Earnings Play: Johnson & Johnson

On Thursday, Johnson & Johnson (JNJ) is expected to report second quarter EPS of $1.50 compared to $2.58 a year ago on revenue of approximately $17.6B vs. $20.6B last year. Johnson & Johnson is the world's largest and most diverse healthcare products company and on July 14th, Janssen Pharmaceutical, a subsidiary of the company, received approval from the U.S. Food and Drug Administration (FDA) for Tremfya, a treatment for adult patients with active psoriatic arthritis, according to Bloomberg.

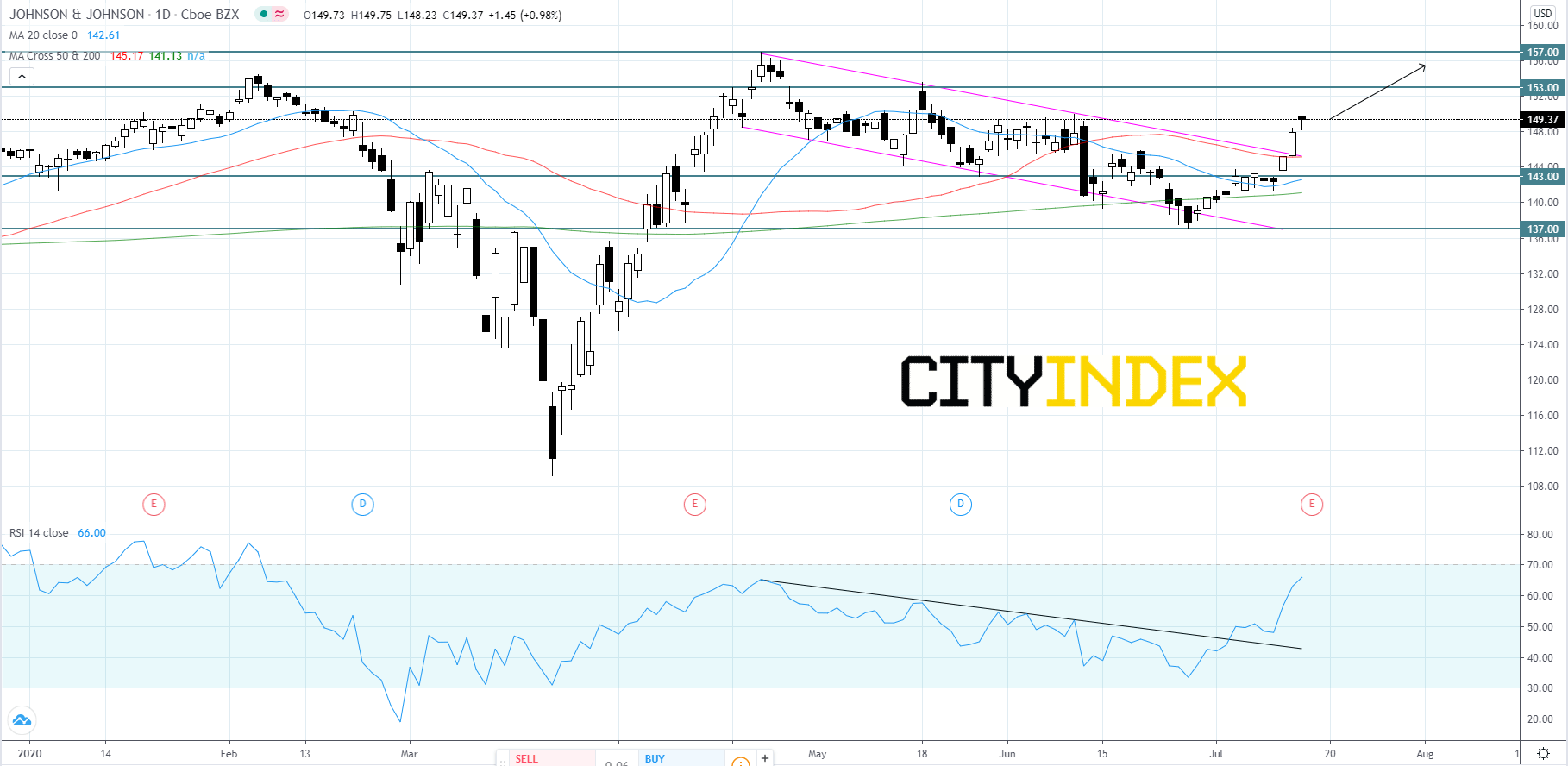

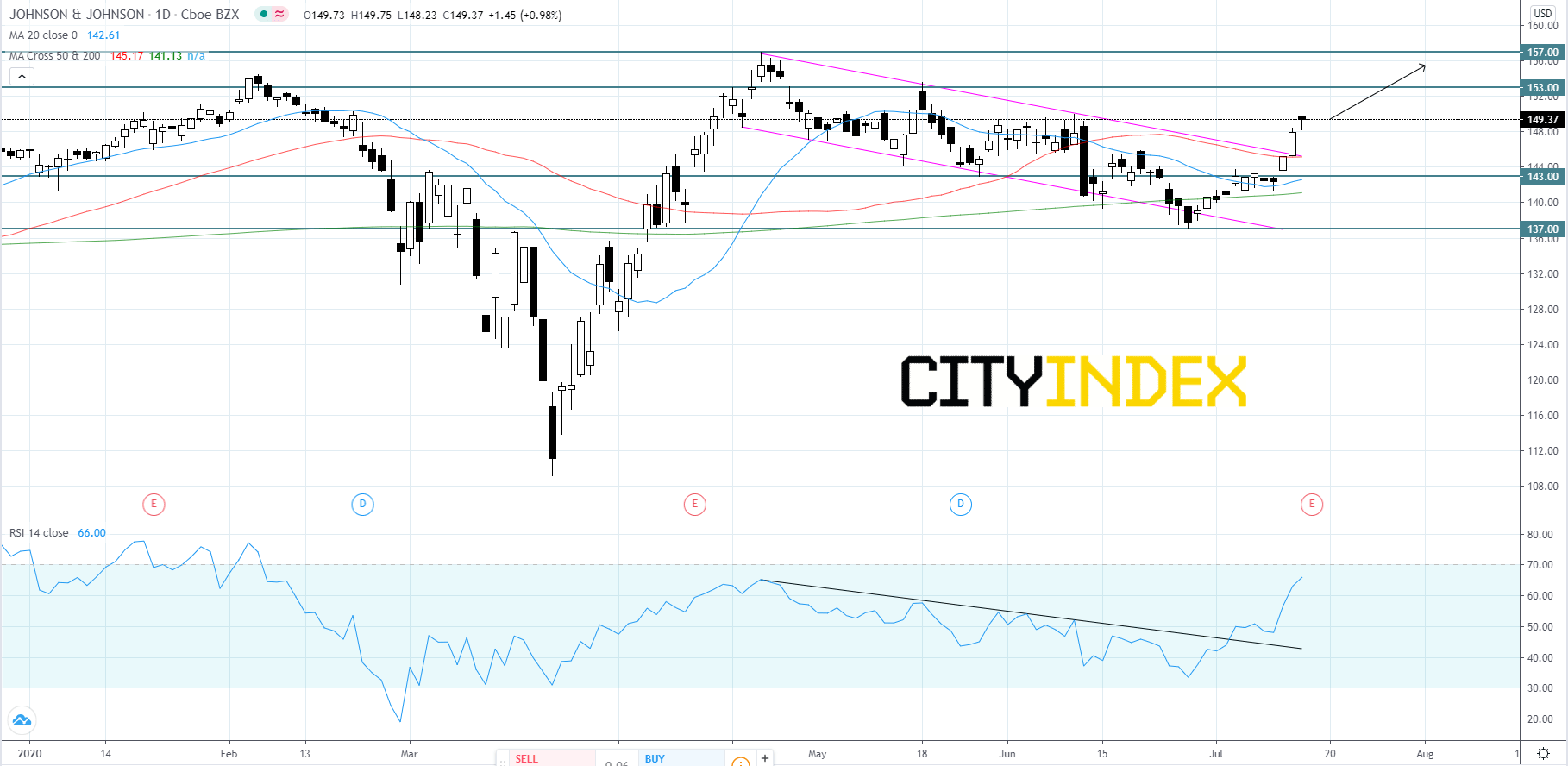

From a technical point of view, on a daily chart, Johnson & Johnson's stock price has just broken out to the upside of a descending channel pattern that began to form in late-April after the company reached a record high of $157.00. The RSI is showing upward momentum after breaking to the upside of a bearish trend line. Price appears to be headed to retest the 153.00 resistance level and since we are still in a bull market, the bias on stocks remains bullish. If price can reach $153.00 it would clear a path towards retesting the all time high of $157.00. If price can not hold above the upper trend line of the descending channel pattern we could see price fall back to the $143.00 support level. If price re-enters the descending channel it may continue to decline down to $137.00.

Source: GAIN Capital, TradingView

From a technical point of view, on a daily chart, Johnson & Johnson's stock price has just broken out to the upside of a descending channel pattern that began to form in late-April after the company reached a record high of $157.00. The RSI is showing upward momentum after breaking to the upside of a bearish trend line. Price appears to be headed to retest the 153.00 resistance level and since we are still in a bull market, the bias on stocks remains bullish. If price can reach $153.00 it would clear a path towards retesting the all time high of $157.00. If price can not hold above the upper trend line of the descending channel pattern we could see price fall back to the $143.00 support level. If price re-enters the descending channel it may continue to decline down to $137.00.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 08:33 AM