Earnings Play: McKesson

On Monday, before market, McKesson (MCK) is expected to release 1Q EPS of $2.32 compared to $3.31 the prior year on revenue of approximately $54.1B vs. $55.7B last year. The company is a global distributor of wholesale pharmaceutical and medical products, and on July 29th, the company raised its quarterly cash dividend to $0.42 per share, from $0.41 per share.

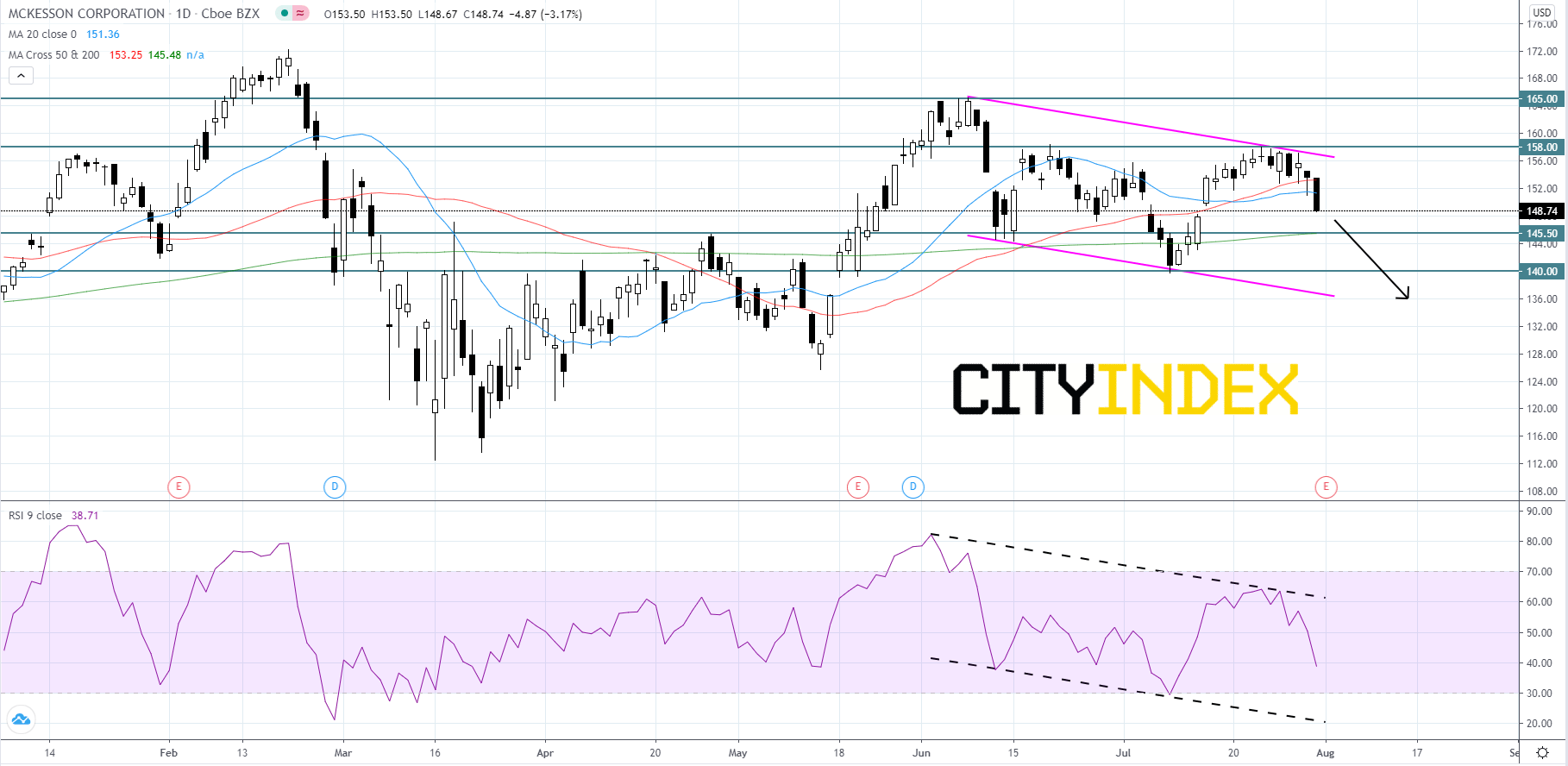

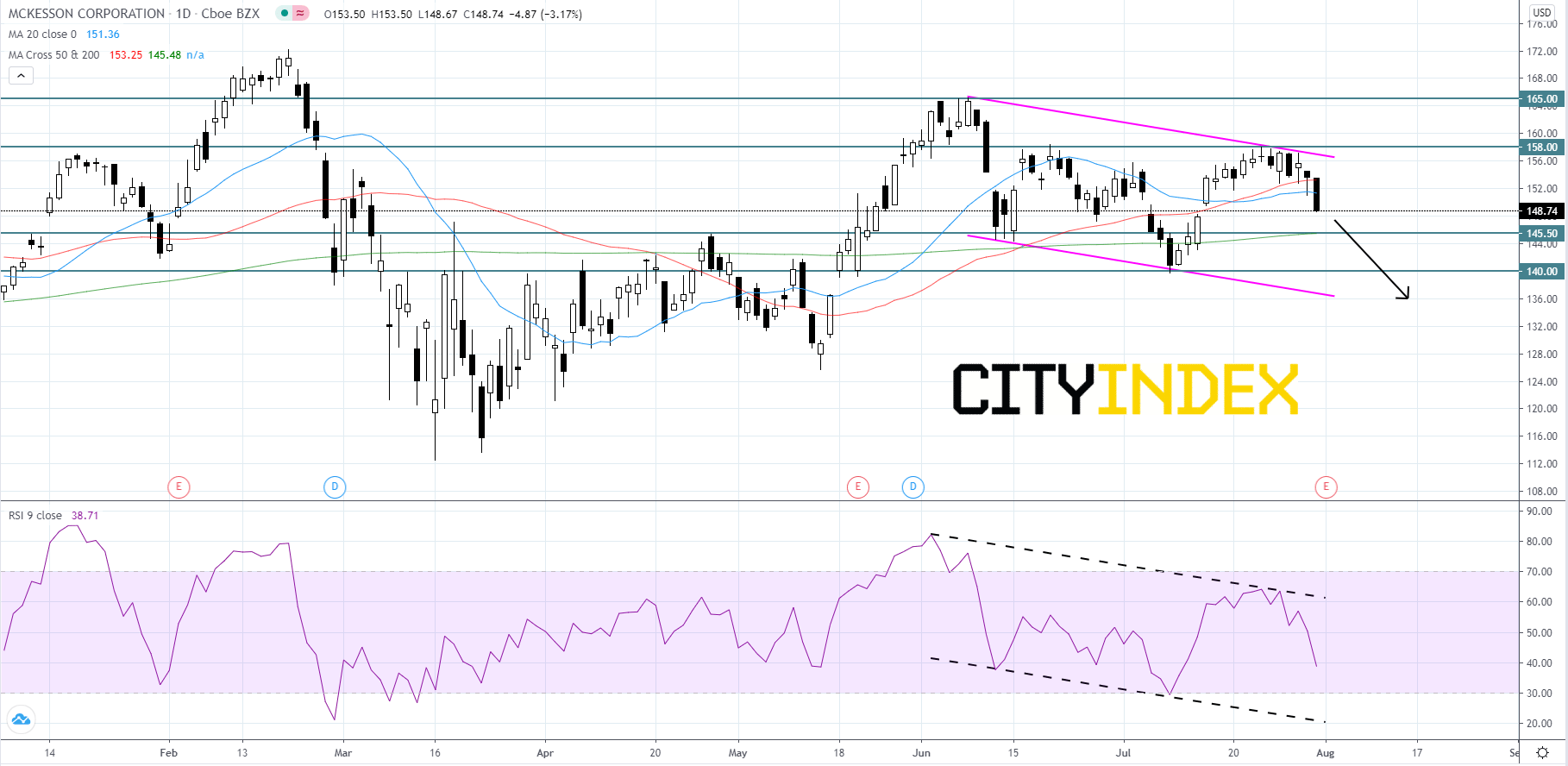

Technically speaking, on a daily chart, McKesson's stock price appears to be forming a descending channel that began after price last peaked on June 8th. The RSI also appears to be forming a downward channel that began at roughly the same time. The 20-day moving average recently crossed below the 50-day moving average, a bearish signal. McKesson's stock price will likely fall to its $145.50 support level, blow past it and continue declining to the $140.00 level. If price reaches $140.00, it could pick up momentum and reach the lower trend line of the pattern. If price happens to move upward, its potential should be checked by either the upper trend line or the $158.00 resistance level. If price gets above $158.00, we could see a jump to retest the $165.00 level.

Source: GAIN Capital, TradingView

Technically speaking, on a daily chart, McKesson's stock price appears to be forming a descending channel that began after price last peaked on June 8th. The RSI also appears to be forming a downward channel that began at roughly the same time. The 20-day moving average recently crossed below the 50-day moving average, a bearish signal. McKesson's stock price will likely fall to its $145.50 support level, blow past it and continue declining to the $140.00 level. If price reaches $140.00, it could pick up momentum and reach the lower trend line of the pattern. If price happens to move upward, its potential should be checked by either the upper trend line or the $158.00 resistance level. If price gets above $158.00, we could see a jump to retest the $165.00 level.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM