Earnings Play: Kroger

On Thursday, before market, Kroger (KR) is anticipated to release third quarter EPS of $0.66 compared to $0.47 last year on revenue of approximately $29.9 billion vs. $28.0 billion in the previous year. The company operates a chain of superstores and corner stores, and its expected move based on front-month options is 4.9%. The last time the company reported earnings the stock fell 1.1%.

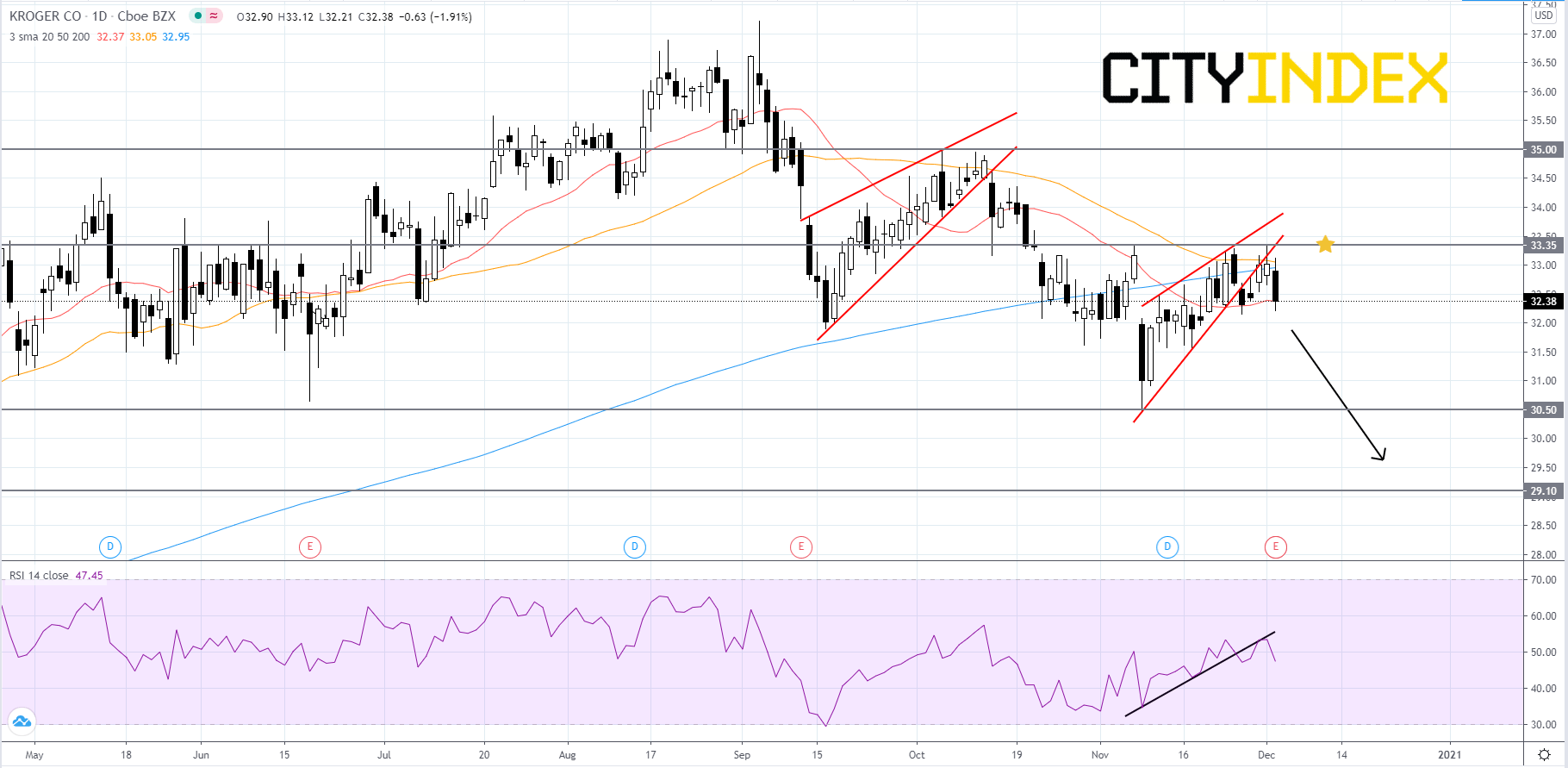

Looking at a daily chart, Kroger's stock price has broken out to the downside of a short-term rising wedge pattern that began to form in early-November. Looking at the chart, one can see that this same pattern formed in mid-September and broke out to the downside in mid-October. The RSI is below 50 and has fallen below a rising trendline that has been in place since early-November. Kroger's stock price has entered a new downtrend, as price is below its 200-day simple moving average (SMA). The 20-day SMA is below the 200-day SMA and if the 50-day SMA crosses below the 200-day SMA it will be another bearish signal. Price will likely continue to decline to 30.50. If price can penetrate 30.50, it could tumble to 29.10. On the other hand, if price gets above 33.35 it could rally towards 35.00.

Source: GAIN Capital, TradingView

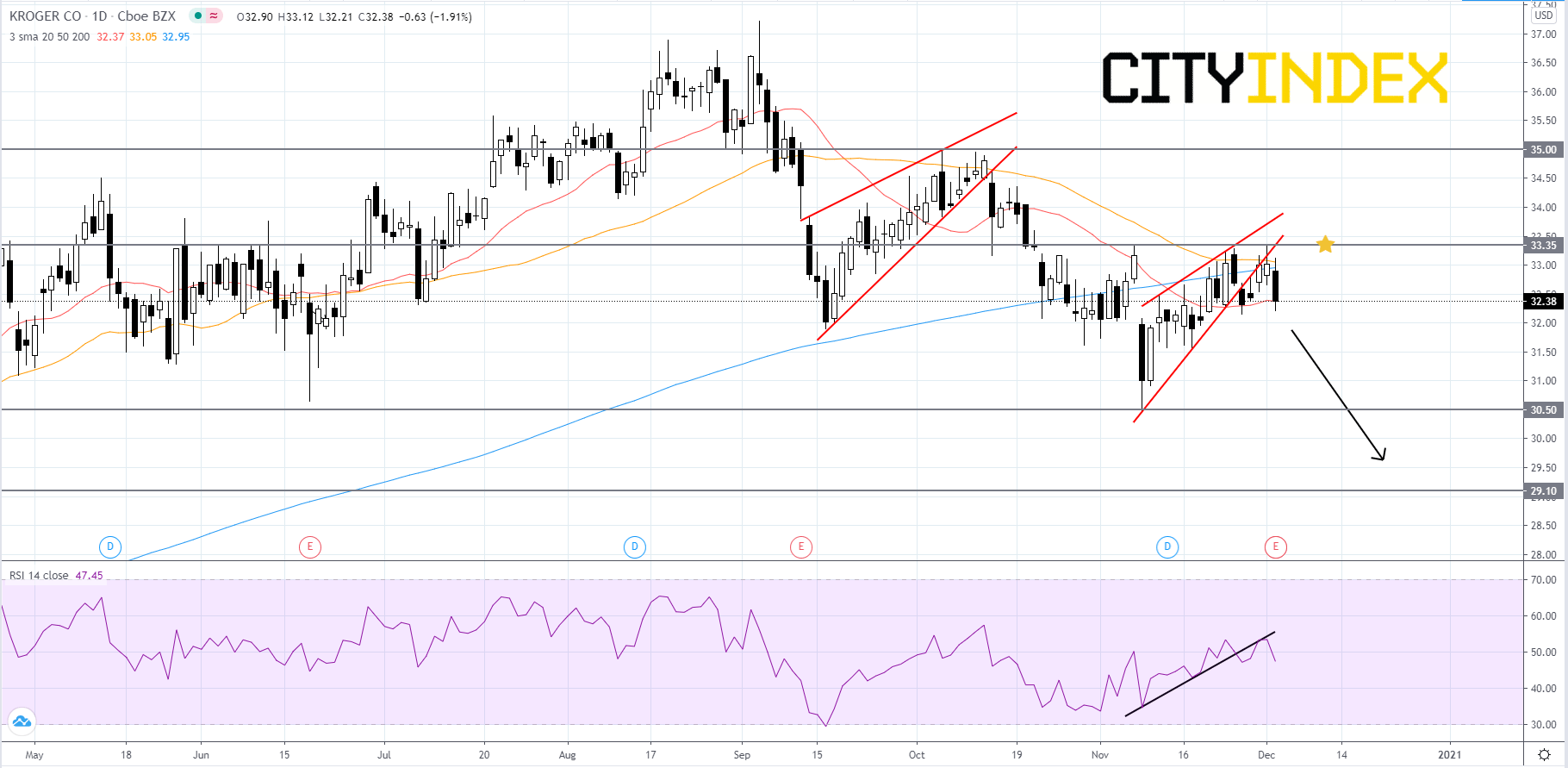

Looking at a daily chart, Kroger's stock price has broken out to the downside of a short-term rising wedge pattern that began to form in early-November. Looking at the chart, one can see that this same pattern formed in mid-September and broke out to the downside in mid-October. The RSI is below 50 and has fallen below a rising trendline that has been in place since early-November. Kroger's stock price has entered a new downtrend, as price is below its 200-day simple moving average (SMA). The 20-day SMA is below the 200-day SMA and if the 50-day SMA crosses below the 200-day SMA it will be another bearish signal. Price will likely continue to decline to 30.50. If price can penetrate 30.50, it could tumble to 29.10. On the other hand, if price gets above 33.35 it could rally towards 35.00.

Source: GAIN Capital, TradingView

Latest market news

Today 07:55 AM

Today 04:47 AM