Earnings Play: Intel

Today, after market, Intel (INTC) is expected to release third quarter EPS of $1.10 compared to $1.42 last year on revenue of approximately $18.2 billion vs. $19.2 billion a year earlier. Intel designs and manufactures microprocessors and on October 20th, Bloomberg reported that the company agreed to sell its NAND memory and storage business to SK Hynix for 9 billion dollars.

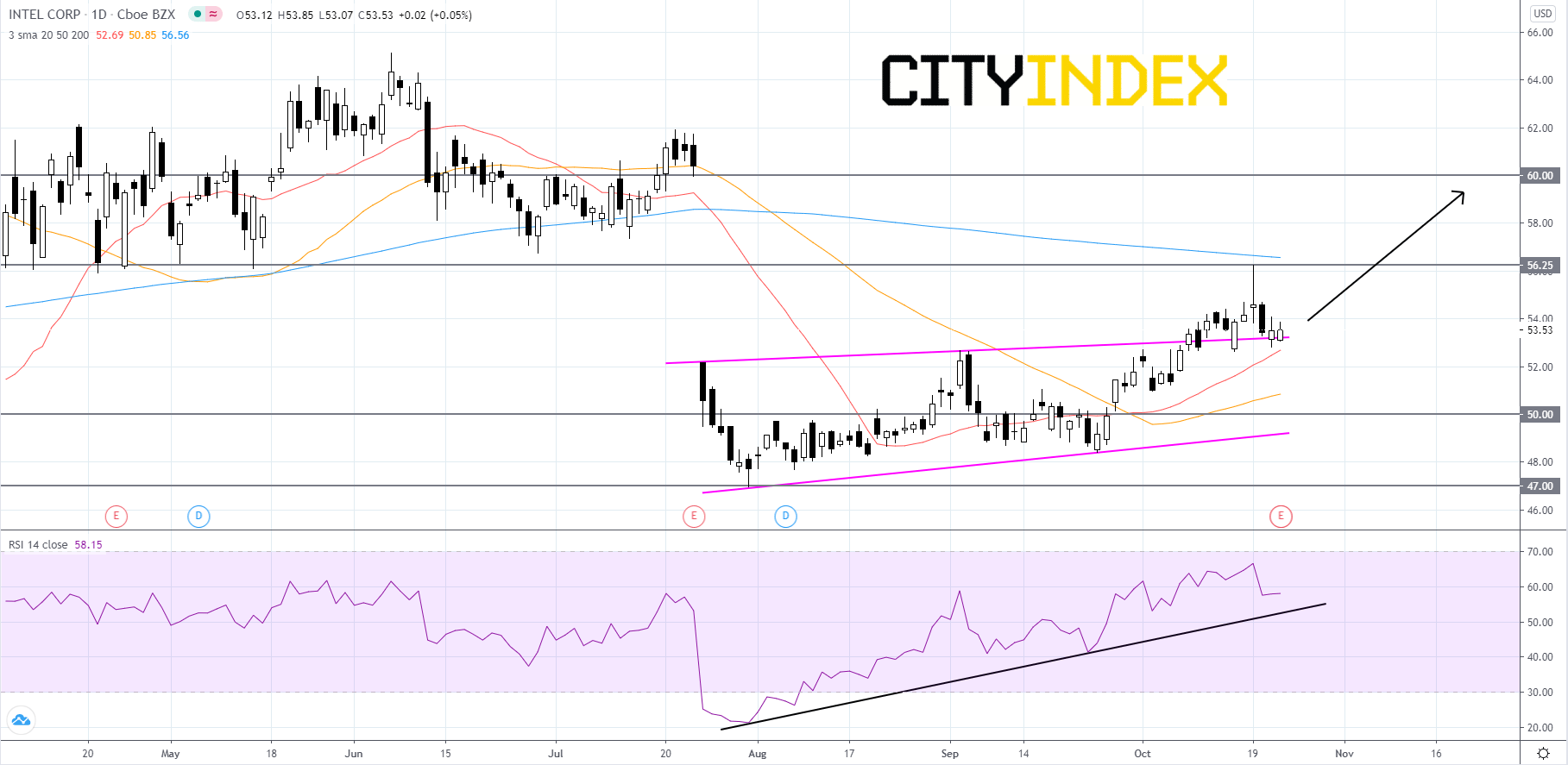

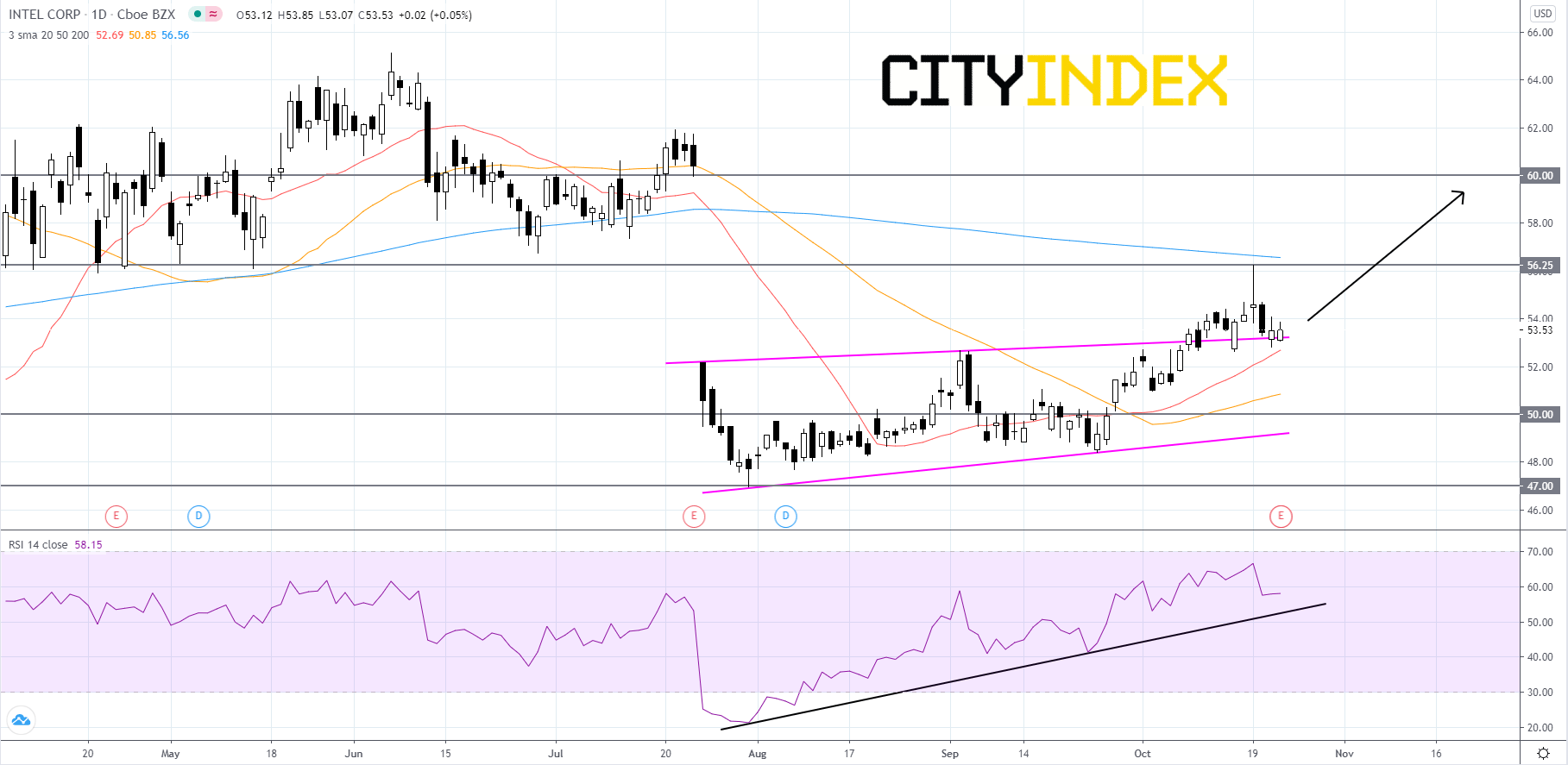

Technically speaking, on a daily chart, Intel's stock price is currently holding at the upper trendline of an ascending wedge pattern that price recently broke out above in early-October. The RSI is over 50 and holding above a bullish trendline. Price will likely hold around the upper trendline before gaining momentum and advancing to retest the 56.25 resistance level. If price can get above 56.25 it would be a bullish signal because 56.25 acted as major support for price earlier in 2020. After 56.25 the next target would be 60.00. On the other hand, if price fails to hold above the upper trendline, then price could find support around the 50-day simple moving average (SMA). If price cannot find support at the 50-day SMA, then the next stop would be the 50.00 support level. If price cannot rebound off of 50.00 then it could fall even further.

Source: GAIN Capital, TradingView

Technically speaking, on a daily chart, Intel's stock price is currently holding at the upper trendline of an ascending wedge pattern that price recently broke out above in early-October. The RSI is over 50 and holding above a bullish trendline. Price will likely hold around the upper trendline before gaining momentum and advancing to retest the 56.25 resistance level. If price can get above 56.25 it would be a bullish signal because 56.25 acted as major support for price earlier in 2020. After 56.25 the next target would be 60.00. On the other hand, if price fails to hold above the upper trendline, then price could find support around the 50-day simple moving average (SMA). If price cannot find support at the 50-day SMA, then the next stop would be the 50.00 support level. If price cannot rebound off of 50.00 then it could fall even further.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM