Earnings Play: Nielsen

On Monday, Nielsen (NLSN) is anticipated to report second quarter EPS of $0.29 compared to $0.53 a year ago on revenue of approximately $1.5B vs. $1.6B last year. The company provides marketing and client analytic services, and its current analyst consensus rating is 9 buys, 6 holds and 3 sells, according to Bloomberg.

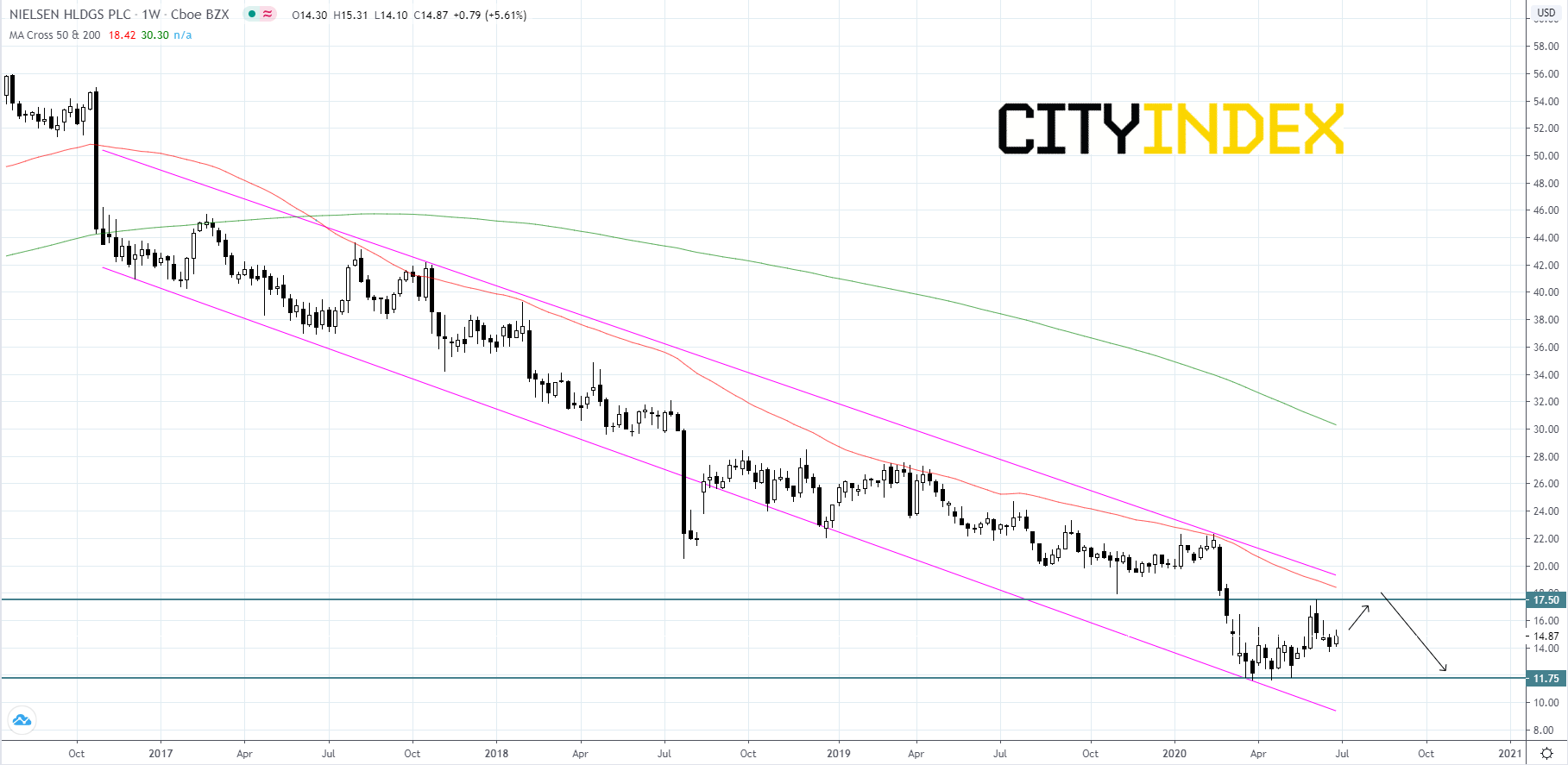

Looking at a weekly chart, Nielsen's stock price has been falling inside of a descending channel that began in late 2016. Price is expected to continue to advance in the short-term until it reaches its 50-week moving average where price is likely to find strong resistance and turn back to the downside.

Source: GAIN Capital, TradingView

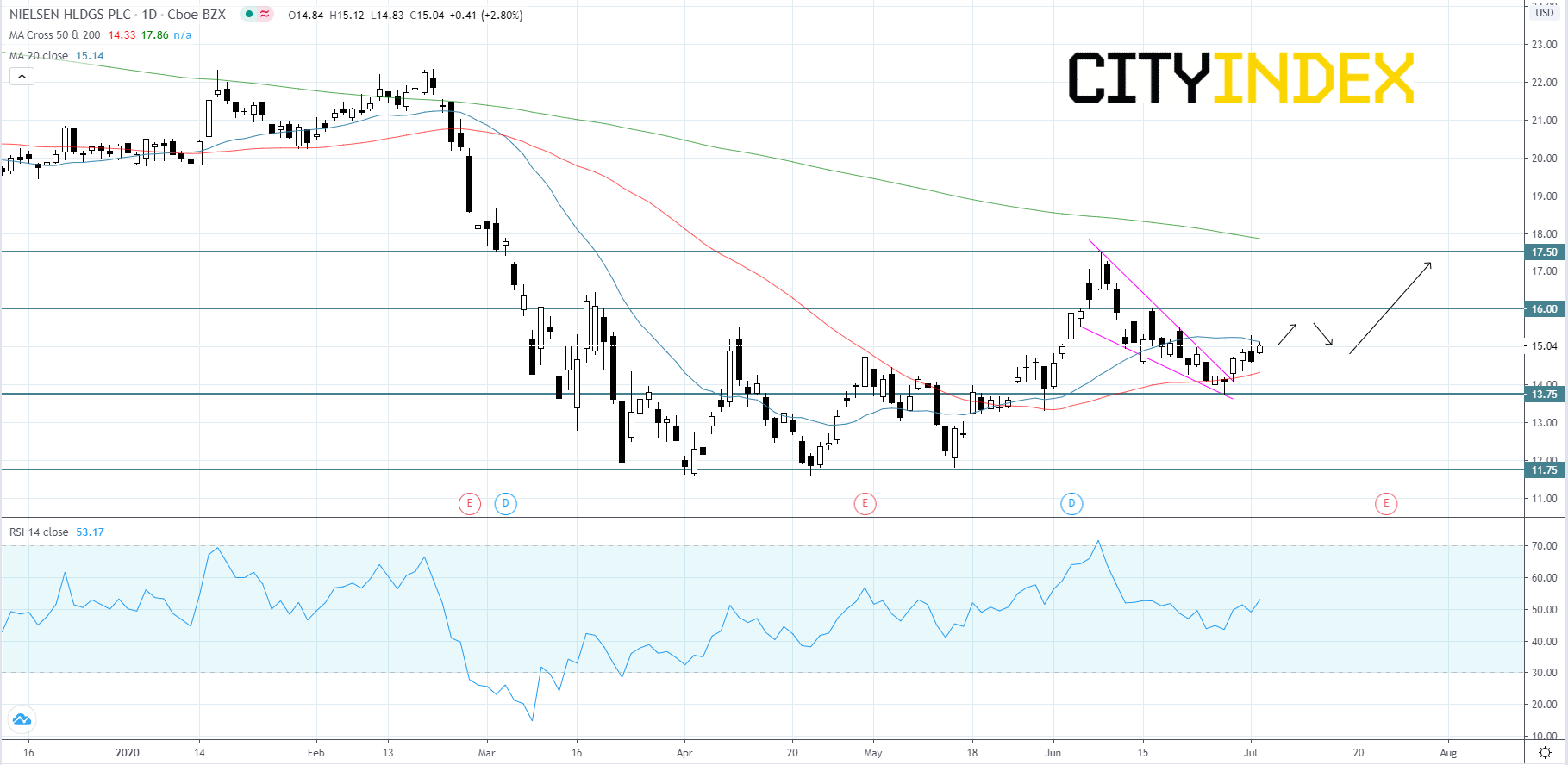

Looking at a daily chart, Nielsen's stock price has just broken to the upside of a short-term falling wedge pattern that began to form in early-June. The RSI appears to be turning up and is currently sitting above the 50 median level which indicates bullish momentum. Price is expected to continue to rise until it reaches its first resistance level at $16.00. Look for a move towards $17.50 to complete the measured move of the wedge pattern. If price breaks below $13.75 support then we may see the stock continue to fall inside the bearish trend channel towards $11.75.

Source: GAIN Capital, TradingView

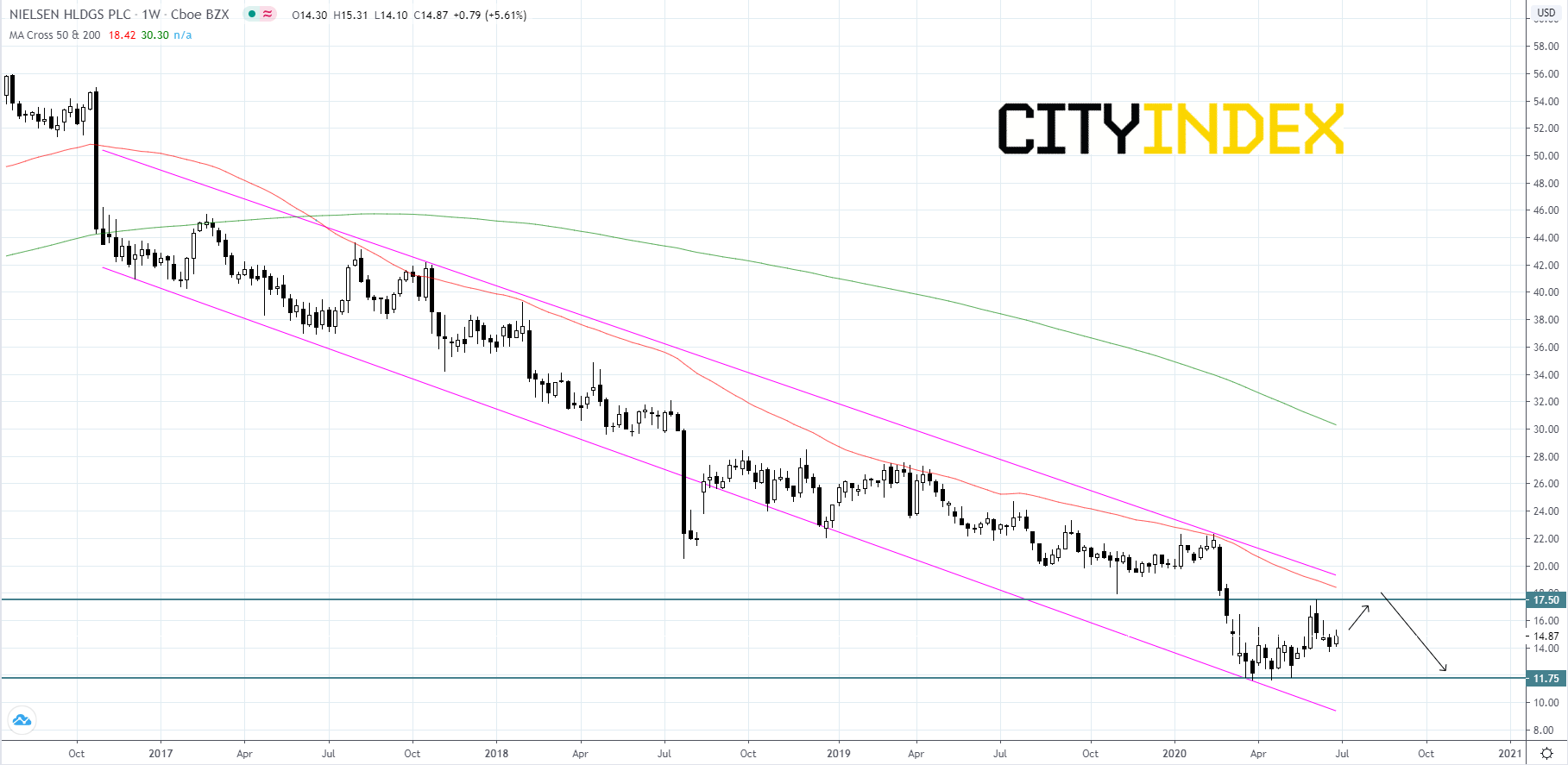

Looking at a weekly chart, Nielsen's stock price has been falling inside of a descending channel that began in late 2016. Price is expected to continue to advance in the short-term until it reaches its 50-week moving average where price is likely to find strong resistance and turn back to the downside.

Source: GAIN Capital, TradingView

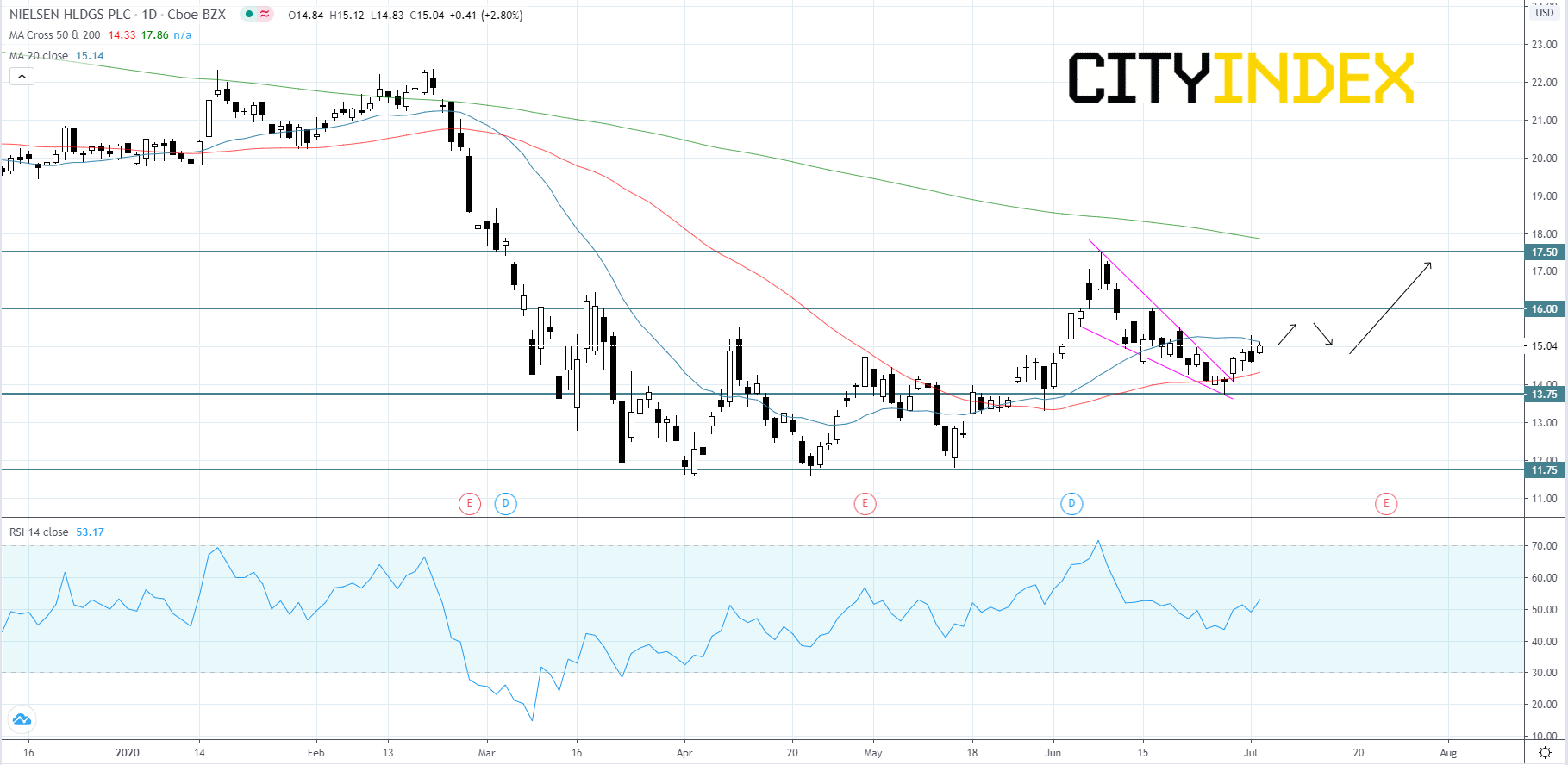

Looking at a daily chart, Nielsen's stock price has just broken to the upside of a short-term falling wedge pattern that began to form in early-June. The RSI appears to be turning up and is currently sitting above the 50 median level which indicates bullish momentum. Price is expected to continue to rise until it reaches its first resistance level at $16.00. Look for a move towards $17.50 to complete the measured move of the wedge pattern. If price breaks below $13.75 support then we may see the stock continue to fall inside the bearish trend channel towards $11.75.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM