Earnings Play: Lennar

On Monday, after market, Lennar (LEN) is expected to release third quarter EPS of $1.57 compared to $1.59 last year on revenue of approximately $5.5 billion vs. $5.9 billion a year earlier. The company is the largest homebuilder in the U.S. and its current analyst consensus rating is 10 buys, 10 holds and 0 sells, according to Bloomberg.

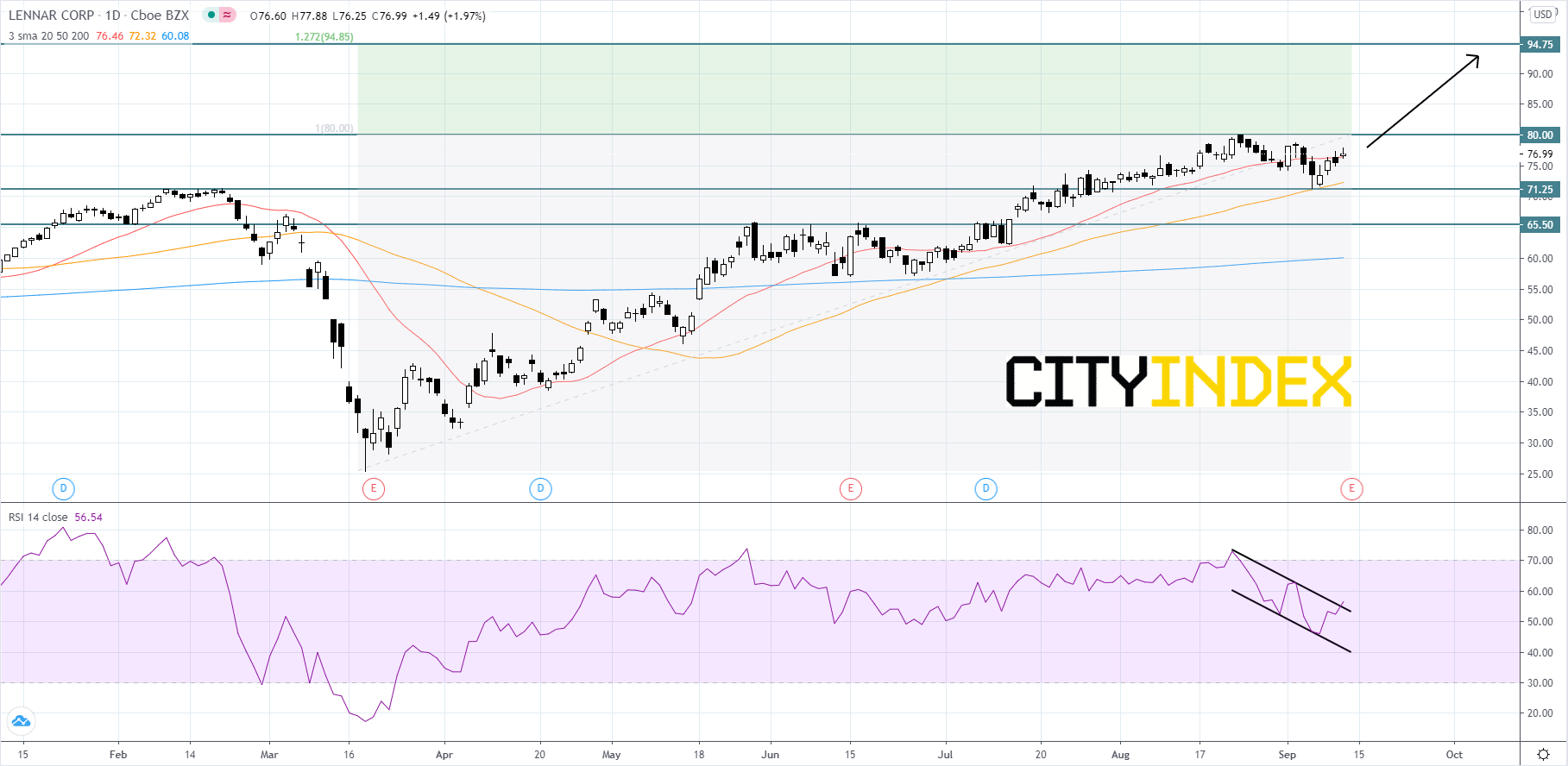

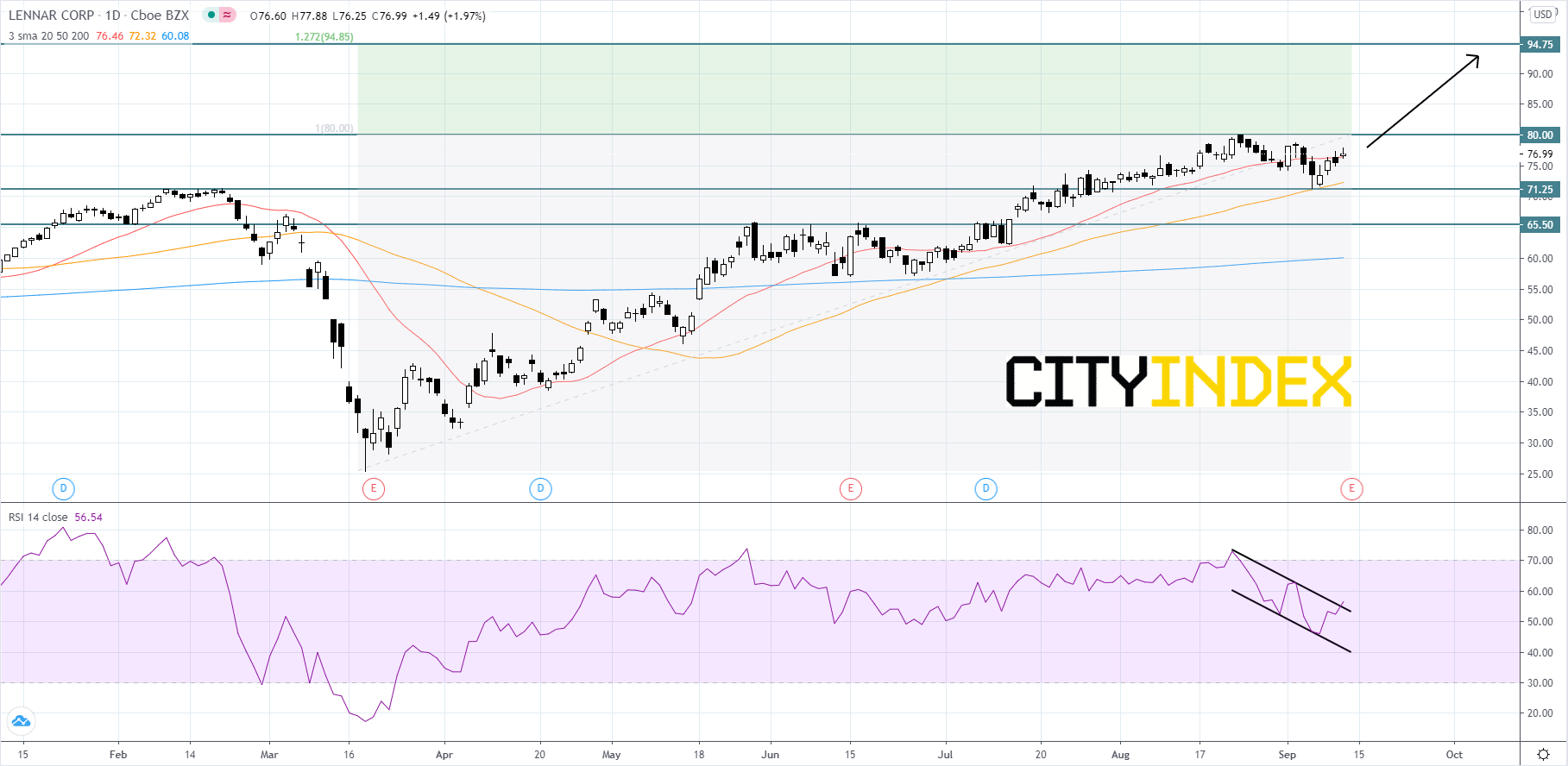

Technically speaking, on a daily chart, Lennar's stock price has been increasing in a uptrend that began in mid-March. Price has been using its 20-day and 50-day simple moving averages (SMA) as rough support. The RSI is mixed with a bullish bias, as it has been falling in a short-term bearish channel, but appears to be breaking through the upper trendline. The current low interest rate environment in the U.S. favors home purchases and according to the U.S. Census Bureau, New Home Sales have been rising monthly since April. Price will likely rise and break through its record high of 80.00. If price gets above 80.00 it will probably continue advancing and grind towards it first Fibonacci target at about 94.75. On the other hand, if price cannot hold above its 71.25 support level it would be a bearish signal, as price would also likely fall below both of its SMAs. If that occurs then price could continue falling to its second support level at 65.50. If a rebound does not occur at 65.50 then a new downtrend could be forming.

Source: GAIN Capital, TradingView

Technically speaking, on a daily chart, Lennar's stock price has been increasing in a uptrend that began in mid-March. Price has been using its 20-day and 50-day simple moving averages (SMA) as rough support. The RSI is mixed with a bullish bias, as it has been falling in a short-term bearish channel, but appears to be breaking through the upper trendline. The current low interest rate environment in the U.S. favors home purchases and according to the U.S. Census Bureau, New Home Sales have been rising monthly since April. Price will likely rise and break through its record high of 80.00. If price gets above 80.00 it will probably continue advancing and grind towards it first Fibonacci target at about 94.75. On the other hand, if price cannot hold above its 71.25 support level it would be a bearish signal, as price would also likely fall below both of its SMAs. If that occurs then price could continue falling to its second support level at 65.50. If a rebound does not occur at 65.50 then a new downtrend could be forming.

Source: GAIN Capital, TradingView

Latest market news

Today 04:24 AM

Yesterday 10:48 PM

Yesterday 02:00 PM