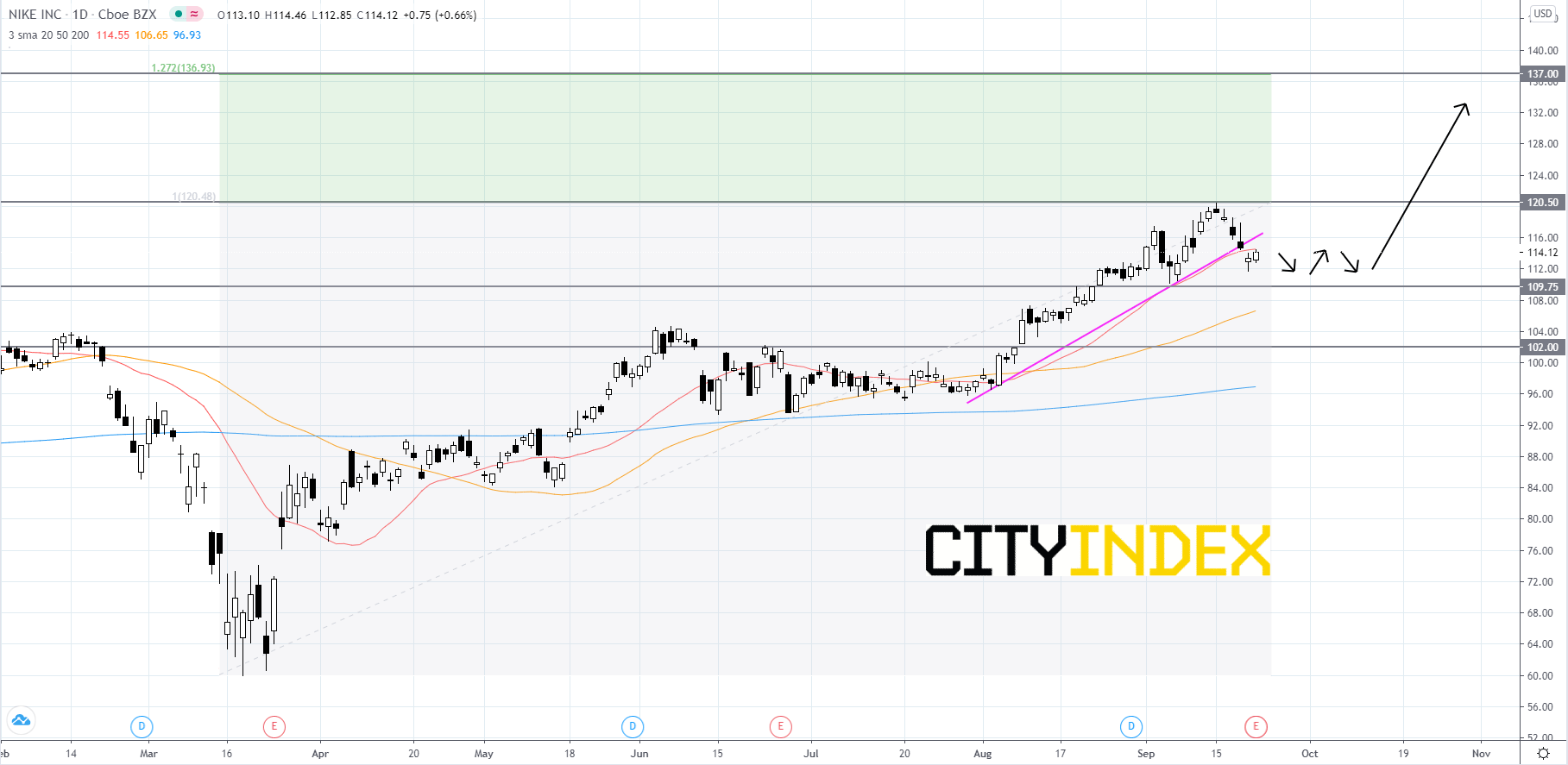

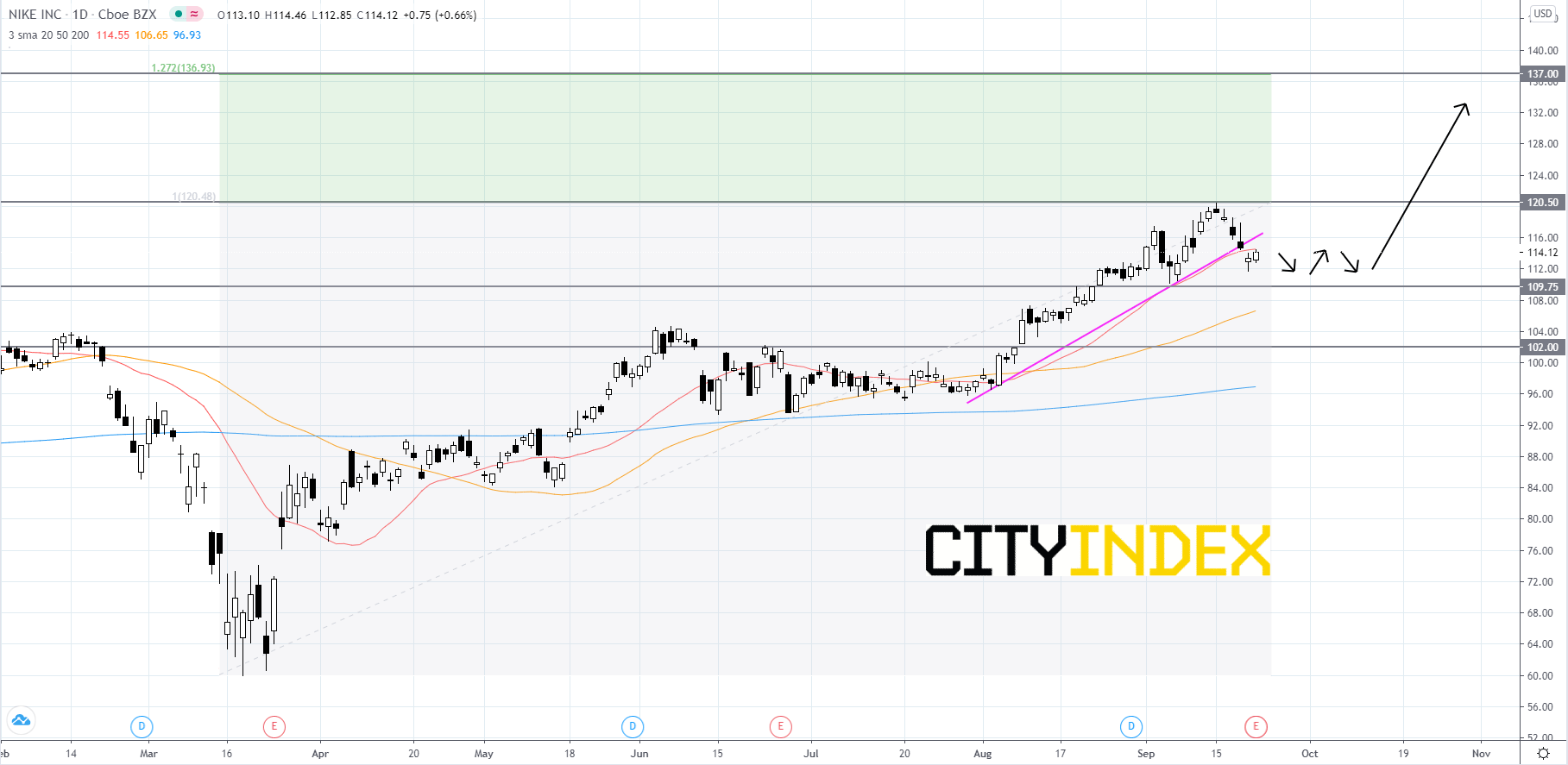

Technically speaking, on a daily chart, Nike's stock price has been in an uptrend since mid-March. Yesterday, on September 21st, price opened below a bullish trendline and the 20-day simple moving average, a short-term bearish signal. However, the candle sticks after the trendline and 20-day SMA break are spinning tops, which are neutral candle sticks and could mean that buyers are still holding up the price. Even though price broke below a short-term bullish trendline and the 20-day SMA, it is holding above its 109.75 support level. Price will probably consolidate and hold above 109.75 before regaining momentum and retesting the all-time high of 120.50. If price can break above 120.50, it will likely continue its uptrend and advance towards its first Fibonacci target of roughly 137.00. On the flip side, if price cannot hold above its 109.75 support level, that would be a bearish move and price could drop to its second support level at 102.00. If price does not rebound off 102.00 and falls further it could be the beginning of a new downtrend.

Source: GAIN Capital, TradingView

Technically speaking, on a daily chart, Nike's stock price has been in an uptrend since mid-March. Yesterday, on September 21st, price opened below a bullish trendline and the 20-day simple moving average, a short-term bearish signal. However, the candle sticks after the trendline and 20-day SMA break are spinning tops, which are neutral candle sticks and could mean that buyers are still holding up the price. Even though price broke below a short-term bullish trendline and the 20-day SMA, it is holding above its 109.75 support level. Price will probably consolidate and hold above 109.75 before regaining momentum and retesting the all-time high of 120.50. If price can break above 120.50, it will likely continue its uptrend and advance towards its first Fibonacci target of roughly 137.00. On the flip side, if price cannot hold above its 109.75 support level, that would be a bearish move and price could drop to its second support level at 102.00. If price does not rebound off 102.00 and falls further it could be the beginning of a new downtrend.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 11:48 PM

Yesterday 11:16 PM

Yesterday 05:00 PM