Earnings Play: Lululemon Athletica

On Tuesday, after market, Lululemon Athletica (LULU) is expected to release second quarter EPS of $0.55 compared to $0.96 last year on sales of approximately $844.1 million vs. $883.4 million a year earlier. The company designs athletic accessories and apparel, and its expected move based on front-month options is 11.0%. The last time the company reported earnings it fell 3.8%.

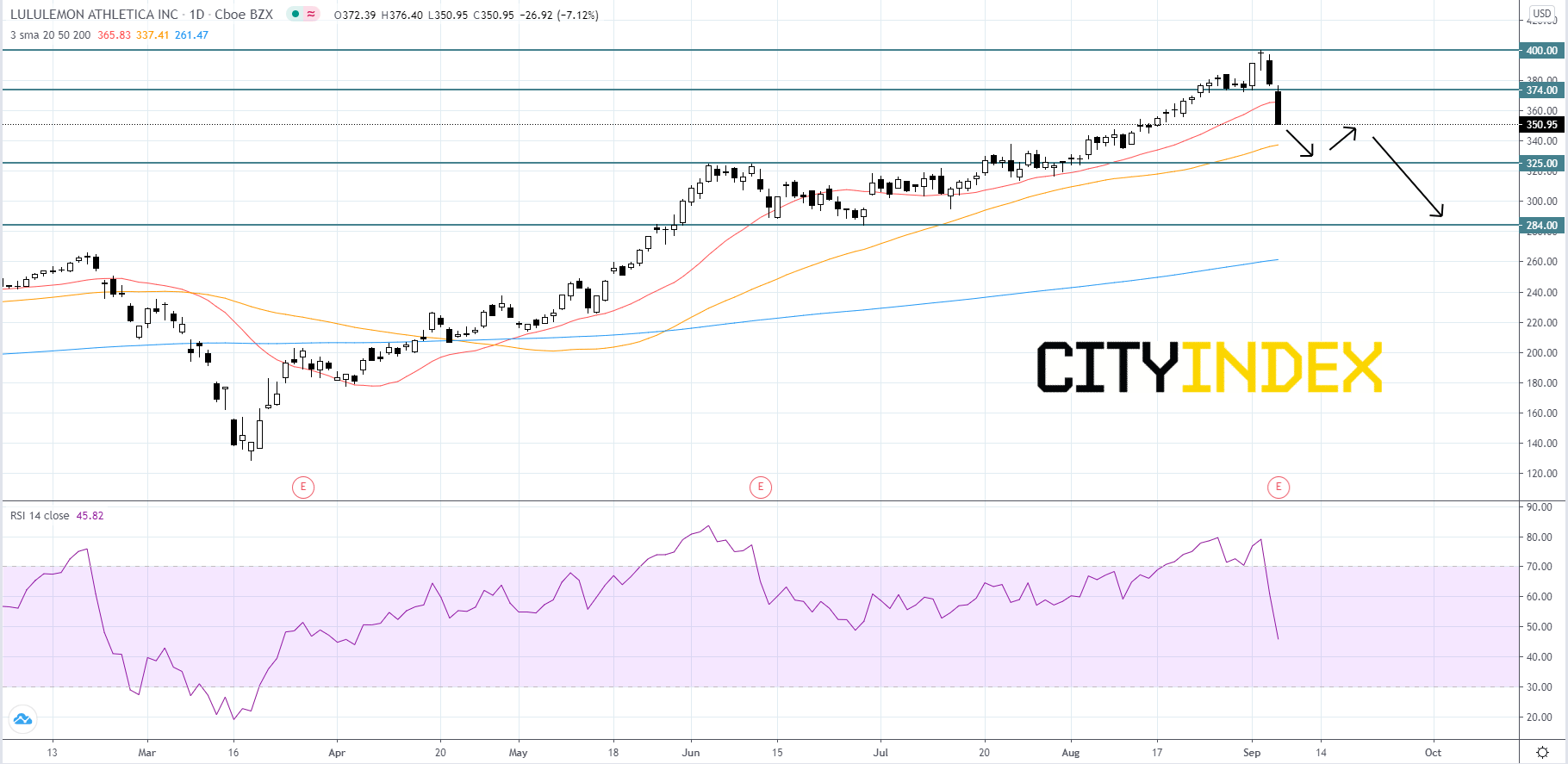

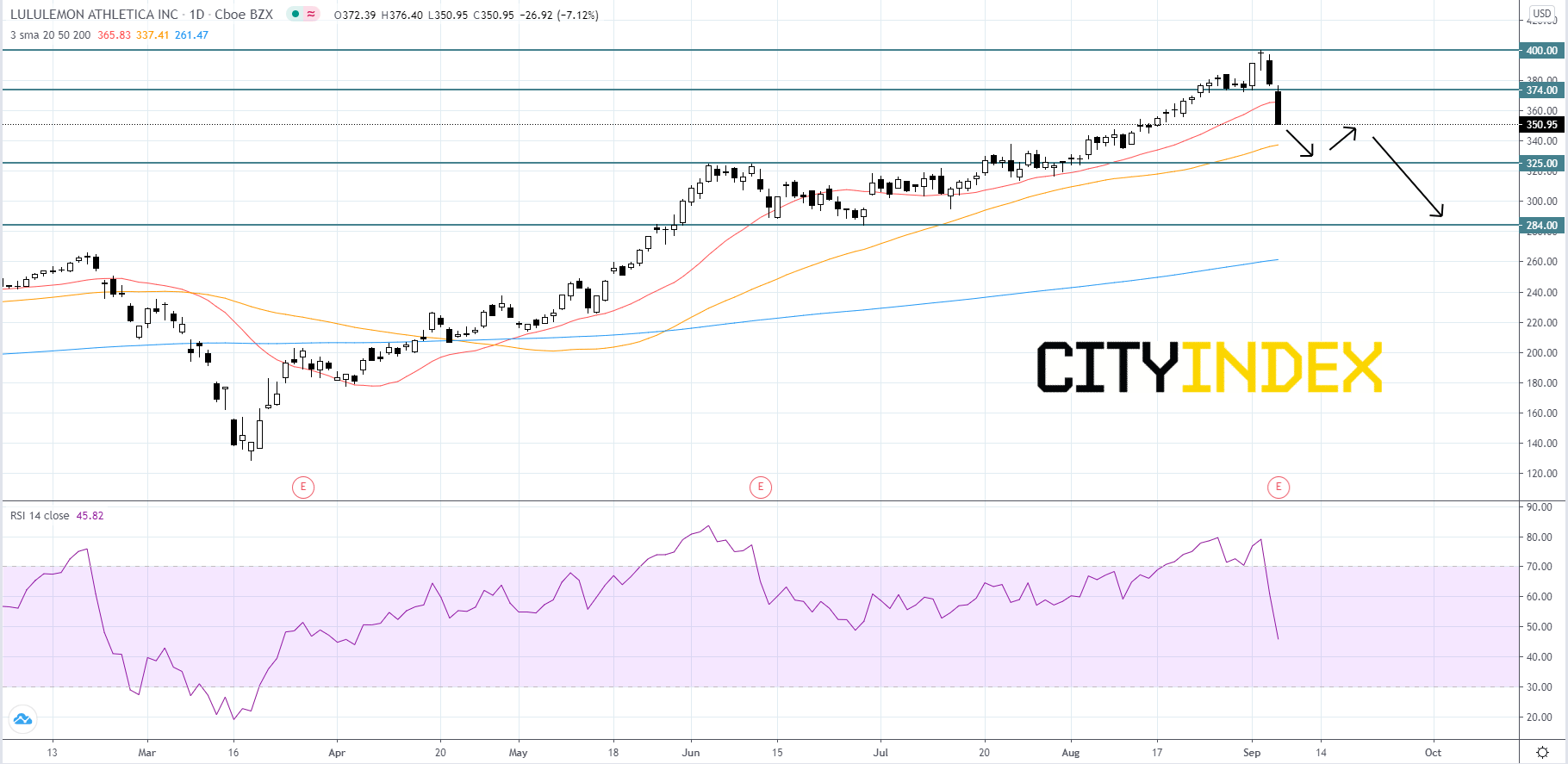

Looking at a daily chart, Lululemon's stock price has been rising in an uptrend since mid-March. On Wednesday, September 2nd, Lulu reached an all-time high of 399.90, where price action formed a doji candle before pulling back. The RSI shows bearish momentum and is currently sitting below its neutrality area at roughly 45. On Friday morning, price broke below its 20-day simple moving average (SMA) with a large price drop, a possible warning sign. Price will likely fall further and find support at the 325.00, as dip buyers could be looking for a late entry on the uptrend. Price will probably consolidate and chop around between 374.00 and 325.00. If price breaks below the 325.00 support level, price will most likely decline to the next support level at 284.00. If price can manage to hold above 325.00, it could potentially break out to the upside of 374.00 and advance to retest the record high just below 400.00. However, given the two consecutive large down days on the S&P 500 and the sell off in the tech sector, the bullish sentiment could be shifting.

Source: GAIN Capital, TradingView

Looking at a daily chart, Lululemon's stock price has been rising in an uptrend since mid-March. On Wednesday, September 2nd, Lulu reached an all-time high of 399.90, where price action formed a doji candle before pulling back. The RSI shows bearish momentum and is currently sitting below its neutrality area at roughly 45. On Friday morning, price broke below its 20-day simple moving average (SMA) with a large price drop, a possible warning sign. Price will likely fall further and find support at the 325.00, as dip buyers could be looking for a late entry on the uptrend. Price will probably consolidate and chop around between 374.00 and 325.00. If price breaks below the 325.00 support level, price will most likely decline to the next support level at 284.00. If price can manage to hold above 325.00, it could potentially break out to the upside of 374.00 and advance to retest the record high just below 400.00. However, given the two consecutive large down days on the S&P 500 and the sell off in the tech sector, the bullish sentiment could be shifting.

Source: GAIN Capital, TradingView