Earnings Play: Microsoft

Today, after market, Microsoft (MSFT) is expected to release first quarter EPS of $1.55 compared to $1.38 last year on revenue of approximately $35.7 billion vs. $33.1 billion a year earlier. The company develops and licenses software, and its expected move based on front-month options is 4.6%. The last time the company reported earnings the stock dropped 4.4%.

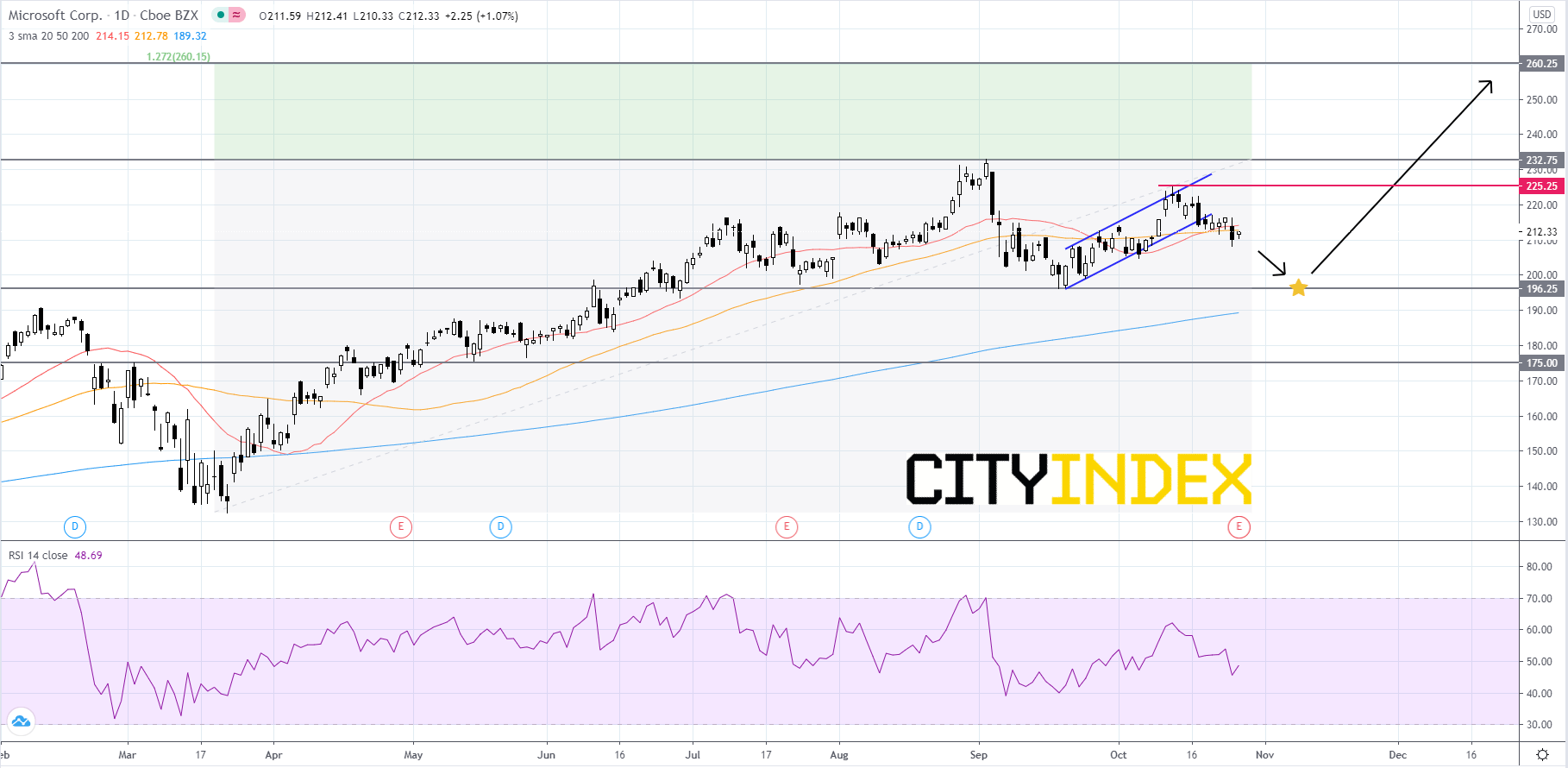

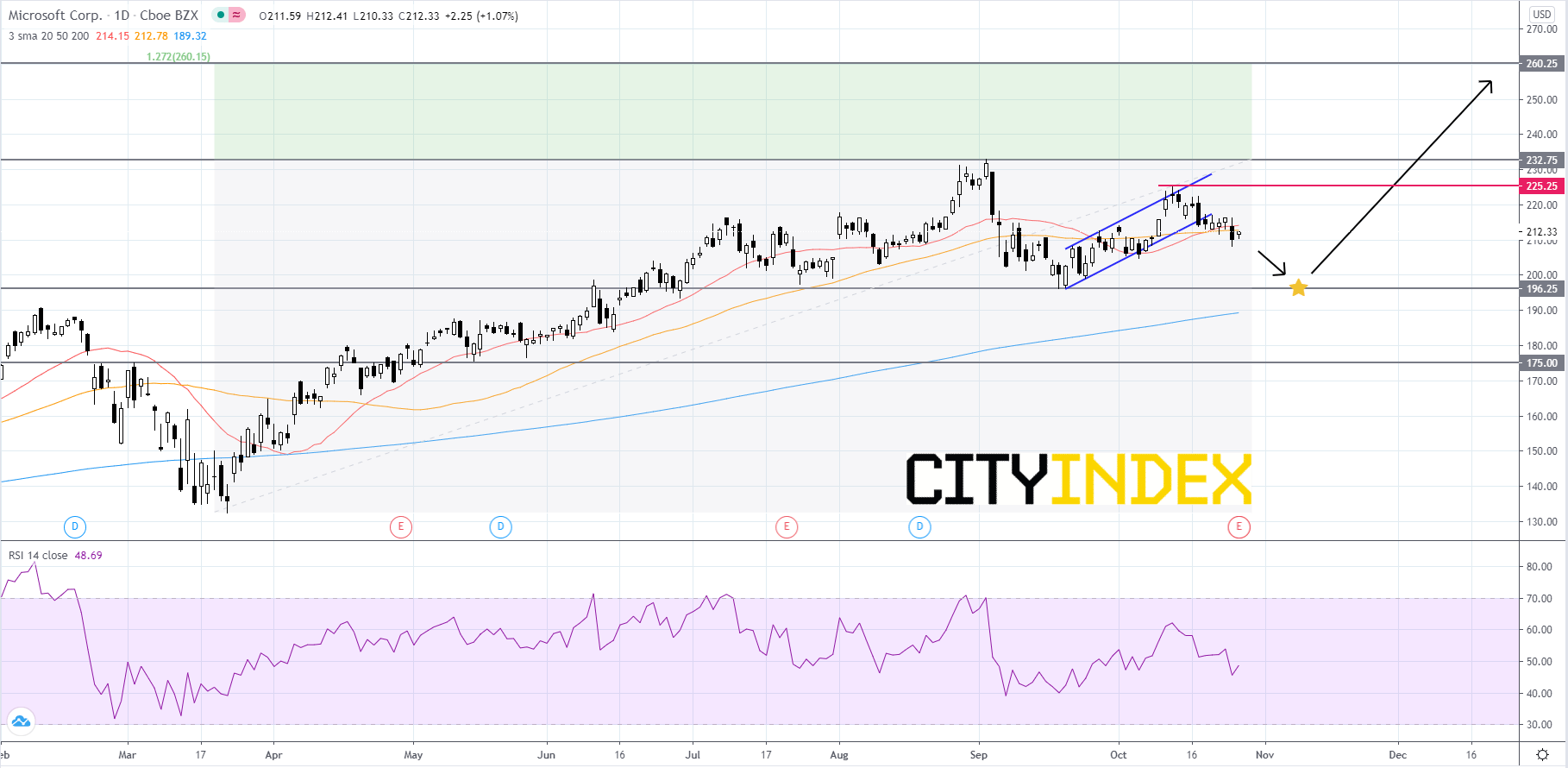

Technically speaking, on a daily chart, Microsoft's stock price recently broke to the downside of a short-term rising channel that began to form in mid-September after price bounced off of the 196.25 support level. The RSI is below its neutrality area of 50 and appears to be confirming price action with a lower high made in mid-October compared to the last peak in early-September. Microsoft will likely continue to fade until price reaches its 196.25 support level. Prices will likely find support at 196.25 and rebound towards its last peak of 225.25. If price can surpass 225.25 then its next target would be the all-time high of roughly 232.75. If price can get above the record high then its next target would be 260.25. On the other hand, if price breaks out and closes below its 196.25 support level it would be a bearish signal that could send price down further towards the 175.00 support level.

Source: GAIN Capital, TradingView

Technically speaking, on a daily chart, Microsoft's stock price recently broke to the downside of a short-term rising channel that began to form in mid-September after price bounced off of the 196.25 support level. The RSI is below its neutrality area of 50 and appears to be confirming price action with a lower high made in mid-October compared to the last peak in early-September. Microsoft will likely continue to fade until price reaches its 196.25 support level. Prices will likely find support at 196.25 and rebound towards its last peak of 225.25. If price can surpass 225.25 then its next target would be the all-time high of roughly 232.75. If price can get above the record high then its next target would be 260.25. On the other hand, if price breaks out and closes below its 196.25 support level it would be a bearish signal that could send price down further towards the 175.00 support level.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM